It's not only Wall St that can't beat the index. Silicon Valley can't either, an explosive new review has claimed.

Silicon Valley's venture capitalists are often thought to be the cream of the crop. Flush with Ivy league degrees, Silicon Valley's VC elite are often though to marry the best of New York - deep capital - with the best of California - tech brilliance.

They charge high fees: much like hedge funds, they take 2% of assets managed and a 20% performance fee. They're very well paid: the average San Francisco venture capitalist earns $230,000 a year, salary.com indicates.

But do they deliver? Apparently not.

Source: Social Capital

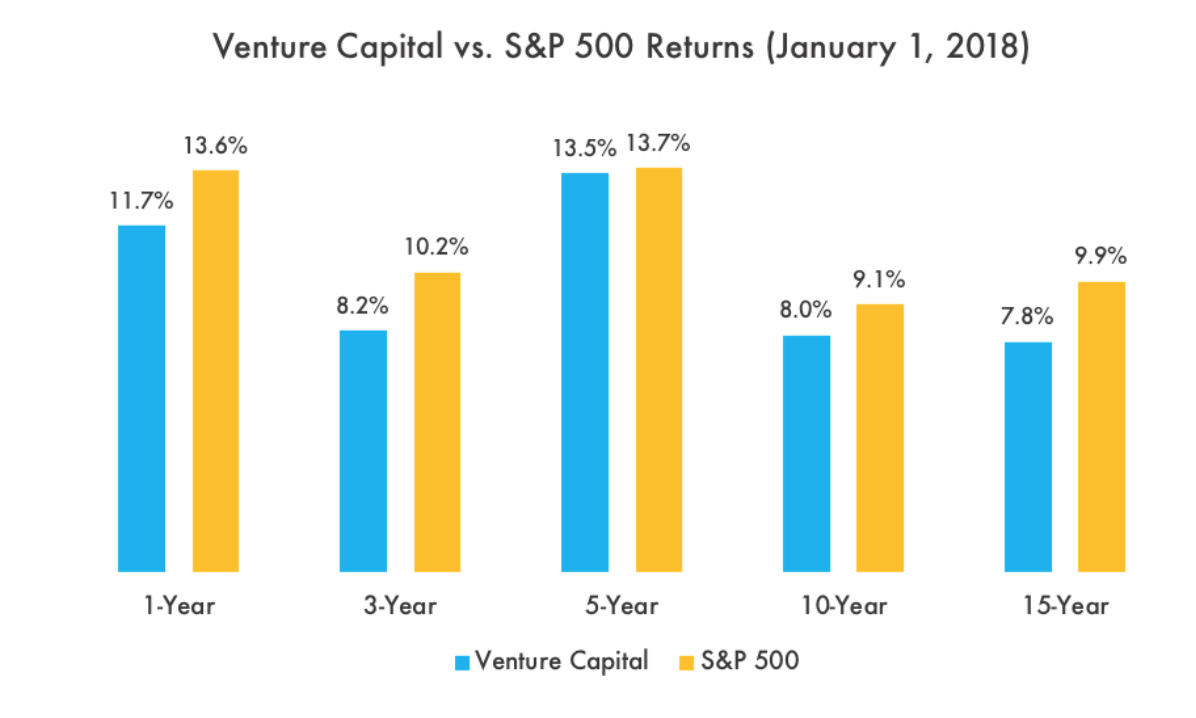

US venture capital routinely underperforms the S&P 500, in a manner reminiscent of Wall St hedge funds, a new paper has claimed.

The past 10 years, the S&P 500 has provided a total return of 9.1%. The average US venture capitalist provided return of 8% over the same period. The venture capital industry has unperformed the index over every time period: 1-year, 5-year, 10-year and 15-year, the paper indicates.

"We seem to have arrived in a new… phase of venture capital where money is no longer scarce at all. Rather, it has become plentifully available. The collective returns reflect the new reality that venture capital does not deliver a premium for its investors. In fact, the VC industry reliably trails the S&P," it concluded.

The paper was written by Chamath Palihapitiya, the billionaire CEO of Social Capital, a Silicon Valley VC firm with $1.2 billion under management.

It claims that while VC firms have the reputation for producing enormous gains for their investors, much of these gains are illusory. They owe to something resembling a conspiracy among VC firms, in which firms marks up the value of each other's assets in order to rake in more on fees.

"VCs habitually invest in one another's companies during later rounds, bidding up rounds to valuations that allow for generous markups on their funds' performance. These markups, and the paper return that they suggest, allow VCs to raise subsequent, larger funds, and to enjoy the management fees that those funds generate."

More damningly, it claims that venture capital is plagued by a structural misalignment of incentives, which pit off VCs interests against those of its investors.

This misalignment owes mostly to the fact that it's easy for VCs to profit from management fees. Whereas profiting from performance fees is hard.

Performance fees require building successful businesses - which requires time, risk and labour. Management fees, however, require no work or risk.

"If you're a VC with a $200 million dollar fund, you're able to draw $4 million each year in fees. (typical venture funds pay out 2 percent a year in management fees plus 20 percent of earned profit in carried interest, commonly called "two and twenty").

"Most funds never return enough profit for their managers to see a dime of carried interest. Instead, the management fees are how they get paid. If you're able to show marked up paper returns and then parlay those returns into a newer, larger fund - say, $500 million - you'll now have a fresh $10 million a year to use as you see fit."

The letter concludes with a sigh of lament for the employees of VC-backed startups. Staff at startups are often low paid, and typically promised equity in return for hard work towards an uncertain outcome.

While these equity schemes worked well in the early days, the letter claims, they have since become a vehicle for ripping staff off. They do this by either providing equity knowing it is worthless, or giving equity compensation at inflated strike prices.

The letter is available here.