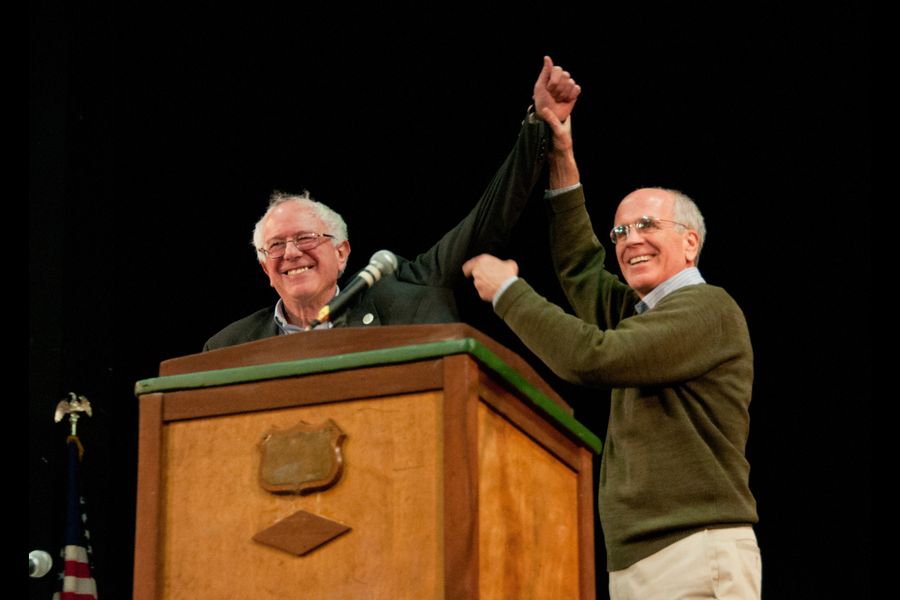

The dominance of the ‘Big Three’ US fund giants BlackRock, Vanguard and State Street Global Advisors (SSGA) is a threat to democracy, US senator Bernie Sanders has warned.

In his latest attack on the three asset managers, Sanders labelled the three Wall Street firms as an “oligarchy” and added “democracy will not survive” with concentration at current levels.

Tweeting on X, Sanders said: “This is what oligarchy is about. Today just three Wall Street firms, BlackRock, Vanguard & State Street manage $20.7trn in assets.

“These three firms are major shareholders in 95% of S&P 500 companies. Democracy will not survive with this concentration of economic and political power.”

It comes 18 months after a similar tweet by the US senator calling the asset hoarding of the three firms “obscene”.

Concerns over the market dominance of BlackRock, Vanguard and SSGA have been growing in recent years.

Responding to Sanders on X, Martin Schmalz, professor of finance and economics at Oxford Saïd, added the ‘Big Three’ control almost a quarter of the votes of the S&P 500 companies.

“Perhaps more importantly, they control about 23% of the votes of the S&P 500 [single-class] companies,” he said.

A large part of their dominance has been able to happen due to the rise of passive investing.

Research also found the ‘Big Three’ were implementing a “millennial marketing strategy” allowing them to potentially acquire “trillions of dollars of assets under management without having to become informed”.

A research paper titled Opportunism in the Shareholder Voting and Engagement of the ‘Big Three’ Investment Advisers to Index Funds, found it was difficult for the firms to act in the interest of each end investor and therefore often voted in line with the board of the company.

Despite this, BlackRock, Vanguard and SSGA have all developed ways to devolve corporate proxy voting powers to investors following increased scrutiny of their practices.