Securities lending is a common method of adding extra ETF returns, however, the European regulator remains vehemently against the “risky and complex” practice.

Last week, State Street Global Advisors (SSGA) expanded its securities lending programme across a further 67 ETFs in a bid to boost investor income.

In a notice to shareholders, SSGA said securities lending is “a valuable portfolio management tool, which provides an additional source of income for fund shareholders”.

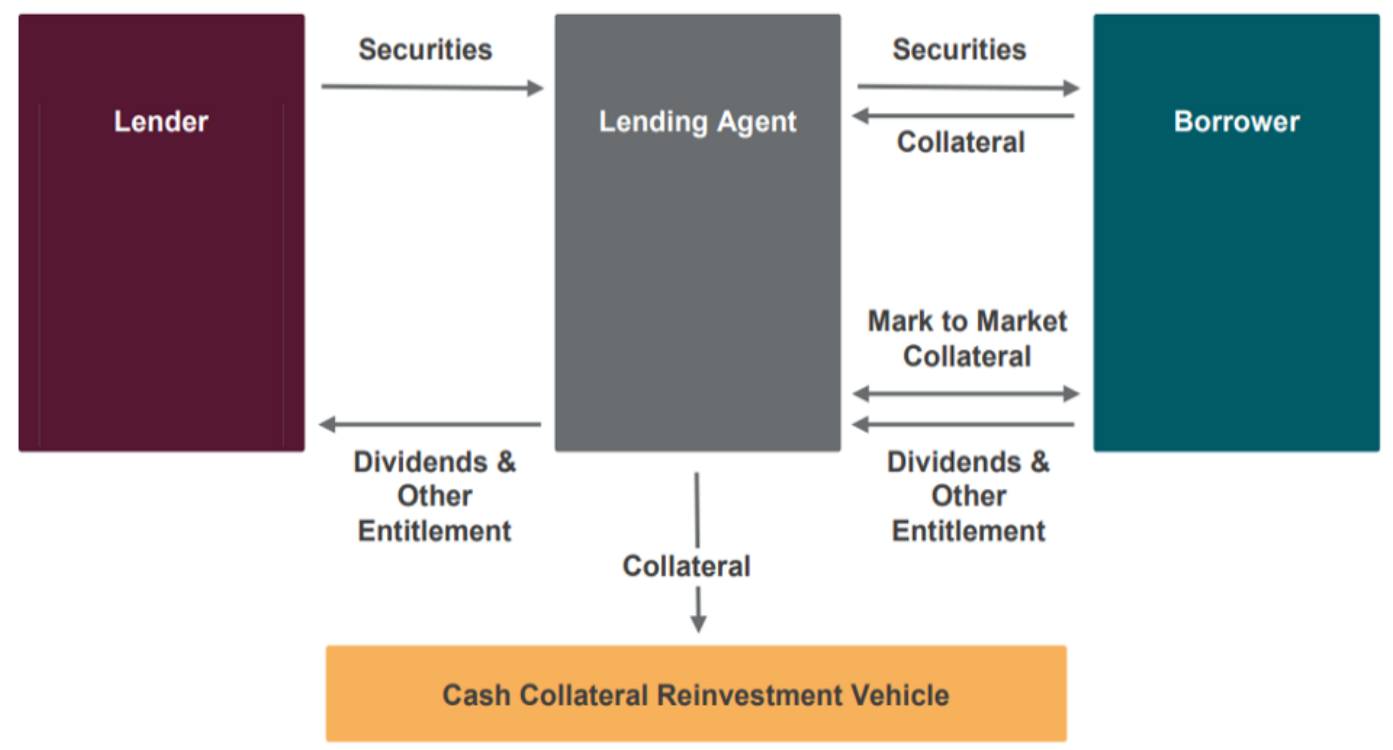

The process of securities lending is a relatively straightforward one. An issuer will loan out the underlying securities of an ETF in exchange for collateral and a small fee.

The fee will be determined by market demand. If the securities are in high demand, the borrower may want to pay a premium for the shares while securities in less demand will result in a lower yield.

After a pre-agreed date, or when the lender asks, the borrower will send back the original basket to the issuer in exchange for the collateral which is typically limited to sovereign debt for UCITS ETFs.

Chart 1: The mechanics of securities lending

Source: FTSE Russell

However, the European Securities and Markets Authority (ESMA) has been consistent in arguing that securities lending does not justify the risks for retail investors.

In a statement in July, the European watchdog warned the practice is “difficult for the average retail client to understand”.

“The prospect of any indirect ‘benefit’, such as lower trading commissions, may not justify exposing a retail client to the risks of securities lending,” ESMA said.

“Furthermore, such an indirect ‘benefit’, if any, would not necessarily and proportionately accrue to all retail clients exposed to the risks arising from the lending of their securities, but to retail clients exhibiting more active trading behaviour.”

The regulator has also highlighted issues around the fee structures of securities lending with asset managers failing to pass on full revenues to investors.

ESMA found securities lending agents working on fixed fees retain between 10-50% of the gross revenue created by the transaction, with the rest returned to the UCITS fund.

Investors in the iShares Core S&P 500 UCITS ETF (CSPX), for example, Europe’s second-largest ETF, retain 62.5% of the income from securities lending while BlackRock receives 37.5% which includes operational costs.

However, ESMA has stated revenues from securities lending should be returned directly to investors following costs.

“Revenues from securities lending should directly accrue to the retail client, net of a normal compensation for the firm’s services,” it said in a statement.

Overall, while securities lending helps efficient pricing across financial markets, investors should remain aware of the revenue structures in place for each ETF issuer.

The regulator is evidently nervous about the practice so it is up to the asset management industry to ensure securities lending programmes run as efficiently as possible.