ESG ETFs run by BlackRock, State Street Global Advisors (SSGA) and Legal and General Investment Management (LGIM) among others are investing heavily in fossil fuel companies, research has found.

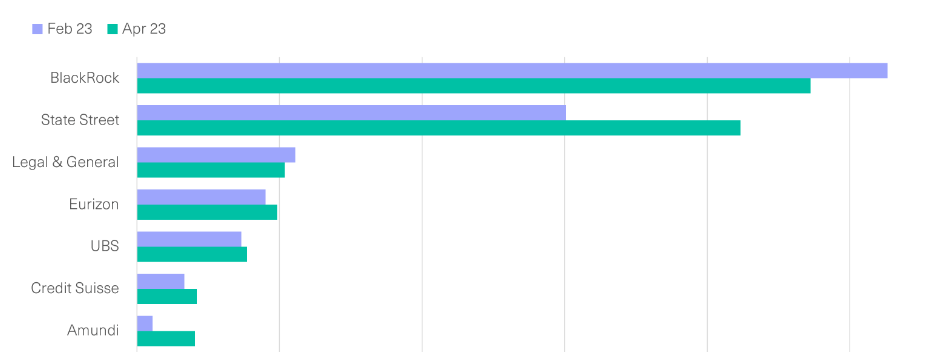

A report by thinktank Common Wealth found the three asset managers had almost $1bn invested in companies involved in oil, gas and coal across their fixed income funds between February and April this year.

Other asset managers including UBS Asset Management and Amundi also hold fossil fuel companies in their fixed income strategies, with the total reaching over $1.5bn across the 192 funds analysed.

According to Common Wealth, the report consisted of both mutual funds and ETFs using Refinitiv eMaxx data. While it did not name which funds it included in its research, several high-profile sustainable ETFs do hold fossil fuel companies within their portfolio.

Source: Refinitiv Eikon, Urgewald

For instance, one of BlackRock’s largest sustainable fixed income ETFs, the €4.4bn iShares € Corp Bond ESG UCITS ETF (SUOE), holds several bonds from natural gas companies such as Italigas, Australian energy infrastructure group APT Pipelines and VierGas Transport.

SSGA also holds fossil-fuel companies in one of its flagship fixed income ESG ETFs. The €6.3bn SPDR Bloomberg SASB U.S. Corporate ESG ETF (USCR) currently has weightings to oil giants Shell and BP.

Meanwhile, the €573m SPDR Bloomberg SASB 0-3 Year Euro Corporate ESG UCITS ETF (SPPS) holds French petroleum company TotalEnergies.

While BlackRock has reduced its exposure to fossil fuels since February, SSGA added over $100m in coal, oil and gas bonds to its ESG portfolios in a little over two months, the research found

Common Wealth said the finding raises “serious doubts” about whether ESG products comply with their claims or marketing.

Previously, asset managers have been criticised for divesting from their coal shares with some favouring engagement to shape company practices.

BlackRock said it clearly discloses the objectives of each fund and manages investments to align with those objectives, while disclosing the holdings of its iShares ETFs on a daily basis.

"BlackRock provides investors with choice in how they make sustainable investments, whether that be in clean energy, investments that explicitly exclude fossil fuels or those that are more broadly diversified, including investments in issuers that are actively transitioning", a BlackRock spokesperson said.

LGIM said the group engages with the companies it owns to ensure they are decarbonising in line with the net-zero goals and to support the transition to renewable alternatives.

“We believe investing to support companies to make the transition to a low carbon world will have a greater impact on real economy emissions than simply divesting,” the spokesperson said.

“By divesting from entire sectors like oil and gas, we won’t achieve the real world outcomes we need and investors lose their ability to exert a positive influence via active engagement.

“LGIM remains committed to working with clients on the climate crisis as our era's most defining systemic challenge.”

Amundi, UBS AM and SSGA did not respond to a request for comment.