Climate change impacts everyone, and its effects can already be seen today. With more than half of the world’s population living within 60km of the sea, rising sea levels are posing an increasing risk to people’s livelihoods and homes.

Water scarcity can at the same time lead to drought and famine in developing countries, while floods contaminate freshwater supplies, increasing the risk of water-borne diseases. Rising temperatures will also disrupt agriculture and food production, increasing the prevalence of mal- and undernutrition. The consequences of climate change are devastating. We must act now to limit the worst impact.

Policy changes will affect corporate profits

Climate change is therefore a topic that is top of mind as it is having a material impact on the world we live and work in today. In response to this challenge, countries across the globe have signed up to the Paris Agreement, a legally binding international treaty, which is trying to limit global warming to well below 2°C.

In 2019, the UK and France became the first major economies to sign a net-zero 2050 target into law. Today, more than 70 countries have set net-zero targets, accounting for 76% of global emissions. In order to achieve these targets, policymakers have pledged to adopt aggressive emission reduction policies. That means we will need to reduce our use of fossil fuels and importantly increase our use of renewable energy sources such as solar and wind power.

For investors, the way that policymakers approach the path to net zero will have a meaningful financial impact on the companies in their portfolios, both operationally and financially. If, for example, governments implement higher carbon taxes, it will directly impact companies’ net income. New environmental regulations or increased subsidies for greener forms of energy could also benefit companies already moving in a more sustainable direction by investing in cleaner forms of energy.

As a result, there will be both opportunities and risks across industries. Importantly, for most industries, emission reduction rather than offset (paying others to reduce emissions or absorb CO2 to compensate for your own emissions) will be required, and investors should view corporate commitments with this in mind.

Positioning for the transition to a low carbon world

The JPM Carbon Transition Global Equity (CTB) UCITS ETF (JPCT)* has been designed to help investors reflect the financial risks of climate in their portfolio and contribute to the solutions, while taking advantage of the opportunities presented by the transition to a low carbon economy.

JPCT* is designed to be in line with the Climate Transition Benchmark (CTB), which requires at least a 30% reduction in carbon emissions and at least a 7% year-on-year rate of self-decarbonisation.

To meet these targets, our investment framework seeks to identify companies that are best positioned to benefit from the transition. With this approach, we have created a portfolio that achieves a meaningful reduction in carbon intensity relative to a traditional index. Importantly, we do this without applying sector exclusions, as we want to keep sectors in line with the index.

Instead, we achieve the reduction in carbon intensity through individual security selection, investing in companies leading the way in the transition and avoiding those that will lose out as a result.

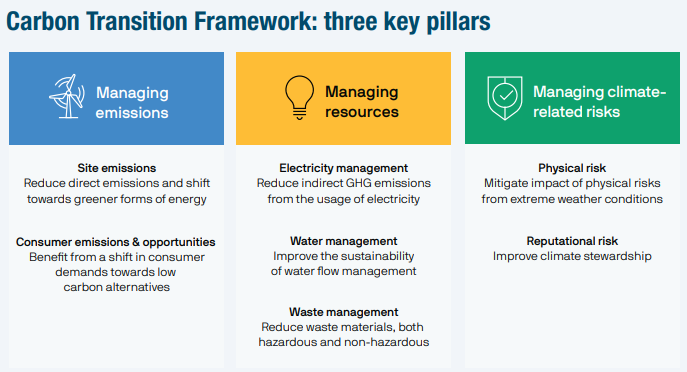

Our research suggests there are three key ways companies can prepare themselves for the transition to a low-carbon world. Analysis of company performance against these three key pillars forms the basis of our framework (see graphic).

Using alternative data to broaden the opportunity set

Traditional sources of corporate information, such as company reports and analysis from third-party data providers, are useful in analysing whether companies are managing their businesses sustainably. However, this data can be patchy. Many companies do not report their emissions, and it is challenging to uncover the companies creating the innovative solutions and technologies required for a low carbon world.

To address this issue, we rely on our expertise in artificial intelligence and big data, and a proprietary technology tool, ThemeBot. This tool uses natural language processing to screen more than 10,000 stocks globally, and rapidly analyses hundreds of millions of data sources – such as news articles, company reports, earnings transcripts, and broker research – to identify stocks with the highest exposure to a theme.

For our carbon transition framework, we have selected a number of innovative climate solutions that will be required to spur change towards a low-carbon world. We use ThemeBot to identify companies involved in areas such as renewable energy sustainable food and agriculture and sustainable transport, as well as companies focusing on energy efficiency or offsetting their carbon footprint.

Based on this framework, we evaluate companies to identify those most transitionready. We then take overweight positions in companies taking the necessary steps to ensure they are reducing carbon emissions. We go underweight in those companies that are most at risk as they are failing to prepare their businesses for the transition to a low carbon economy.

JPMCT* provides exposure to a diversified portfolio of approximately 400 equities, globally, was launched in November 2020 and is categorised as Article 9 under the Sustainable Finance Disclosure Regulation (SFDR).

This article was first published in ESG Unlocked: Europe out in front, an ETF Stream report

FOR BELGIUM ONLY: *Please note the ETF marked with an asterisk (*) in this page are not registered in Belgium and can only be accessible for professional clients. Please contactyour J.P. Morgan Asset Management representative for further information. The offering of Shares has not been and will not be notified to the Belgian Financial Services andMarkets Authority (Autoriteit voor Financiële Diensten en Markten/Autorité des Services et Marchés Financiers) nor has this document been, nor will it be, approved by the FinancialServices and Markets Authority. This document may be distributed in Belgium only to such investors for their personal use and exclusively for the purposes of this offering ofShares. Accordingly, this document may not be used for any other purpose nor passed on to any other investor in Belgium.This is a marketing communication and as such the views contained herein do not form part of an offer, nor are they to be taken as advice or a recommendation, to buy or sellany investment or interest thereto. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxationagreements and investors may not get back the full amount invested. Past performance is not a reliable indicator of current and future results. There is no guarantee that anyforecast made will come to pass. Shares or other interests may not be offered to or purchased directly or indirectly by US persons. The latest available Prospectus, the KeyInvestor Information Document (KIID), any applicable local offering document and sustainability-related disclosures are available free of charge in English from your J.P. MorganAsset Management regional contact or at www.jpmorganassetmanagement.ie. A summary of investor rights is available in English at https://am.jpmorgan.com/lu/investor-rights.J.P. Morgan Asset Management may decide to terminate the arrangements made for the marketing of its collective investment undertakings. Units in Undertakings for CollectiveInvestment in Transferable Securities (“UCITS”) Exchange Traded Funds (“ETF”) purchased on the secondary market cannot usually be sold directly back to UCITS ETF. Investorsmust buy and sell units on a secondary market with the assistance of an intermediary (e.g. a stockbroker) and may incur fees for doing so. In addition, investors may pay more thanthe current net asset value when buying units and may receive less than the current net asset value when selling them. Our EMEA Privacy Policy is available at www.jpmorgan.com/emea-privacy-policy. In Switzerland, JPMorgan Asset Management (Switzerland) LLC, Dreikönigstrasse 37, 8002 Zurich, acts as Swiss representative of the funds and J.P. Morgan(Suisse) SA, Rue du Rhône 35, 1204 Geneva, as paying agent of the funds. JPMorgan Asset Management (Switzerland) LLC herewith informs investors that with respect to itsdistribution activities in and from Switzerland it receives remuneration which is paid out of the management fee as defined in the respective fund documentation. Further informationregarding this remuneration, including its calculation method, may be obtained upon written request from JPMorgan Asset Management (Switzerland) LLC. This communication isissued in Europe (excluding UK) by JPMorgan Asset Management (Europe) S.à r.l. and in the UK by JPMorgan Asset Management (UK) Limited, which is authorised and regulatedby the Financial Conduct Authority.09as222809074222