The vast majority (85%) of exchange-traded fund investors want to own companies with good environmental and sustainability records, a recent Investment Trends survey has found.

Given the huge investor interest, it is no wonder ETFs that emphasise good environmental, social and governance (ESG) attributes are becoming so popular.

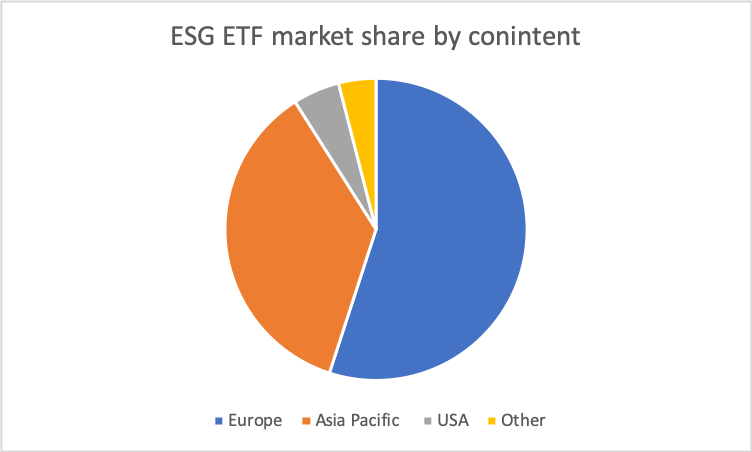

According to ETF research house ETFGI, there were 248 exchange-traded products (ETPs) with ESG traits, with more than US$40 billion in assets under management. Of this 55 % are in Europe, 36% are in Asia Pacific and 5% are in the US.

Meaghan Victor, head of SPDR ETFs Australia, says ESG ETFs are in demand as client needs have become more sophisticated and thanks. Demand from younger investors has also helped.

“ESG approaches are increasingly important as money flows down to millennials. When you consider more than 40% of Australian ETF investors are millennials, compared to just 12% five years ago, demand for ESG related products is likely to increase.”

Evan Reedman, Vanguard Australia’s head of product, says the focus on companies’ sustainable economic health has aided momentum around ESG investing.

“Regulatory change is also driving the adoption of ESG products by institutional investors.”

For instance, trustees in the UK are required to demonstrate sustainability in their approaches as part of their responsibility to investors. In France, funds must publicly report their carbon footprint. Product disclosure statements in Australia have required information about ESG issues for many years now.

Reedman says ESG investments are becoming increasingly popular due to the emergence of common definitions about what ESG means. “This clarity can help investors choose the approach most aligned with their goals.”

Last year Vanguard launched two ESG ETFs: the Vanguard Ethically Conscious International Shares ETF (VESG) and the Vanguard Ethically Conscious Global Aggregate Bond ETF (VEFI). Both funds track broad bond and share market indexes that exclude companies in gambling, weapons, pornography, coal mining and some other industries.

Fee for all

Costs can vary widely among ESG products. But they’re typically more expensive than non-ESG products.

Says Reedman: “Cost depends on the firm offering the product, its agreement with the benchmark provider that constructs the index and management expenses. ESG products are predominantly actively-managed.” He also notes ESG funds tend to be smaller, which often implies higher fees due to lack of scale.

Performance matters

ETFs with ESG screens perform differently to garden variety funds because their vast exclusions often mean some sectors – particularly the oil major heavy energy sector – get underweighted.

“Investors should understand…the differences between products as they will drive the level of variation in returns when compared to the market,” says Reedman.

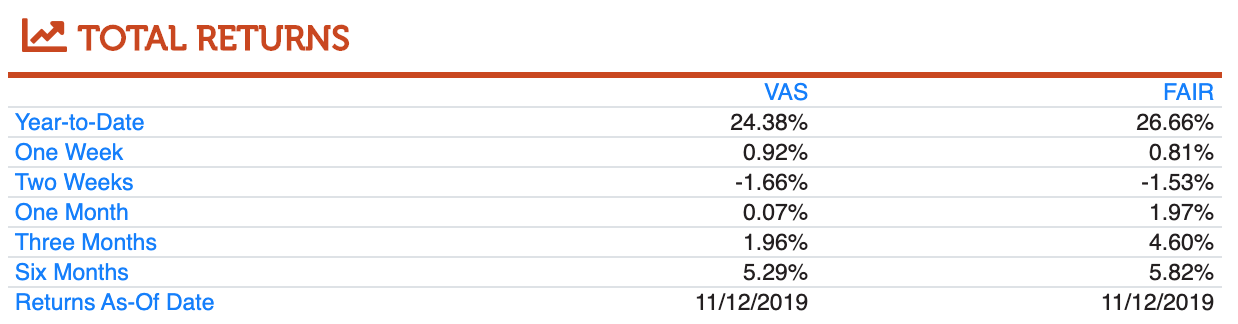

Investors sometimes worry that ESG funds will underperform. While the evidence is mixed, recent high quality academic studies suggest that ESG funds have outperformed the past decade.

BetaShares FAIR, an ethical Australian share ETF, has outperformed Vanguard’s ASX300 tracker in 2019. Source: Ultumus, ETF Stream

When it comes to product design, Nathan Lim, executive director, Morgan Stanley Wealth Management, says negative screening – when funds exclude certain stocks or sectors - naturally fits ETFs. By contrast, products that have a positive screen give certain sectors or stocks more weight because they have strong ESG credentials –renewable energy is an example.

“You can build pillars with ETF products that have negative screen. That's a good way to start your portfolio journey. Then, if you want a positive impact and to contribute to social good, look for active managers creating positive outcomes...You can marry a passive core with a negative screen with active managers tilted towards what you're trying to achieve in terms of a social outcome,” Lim explains.

Wealth managers are also exploring ESG ETF innovations. Victor says: “According to anecdotal feedback, in Australia licensees are looking to create an option within their model portfolios that is a full replacement of the ASX200 with an ESG function. Normally, it would be 5 per cent allocation to ESG – but now this is a like-for-like replacement.”

While greenwash ETFs – products that say they’re ESG, but are really just faking it – were a problem in the past, Lim says this is less of a concern now.

Adam Verwey, Future Super director, urges investors to make sure an ESG ETF isn’t greenwash. “Look into the institutions that are being invested in to make sure they match your definition of environmental, social and governance investing.”

Overall, investors are advised to be prudent when picking an ESG ETF. Victor suggests investors check whether the index reports holdings on a daily basis, whether it’s concentrated in particular sectors, companies or countries, as well as how many stocks or bonds are in the index.

She also suggests investors compare the fund’s return, cost of ownership, redemption fees, average daily volume and liquidity.

When it comes to ESG ETFs, next year, Victor says more investors are likely to move from purely exclusionary to integrated ESGs, as well as investments powered by multiple sources of ESG data.

“Growing demand to understand ESG performance against objectives will drive the need for enhanced reporting and climate solutions will evolve to include adaptation alongside mitigation. Overall, expect ESG to become increasingly mainstream, which should drive investment,” she says.