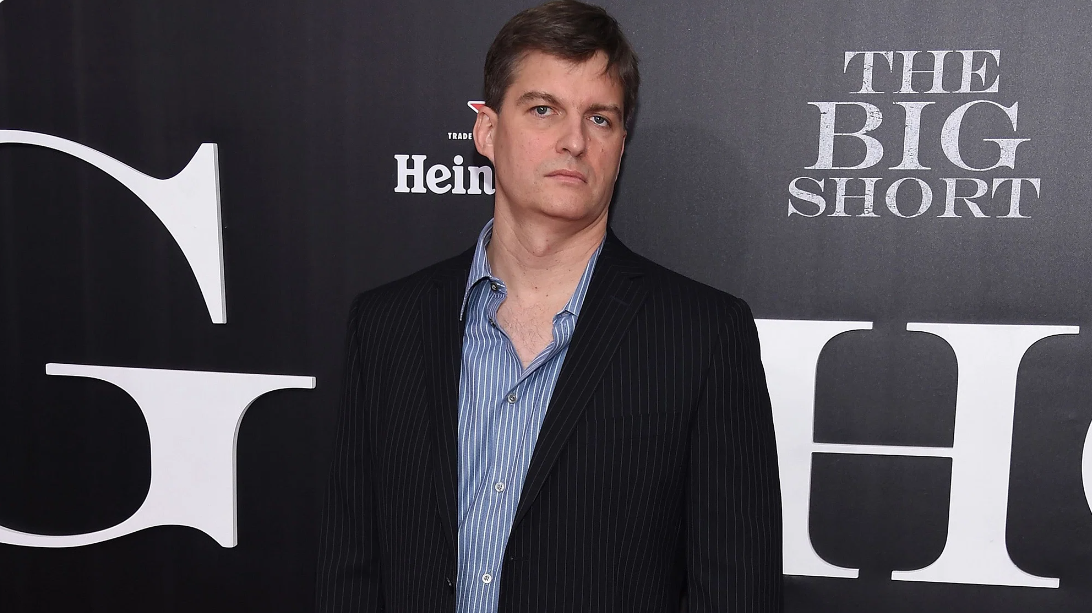

Legendary hedge fund manager Michael Burry, immortalised in Michael Lewis’s book The Big Short, has claimed he was wrong to tell investors to sell earlier this year.

Burry, who founded Scion Asset Management, even congratulated investors on their dip-buying after the Nasdaq 100 entered a technical bull market after closing 20% up on its December 2022 low.

“Going back to the 1920s, there has been no [buy the f****** dip] generation like you. Congratulations,” Burry said in a tweet on 30 March.

The comments come after Burry posted an ominous one-word tweet on 31 January – “sell” – amid a risk-on rally at the start of the year.

Burry has now gone back on that statement by admitting he was wrong.

“I was wrong to say sell,” he said on Thursday.

Burry, who has nicknamed himself Cassandra after the Trojan priestess in Greek mythology cursed to have the gift of foresight but never to be believed, made his name for correctly predicting the Global Financial Crisis (GFC) in 2008.

The comments come amid a rally in equity markets, driven by prospects the Federal Reserve will be forced to cut interest rates earlier than initially thought due to the current banking crisis.

According to the CME FedWatch Tool, markets are forecasting a 34.7% chance the Fed will cut rates by 25 basis points (bps) in July’s Federal Open Market Committee (FOMC) meeting while there is only a 7.3% chance the Fed will not lower rates by the end of the year, as at 29 March.

The Fed is currently in a standoff with the market with chair Jerome Powell warning the central bank will not cut interest rates in 2023.

“Given our outlook, I just do not see us cutting rates this year,” Powell said last Wednesday after the Fed increased rates by 25bps.

The world’s largest asset manager BlackRock also said it does not expect the Fed to cut rates this year amid concerns inflation is likely to stay stickier than current expectations.

“We do not see rate cuts this year – that is the old playbook when central banks would rush to rescue the economy as a recession hit,” the BlackRock Investment Institute said. “Now they are causing the recession to fight sticky inflation – and that makes rate cuts unlikely.”

Attention now turns to the latest round of US inflation and jobs data. With equity markets perfectly priced, risks remain to the downside, especially if inflation stays higher than current expectations.