Losses mount on BlackRock’s long-duration US Treasury ETF on the prospect of additional Federal Reserve rate hikes, even after the product shed almost half of its value from all-time highs.

Europe’s largest long-dated US Treasury ETF, the $5.1bn iShares $ Treasury Bond 20+yr UCITS ETF (DTLA), peaked in price after the start of the COVID-19 pandemic on 31 July 2020. DTLA has fallen 46.5% since, as at 6 October.

The ETF’s longer-standing US equivalent, the $38bn iShares 20 Plus Year Treasury Bond ETF (TLT), has now fallen from its all-time high to its lowest level since before the Global Financial Crisis (GFC), within touching distance of its price in 2003.

Source: TradingView

This trend is consistent across US sovereign strategies with greater duration risk, even after the Fed kept its policy rate unchanged at the last Federal Open Market Committee (FOMC) meeting.

Part of this owes to continued hawkish messaging from Fed Chair Jerome Powell, but also due to fears of too much ‘heat’ in the economy, comprised of robust jobs data and concerns of a second spike in inflation.

Giving credence to the first point, US employment remained unchanged at 3.8% in September while US September payrolls increased by 336,000, well ahead of the estimated figure of 170,000, according to Bloomberg data.

On the second point, the BlackRock Investment Institute said it expects the Fed to keep rates ‘higher for longer’ in order to “keep a lid on growth to avoid resurgent inflation”.

The world’s asset manager reiterated its relative underweight to developed market sovereign debt with a particular focus on long-dated US Treasuries. It then opted for a “maximum overweight” of inflation-linked sovereigns on a strategic basis.

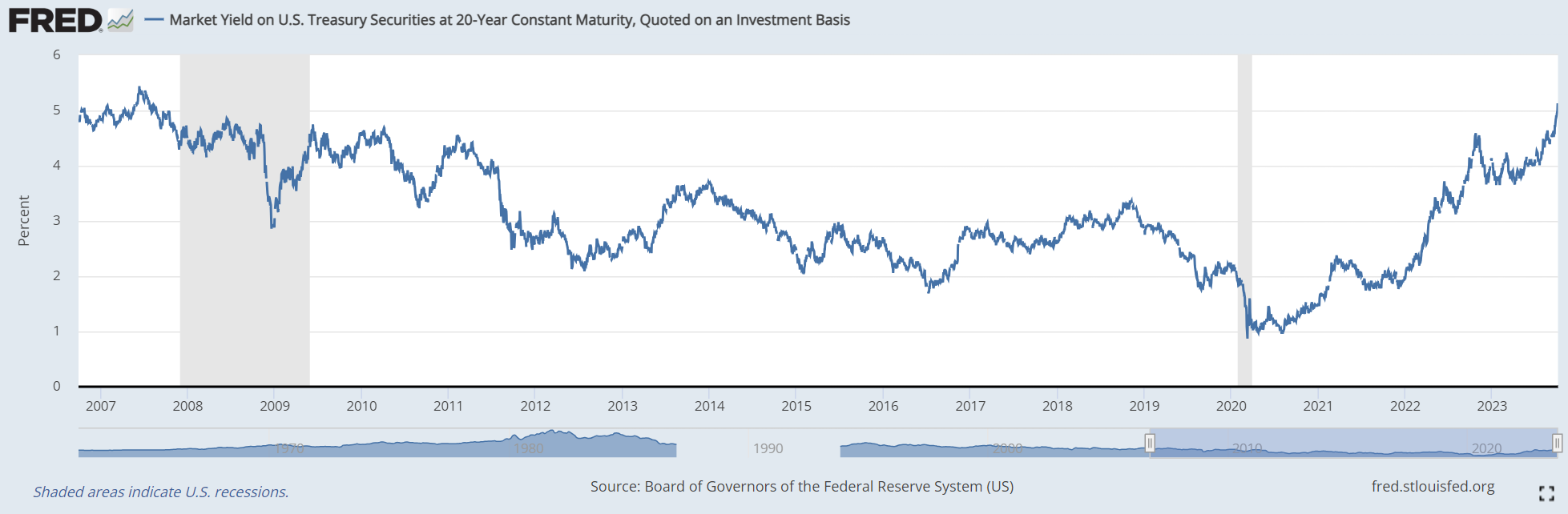

Such numbers and views in recent weeks go some way to explaining the yield on 30-year US Treasuries spiking 14.1% – or 61 basis points (bps) – from their one-month low in September to 4.95% on 6 October.

Source: Board of Governors of the Federal Reserve

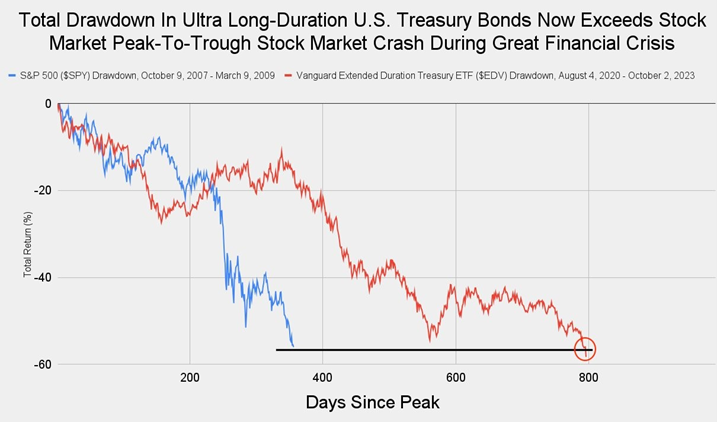

The exceptional movement in yields over the past two years – and the inverse downward effect on prices – has transformed the use case for ‘safe haven’ sovereign bonds on a tactical basis.

Jack Farley, macro researcher at Blockworks, commented: "Incredibly, ultra long-duration US Treasury bonds have now lost more in percentage terms than stocks did during the Global Financial Crisis (GFC)."

Source: Blockworks

Supporting this, DTLA – which captures 40 issuances with a weighted average maturity of 25.9 years – now has a three-year standard deviation of 14.5%, indicating more volatile returns.

Dip buyers’ dream?

Some, however, believe there must be an end in sight for punishing monetary hawkishness and a case to be made for the increased attractiveness of US Treasuries.

Jurrien Timmer, head of global macro at Fidelity, said last week: “The higher rates go, the more compelling the risk-reward becomes for bonds.”

He added the Bloomberg Aggregate index would jump up 11.5% if the Fed cut rates by 100 bps.

While Timmer favours the five to seven-year US Treasuries, some investors have been willing to absorb the duration risk and go all-in on long-dated US Treasuries in hopes of catching the ‘Powell pivot’.

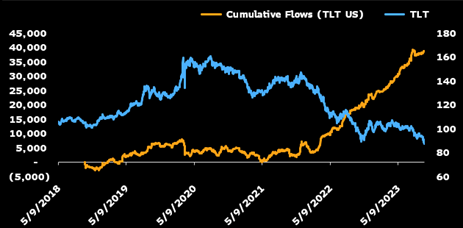

According to data from Bloomberg Intelligence, the US-listed TLT saw its assets under management (AUM) boom from $17bn when the Fed began hiking rates in March 2022 to $38bn by 6 October, even after its price fell 33% over that period.

The ETF has welcomed $17bn net new assets since the start of 2023 alone.

Eric Balchunas, senior ETF analyst at Bloomberg Intelligence, commented: “This is like the inverse of all of those years people did the opposite, buying into the siren call of the ProShares UltraShort 20+ Year Treasury ETF (TBT), because rates were too low, they ‘had’ to go up, but they never did.

“As such, for a while, TBT was the number one ETF in lifetime cash burn. TLT is now climbing that chart fast.”

Describing TLT as the “new fighting the Fed trade”, he said the divergence between price and inflows has cost traders $6bn so far.

Source: Bloomberg Intelligence

Rather than going gung-ho on duration, fund selectors continue to move up the yield curve only as part of diversified fixed income allocations.

In Q3, investors poured €1.4bn into the iShares $ Treasury Bond 0-1yr UCITS ETF (IB01) and €914m into the Xtrackers US Treasuries Ultrashort Bond UCITS ETF (X0TD), according to data from ETFbook.

Meanwhile, BlackRock’s long-duration DTLA saw €1.2bn inflows.

Weixu Yan, head of ETF research at Close Brothers Asset Management, said his team employ a “barbell approach” to be effectively duration neutral by “combining super long duration and super short duration”.

“Monetary policy has either gone too stringent too fast and the actual economy that lags way behind could go off a cliff, or, strong economic numbers will come out and give central banks more leeway to raise rates even higher,” Yan said.

Dan Caps, investment manager at Evelyn Partners, achieves a similar outcome by combining long-dated US Treasuries with inflation-linked sovereign bonds.

“You should be cautious around overconfidence in a consensus and positioning a portfolio for one particular view,” he warned. “We have different parts of the portfolio all serving to protect in different scenarios.”