BlackRock’s latest foray in its delayed entry to synthetic ETFs saw it offer exposure to global equities, presenting new tracking and tax efficiencies as well as counterparty risk considerations versus its existing offering.

The iShares MSCI World Swap UCITS ETF (IWDS) listed on the Euronext Amsterdam to much fanfare last week with a total expense ratio (TER) of 0.20%, equivalent to its physically backed iShares Core MSCI World UCITS ETF (SWDA).

IWDS synthetically replicates the MSCI World Net TR index of 1,480 equities across 23 developed markets and operates an unfunded swap model, whereby a counterparty pays the index total return in exchange for a swap fee.

On the one hand, the ETF’s approach has the advantage of being able to benefit from paying no withholding tax (WHT) on dividends paid by US equities, which comprise 70% of IWDS’s underlying index.

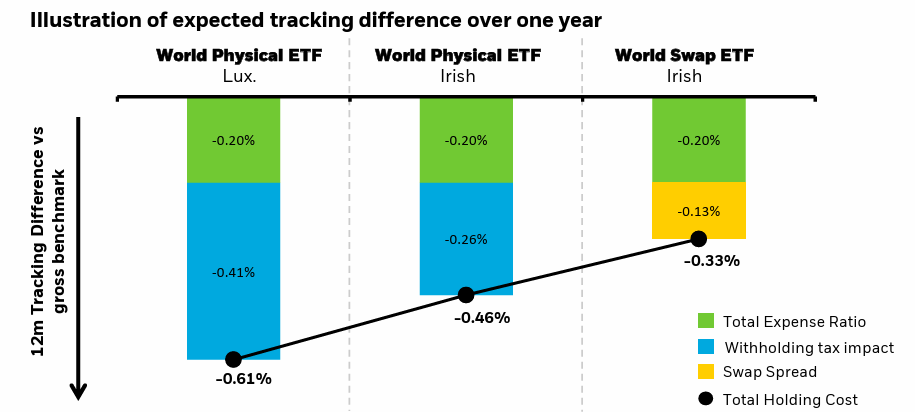

While physical ETFs domiciled in Ireland are subject to 15% WHT on US dividends and Luxembourg domiciled physical ETFs are subject to a 30% WHT rate, synthetic, Irish-domiciled ETFs can side-step WHT by holding a substitute basket comprised entirely of non-dividend paying stocks.

This is the key selling point of IWDS, which, owing to having no ‘slippage’ from withholding tax, had 0.33% tracking difference in the 12 months to 29 December 2023, versus 0.46% for physical Irish domiciled and 0.61% for physical Luxembourg domiciled equivalents.

Chart 1: Differences between domicile and replication

Source: BlackRock

On the other hand, investors are mindful of the potential counterparty risks inherent in the ETF’s swaps-based structure and the composition of its substitute basket.

“IWDS offers investors a low-cost exposure to a diverse range of global equities,” Nathan Sweeney, CIO at Marlborough, said.

“While it provides competitive pricing and potential tax advantages, investors should be aware of the counterparty risks associated with its synthetic structure.”

Simon McConnell, senior portfolio manager and head of portfolio construction at Netwealth, added: “Naturally, clients will have to pay attention to the counterparty risk and how the swap spreads change through time, as well as the differences in market bid-offers to assess whether it makes sense versus the physical alternatives.”

On counterparty risk, BlackRock noted IWDS relies on multiple swap counterparties to ensure best execution, given multiple parties are bidding for the swap contract while avoiding overconcentration with one counterparty.

On the substitute basket, the ETF issuer said constituents must be included within the MSCI World, cannot have a weighting exceeding 5% and the number of any share cannot exceed 100% of the 30-day average day trading volume (ADV) of each security.

Notably, IWDS is impacted by a 0.13% swap fee, whereas the physical SWDA benefits from a 0.03% securities lending uplift. IWDS also has an estimated wider bid-ask spread of 0.06% versus 0.02% for SWDA.

However, its 0.25% WHT advantage over its physical counterpart means it has an ex-ante total cost of ownership advantage of five basis points.

Despite this, some will remain unconvinced by the product’s relatively high 0.20% TER for a global equity exposure, which is marginally higher than the 0.19% carried by the $4.7bn Invesco MSCI World UCITS ETF (MXWS) and the 1D share class of the $6bn Xtrackers MSCI World Swap UCITS ETF (XWD1).

Notably, IWDS’s headline fee far exceeds those of physical world ETFs, with the recently launched, Irish-domiciled Amundi Prime All Country World UCITS ETF (WEBG) carrying a TER of 0.07%.

Sekar Indran, senior portfolio manager at Titan Asset Management, said: “There is added value from the reduced tracking difference of this product.

“We currently hold the physical SPDR MSCI World UCITS ETF (SWRD), which has a cheaper TER of 0.12%, so there would not be strong enough case for switching.”

IWDS marks the third synthetic ETF launch by the world’s largest asset manager following two US equity strategies, the iShares MSCI USA Swap UCITS ETF (MUSA) and the iShares S&P 500 Swap UCITS ETF (I500).

Its move into the space in 2020 marked a sharp about turn from an initial reluctance to offer synthetic replication. Investors will have to decide whether BlackRock’s latest offering provides cost efficiency and whether they are comfortable with the structure.