The climate crisis does not discriminate between asset classes.

Yet for most investors, the emphasis when decarbonising their portfolios has been primarily on public equities, accounting for 84% of Morningstar’s climate fund universe. However, there is increasing recognition that any efforts to reduce emissions in the global economy must also include fixed income.

Clear climate-aware investment targets should be calibrated against other financial and non-financial objectives. This is particularly relevant for long-term asset owners such as insurers and mature pension funds, which are more exposed to fixed income.

Relative to equities, the process of measuring the carbon footprint, setting targets and implementing objectives for fixed income can be more burdensome. In addition to being a larger investment universe, fixed income is also far less homogeneous. For example, corporate debt can be issued in a range of different maturities, duration, subordination characteristics, callability and coupon ratchet mechanisms.

While fixed income is more senior in the capital structure and therefore has higher built-in defences against loss potential, the asset class also comes with an asymmetric risk profile with a more acute emphasis on the downside risk. As a result, there is a perception that any upside due to effective engagement campaigns is more limited when compared to equities. In our view, however, this perception is changing as investors’ understanding of climate factors improves and their motives for engagement evolve.

Fixed income also serves a different purpose in the capital structure that could help investors engage with portfolio companies more effectively when combined with equity engagement efforts. For corporate investment grade and high-yield bonds, for example, issuers often overlap those in listed equity portfolios. Therefore, some of the same tools can be applied to improve issuers’ environmental standards.

And just as stockholders have turned to systematic strategies to incentivise companies to reduce their carbon footprint, more bondholders are applying rules-based solutions to implement a more climate-aware investment strategy.

Implementing a decarbonisation approach using Paris Aligned Benchmarks (PAB)

Typically, systematic strategies can help investors customise the transition pathway according to specific financial and non-financial goals. For example, it is possible to accelerate the rate of portfolio decarbonisation with EU Paris Aligned Benchmarks (PABs) or Climate Transition Benchmarks (CTBs) while maintaining a tracking error within a certain range relative to the parent index.

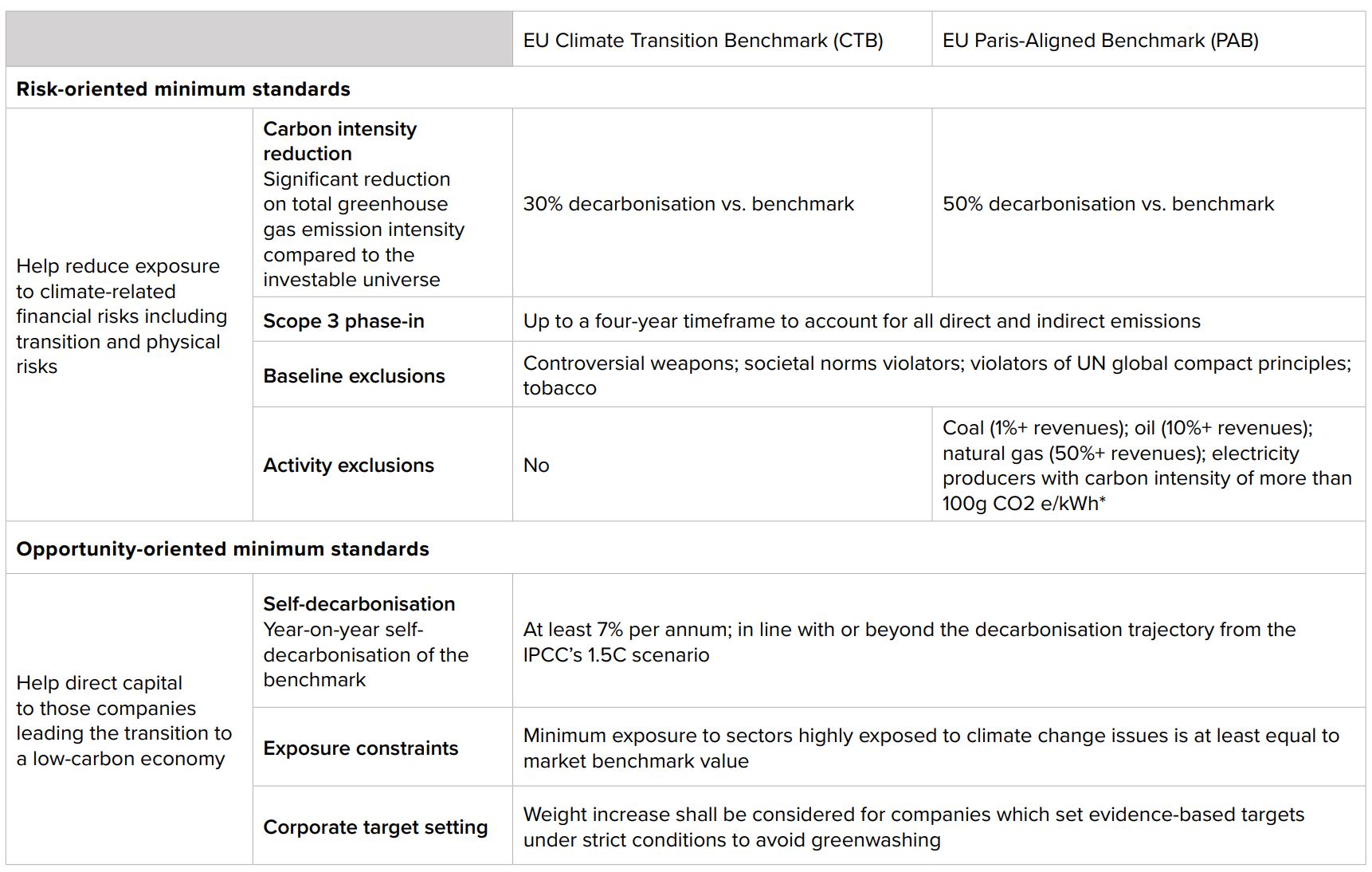

As illustrated in Chart 1, minimum standards for PABs are higher than CTBs, with the former requiring a 50% carbon footprint reduction relative to the parent benchmark in the first year, compared to 30% for the latter. In subsequent years, both types of climate benchmarks – which cover corporate bonds and do not yet include sovereign bonds – require at least a 7% emissions reduction per annum. (The 7% reduction in carbon intensity is consistent with the decarbonisation trajectory from the Intergovernmental Panel on Climate Change 1.5°C scenario relative to a baseline date of 31 January 2020.) PABs also exclude index constituents involved in a vast range of fossil fuel-related activities as a part of a principle to “Do No Significant Harm” (DNSH) to environmental objectives (see Chart 1).

Chart 1: Minimum standards for EU climate benchmarks

Source: European Commission, Sustainable finance – minimum standards for climate benchmarks, 2020. *Electricity producers refers to companies that derive 50%+ of revenues from electricity production.

Tilting towards issuers with higher environmental ratings does not necessarily mean giving up risk-adjusted returns. For example, in a comparison of Solactive US-dollar-denominated high yield corporate bond index against its PAB equivalent, performance appeared similar in the period from 31 December 2014 to 1 November 2022 (see Chart 2).

Chart 2: Performance of investment grade corporate bonds (USD) versus USD Paris Aligned Benchmark equivalents

Past performance is not a reliable indicator of future returns. Source: Fidelity International, based on USD-denominated investment grade index performance data from Solactive as of 1 November 2022, indexed to 1000 (base date: 31 December 2014).

The value of engagement in a systematic approach

While many systematic decarbonisation strategies are based on ratings that are supported by historical data, this does not have to be the norm. In our view, incorporating a more forward-looking assessment can add value. And underpinning that forward-looking approach is an effective engagement process.

Systematic strategies gain informational advantages in the engagement process that can lead to a better understanding of how climate risks may influence risk-return characteristics of issuers. Therefore, the portfolio managers can make more informed decisions to take advantage of a wider set of opportunities within the benchmark while reducing downside risks.

Traditionally, stockholders are viewed as having more potential to influence change through ownership mechanisms such as voting rights.

Therefore, engagement is perceived to be more challenging for bondholders, while the benefits are constrained on the upside compared to equities. In some cases, the holding period for debt may be limited relative to stocks, further reducing the potential to influence issuers. As a result, most corporate bondholders either do not engage or only engage on less than 5% of their holdings, according to the Principles for Responsible Investment (PRI).

However, this is changing for some investors. While fixed income investors are not owners and cannot vote, they can influence the environmental trajectories of portfolio companies through other means.

Timing is of the essence. For example, when companies are restructuring, conducting M&A activities, issuing new bonds or refinancing existing ones, investors may have more options and influence to negotiate improvements in environmental standards, using tools such as covenants to encourage accountability. In addition to holding issuers responsible for their impact on the environment, engagement can also help support a continuous informational feedback loop that assists in more informed investment decision-making.

The range and variations in fixed income instruments require investors to be more deliberate when engaging with issuers. Engagement processes also require a distinct approach in fixed income when following standards such as those established by Principles for Responsible Investment (PRI). Different tactics are needed to influence corporate issuers compared to sovereigns. For example, a corporate issuer coming into debt markets in six months’ time may be more willing to discuss financial covenants to help reduce climate risks.

Fixed income’s role in the climate crisis

As an indicator of future economic activity, it has been said that the bond market is smarter than the stock market. It is thought to be a more stable, reliable metric. Larger and more diversified at about $127trn in debt outstanding in 20211, fixed income is vital to keep the global economy running smoothly. Bond market crashes, for instance, are arguably more insidious. This calls for a reconsideration of priorities to put more emphasis on fixed income when decarbonising an investment portfolio.

Engagement is a powerful means to persuade portfolio companies to raise their environmental standards. Here, bondholders may have more to gain by collaborating internally with their equity colleagues or externally with other financial institutions and government agencies.

Furthermore, engagement can enhance quantitative and qualitative information advantages to better gauge the decarbonisation trajectories of issuers. This allows for a more nuanced understanding of risk-return characteristics while influencing real-world emissions reduction.

Worldwide, an estimated 1550 institutions – including pension funds, with an aggregate $40trn assets – have committed to divesting from fossil fuels.2 Here, too, the decision to divest in fixed income requires a different approach. Because bondholders do not have the same legal rights as equity investors, divesting or the threat of divesting manifests in different ways relative to equities.

There are also some reasons to take a cautious stance. The higher level of complexity in the risk-return characteristics of fixed income relative to equities also calls for a more fine-tuned approach to decarbonising the portfolio. However, delaying action is not a viable option.

That simply ignores climate risks and opportunities while sidestepping investor responsibilities.

For certain asset owners who have committed to a timebound decarbonisation pathway, opting for systematic solutions may offer a more transparent trajectory. This can be done while achieving a comparable tracking error, duration risk and yield-to-worst among other metrics to traditional benchmarks.

In our view, the crucial role of the fixed income market calls on bondholders to play a more active part in reducing the environmental degradation from human activities. By implementing a climate-aware investing strategy in fixed income to align with other parts of their investment portfolios, investors can help provide issuers with the incentives for a low-carbon transition while building resilience in their investment portfolios.

This article was first published inFixed Income Unlocked: After The Storm, an ETF Stream report

1 2022 Capital Markets Fact Book”, Securities Industry and Financial Markets Association (SIFMA), July 2022.2 The database of fossil fuel divestment commitments made by institutions worldwide”, Global Fossil Fuel Divestment Commitments Database, October 2022.

Risk warnings

Past performance does not predict future returns.

The value of investments and the income from them can go down as well as up and investors may not get back the amount invested.

There is a risk that the issuers of bonds may not be able to repay the money they have borrowed or make interest payments. When interest rates rise, bonds may fall in value. Rising interest rates may cause the value of your investment to fall.

Due to the greater possibility of a default an investment in a corporate bond is generally less secure than an investment in government bonds.

Sub-investment grade bonds are considered riskier bonds. They have an increased risk of default which could affect both income and the capital value of the Fund investing in them.

Reference to specific securities should not be construed as a recommendation to buy or sell these securities and is included for the purposes of illustration only.

The use of financial derivative instruments may result in increased gains or losses within the fund.

Important information

This is a marketing communication. This information must not be reproduced or circulated without prior permission. Fidelity only offers information on products and services and does not provide investment advice based on individual circumstances, other than when specifically stipulated by an appropriately authorised firm, in a formal communication with the client. Fidelity International refers to the group of companies which form the global investment management organisation that provides information on products and services in designated jurisdictions outside of North America. This communication is not directed at, and must not be acted upon by persons inside the United States and is otherwise only directed at persons residing in jurisdictions where the relevant funds are authorised for distribution or where no such authorisation is required. Unless otherwise stated all products and services are provided by Fidelity International, and all views expressed are those of Fidelity International. Fidelity, Fidelity International, the Fidelity International logo and F symbol are registered trademarks of FIL Limited. Fidelity UCITS II ICAV is registered in Ireland pursuant to the Irish Collective Asset-management Vehicles Act 2015 and is authorised by the Central Bank of Ireland as a UCITS.

FIL Limited assets and resources as at 31/01/2023 - data is unaudited. Research professionals include both analysts and associates. The Key Investor Information Document (KIID) is available in English and can be obtained from our website at www.fidelityinternational.com. The Prospectus may also be obtained from Fidelity.Solactive AG ("Solactive") is the licensor of Solactive Paris Aligned Global Corporate USD Index (the "Index"). The financial instruments that are based on the Index are not sponsored, endorsed, promoted or sold by Solactive in any way and Solactive makes no express or implied representation, guarantee or assurance with regard to: (a) the advisability in investing in the financial instruments; (b) the quality, accuracy and/or completeness of the Index; and/or (c) the results obtained or to be obtained by any person or entity from the use of the Index. Solactive reserves the right to change the methods of calculation or publication with respect to the Index. Solactive shall not be liable for any damages suffered or incurred as a result of the use (or inability to use) of the Index. Issued in Europe by: FIL (Luxembourg) S.A., authorised and supervised by the CSSF (Commission de Surveillance du Secteur Financier). ETFSSO-01-20230209