The power of bonds to influence company behaviour, the pitfalls and merits of the EU’s Paris-aligned benchmark (PAB) and climate transition benchmark (CTB) and the ongoing ESG data challenge were the topics covered in ETF Stream’s webinar in partnership with ICE.

The discussion, titled Climate indices: The new frontier in fixed income benchmarks, started with an explanation why using equities alone is not the right approach to affecting practical outcomes in ESG.

Mark Geen, senior investment consultant at PGGM, argued the recurring nature of bond issuance to fund companies’ operations makes fixed income an ideal asset class for investors trying to reward or pressure corporates to behave in a certain way.

“Companies do not issue much more equity once they have listed,” Geene said. “Aside from engaging, corporate fixed income issuance is a key opportunity to influence company actions on issues such as emissions reduction.”

Echoing his thoughts, Alberto Ruiz Sena, director, product management, at ICE, added: “While the equity markets were a natural first step for climate metrics, we will not reach net-zero 2050 goals without focusing on the fixed income side of the equation.”

Rebecca Palmer, director, sustainable finance data, at ICE, also said climate and carbon reduction fixed income indices have an important role as asset managers use them as comparison benchmarks versus their own portfolio’s performance on climate metrics.

“Portfolio and asset managers hedge their risk using low carbon indices,” Palmer continued. “They really affect the internal functioning of the entire market.”

The Paris-aligned and climate transition benchmark paradigm shift

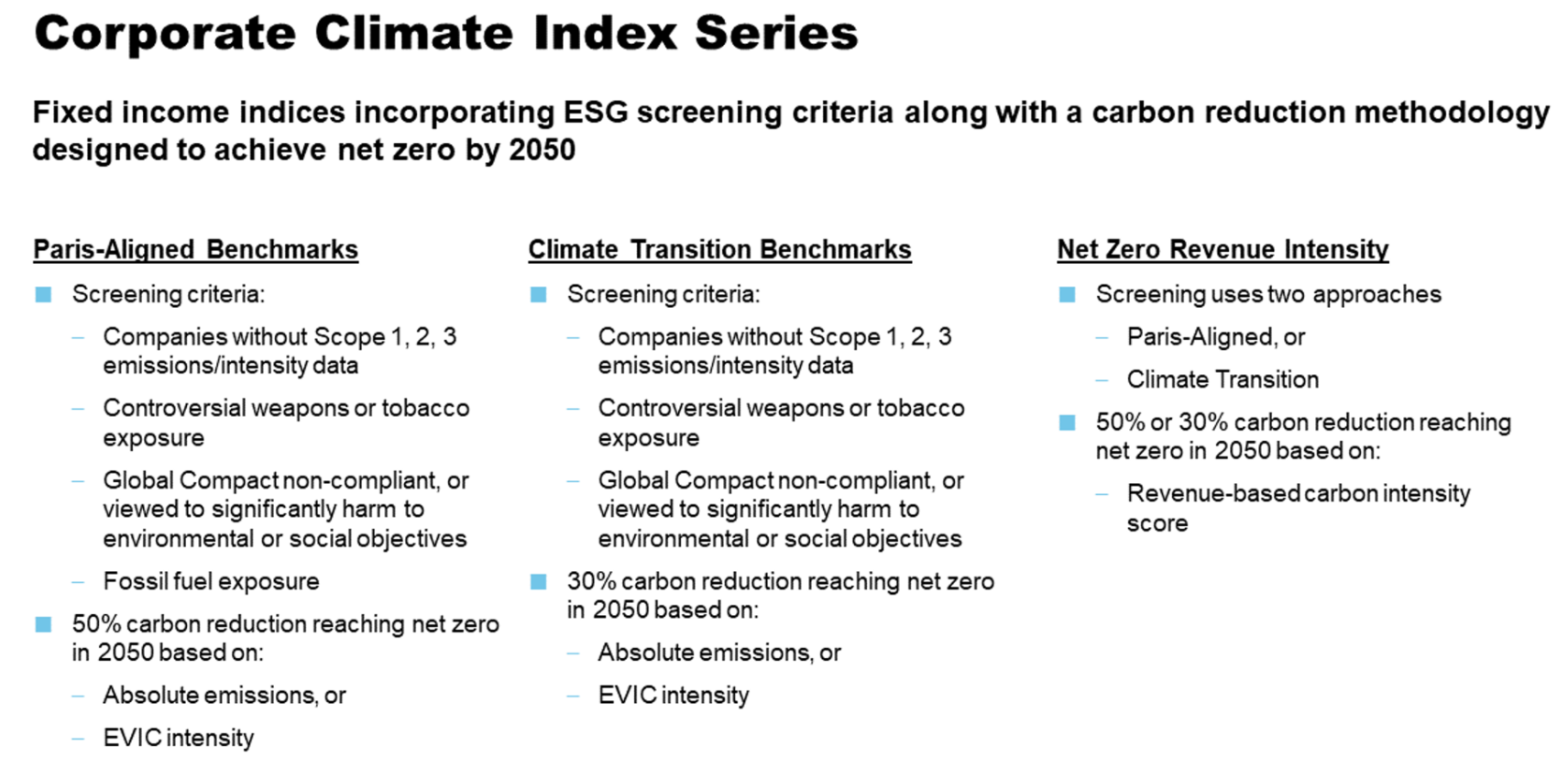

A key development in climate indexing in recent years has been the continued development and investor uptake of PAB and CTB-linked strategies, which the EU launched to attract flows into carbon reduction-benchmarked products and tackle greenwashing as part of the policymaker’s net-zero by 2050 policy.

Source: ICE

However, the benchmarks contain several nuances that bear considering.

First, Palmer said indices should incorporate companies with carbon reduction targets that are “genuine, technically detailed and viable” so they can disclose credible targets and their progress towards them is verifiable.

Next, Sena pointed out some exposures an investor will not find in PABs and CTBs. One asset class is sovereign debt, given it is difficult to engage with governments and also challenging to calculate their performance on climate metrics.

Another group of assets excluded from the benchmarks are green, impact and social bonds, which help corporates finance particular sustainable ventures, however, Sena warned it is difficult to verify whether proceeds are being used for their declared purpose.

Finally, companies involved in fossil fuel extraction and production can be included in the CTB but are outright rejected by the PAB.

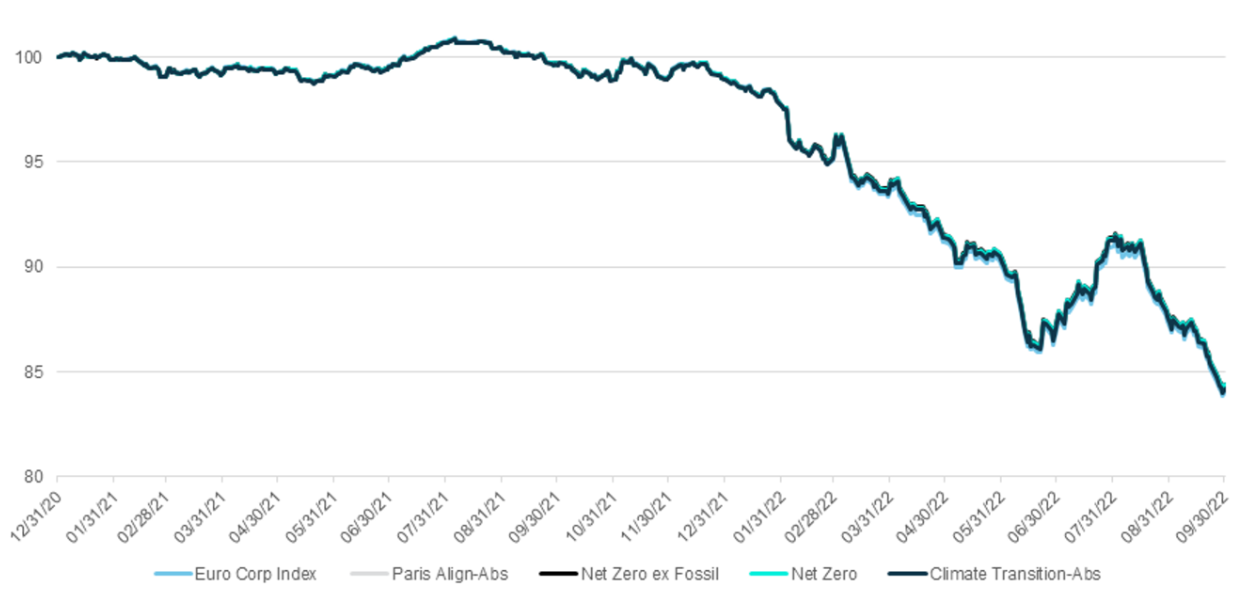

Despite the risk of over-concentration exclusions may cause, Sena said in practice PAB-linked indices behave similarly to their respective parent indices.

Source: ICE

Going forward, Palmer said the EU is consulting the market on whether to allow benchmarks issued in ‘third countries’ – outside of the EU – a discussion which will be reviewed in Q2 next year.

Data shortcomings

Finally, participants addressed the gaping Scope 3 emissions-shaped hole in the data the PAB and CTB rely on to assess companies’ performance on carbon reduction metrics.

Geene argued we are “only at a starting point” on Scope 3 data – which looks at upstream and downstream emissions in supply chains – and that as much as half of the data is estimated while the rest is reported by companies using different methodologies with varying degrees of accuracy.

“There is a challenge on the data side. Many corporates do not publish emissions data,” Geen continued. “Data providers such as MSCI and Sustainalytics are doing modelling to predict the emissions reduction of companies.”

Finally, on a suggestion companies should be rewarded with additional weighting in indices for better disclosure and having clear targets, Sena thought this would be a good mechanism, while Geen warned it would be difficult to agree on a framework for how to assess the quality of reporting by companies.

To watch the full webinar, click here.

Related articles

Solving Europe’s energy crisis: Macro outlook and investment opportunities

Will rising demand breathe life into fixed income ETFs

Does the EU taxonomy vote mean nuclear is officially ESG?