Demand for fixed income ETFs has waned this year, according to a recent survey conducted by TrackInsight, driven by the current macro environment and the “limited range” of strategies available for investors.

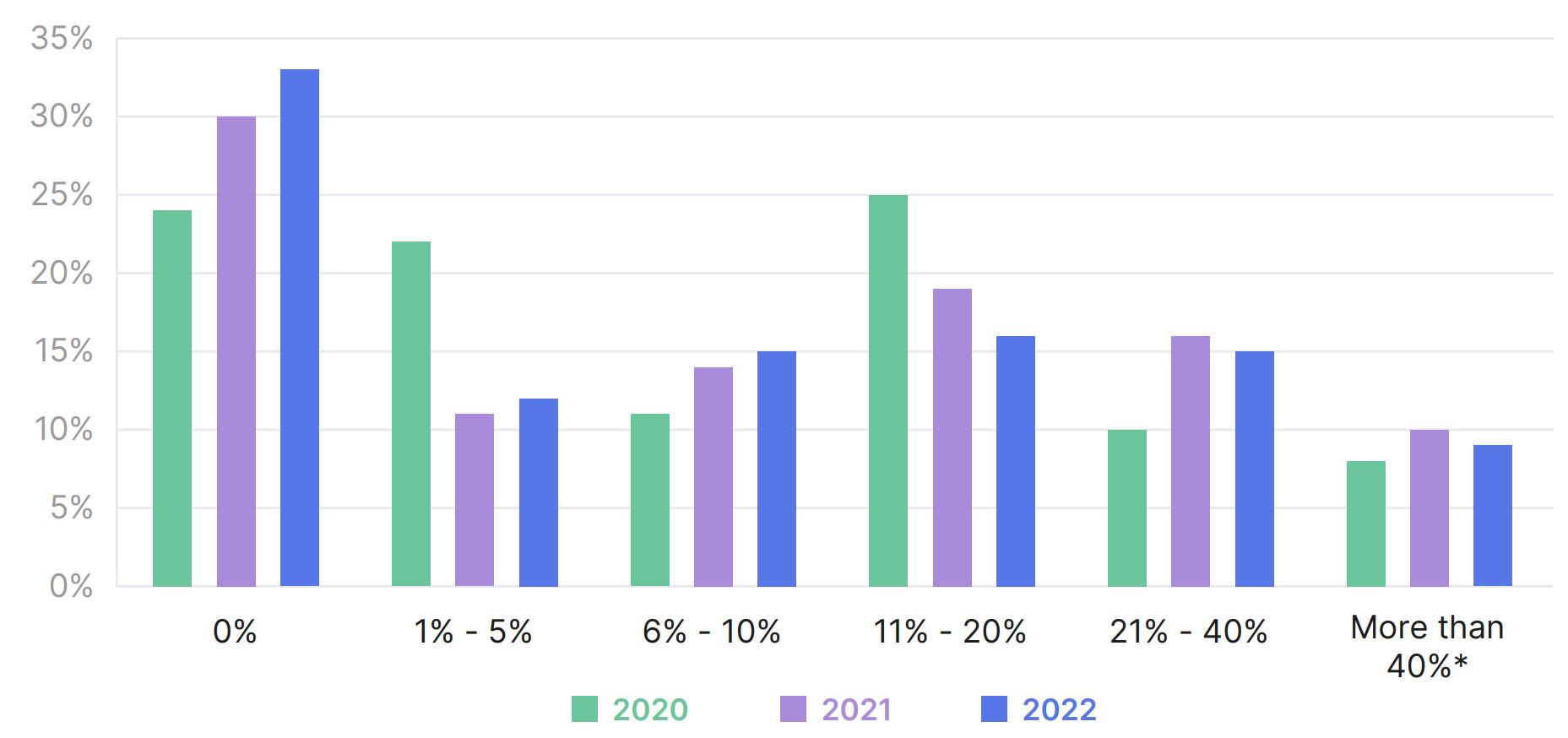

The Global ETF Survey 2022, which interviewed 347 professional investors across 20 countries, found 33% of respondents do not have exposure to fixed income ETFs, up from 24% in 2020, while two-thirds expect to either maintain or reduce their bond ETF allocations over the next 12 months.

Chart 1: Percentage of portfolio invested in fixed income ETFs

Source: TrackInsight

Skyrocketing inflation and subsequent rising interest rates has created a challenging environment for fixed income ETFs, especially during the first five months of the year.

In April, JP Morgan revealed fixed income allocations have fallen to their lowest level since the Global Financial Crisis (GFC) amid lowering liquidity and rising inflation.

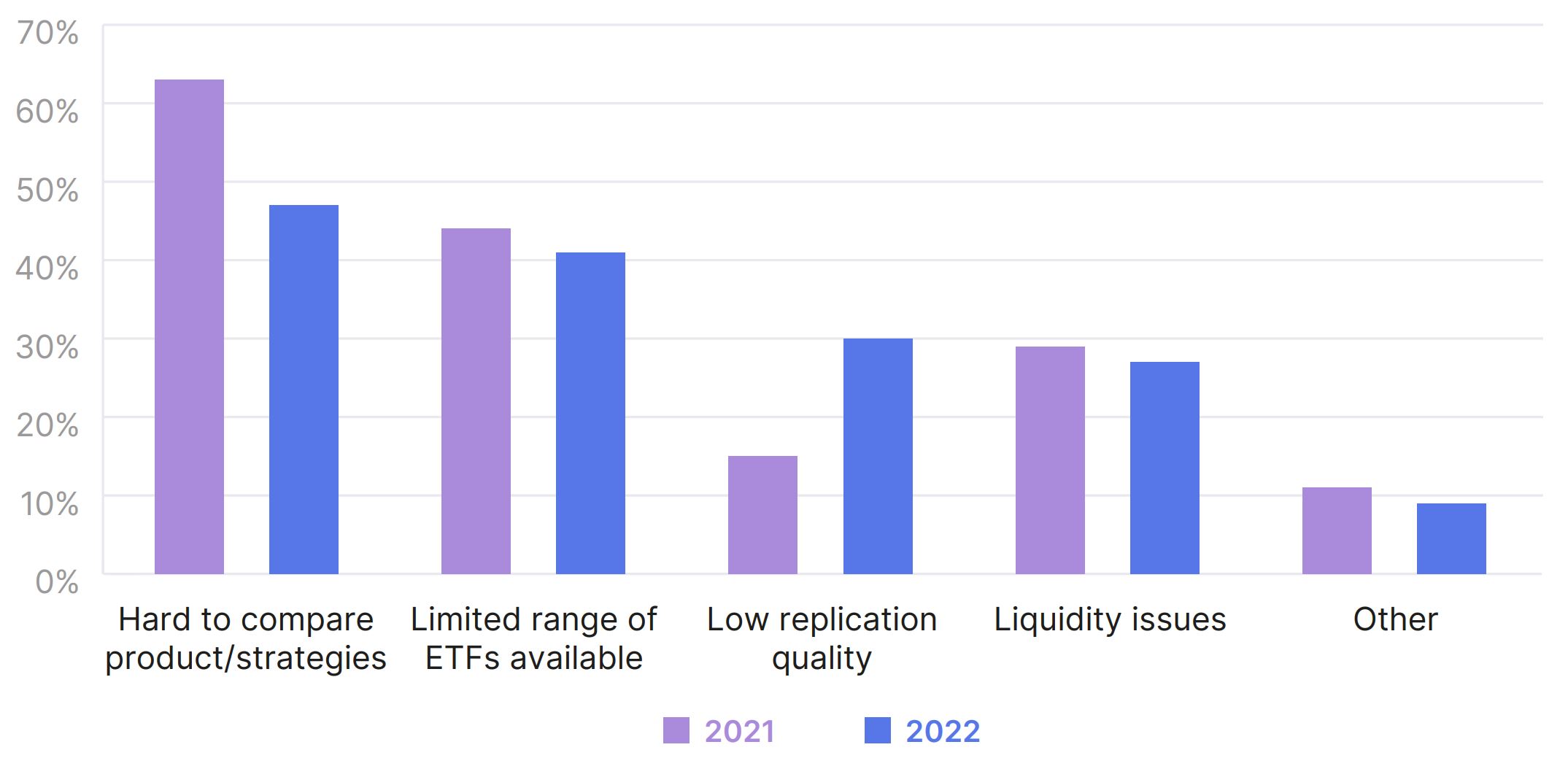

When questioned about the main challenges of investing in bond ETFs, just under 50% of respondents said it was hard to compare strategies while 41% said there is currently a limited range of ETFs available in this asset class.

Chart 2: Main challenges of investing in fixed income ETFs

Source: TrackInsight

“Another chicken-or-egg problem is the limited range of fixed income ETFs available, that means that some investors might not be able to find the exact exposure they are looking for in an ETF form,” the TrackInsight report stressed.

“The lack of money flowing in, combined with poor performance, does not entice many ETF providers to launch products in this segment.”

Highlighting the lack of investor demand, fixed income ETF specialist Tabula has closed three ETFs with low AUM so far this year as it continues to switch its focus to ESG strategies.

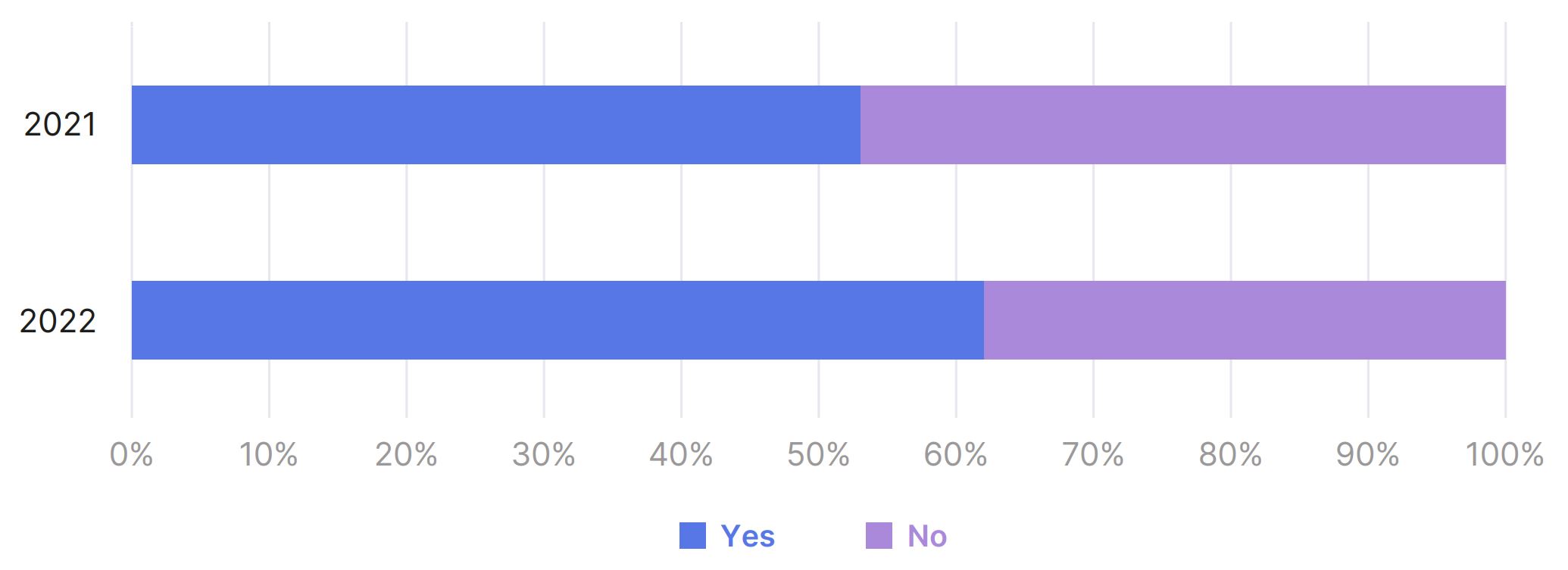

From a liquidity perspective, most investors appear to be comfortable with the ETF wrapper in fixed income. Some 63% of respondents said they would use ETFs in less liquid parts of the bond market, up from 53% in 2021.

Chart 3: Percentage of respondents that would use ETFs to invest in less liquid fixed income securities

Source: TrackInsight

Furthermore, there was a slight drop from 2021 in investors highlighting liquidity issues as one of the main challenges of investing in fixed income.

“This shows the trust that professional investors have in the additional layer of liquidity provided by ETFs that might help them access some illiquid markets,” the report added.

During the March 2020 sell-off, fixed income ETFs started trading at all-time high discounts to net asset value (NAV) but this simply highlighted how the wrapper can become a price discovery tool when the underlying market effectively stops trading.

Highlighting this, the iShares $ Corp Bond UCITS ETF (LQDE) traded 1,000 times on 12 March 2020 while its underlying securities changed hands just 27 times.

Finally, demand for fixed income ESG ETFs among respondents fell to 58% this year, down from 69% in 2021.

Related articles