Advancements in technology have and will continue to dramatically change the world we live and work in. The investment management industry, and thematic investing in particular, has perhaps been one of the greatest recent beneficiaries of this progress.

Increased market efficiencies, enhanced information flows, the ability to extrapolate views from a variety of data sources and significantly greater transparency have given investors more tools to explore potential opportunities for growth.

Bottom-up and top-down?

Thematic investing is emerging as a way to invest in up-and-coming firms. At first glance, that might sound like traditional growth investing.

We advocate that the two approaches are different – but can effectively complement each other.

Thematic investing is an investment approach that seeks to identify longer-term, structural trends that could drive stock performance in a rapidly changing world. It aims to find companies that stand to benefit from opportunities revolving around a particular theme. And it is one of the fastest-growing investment approaches globally, with ETF assets accounting for $157bn and mutual fund assets exceeding $400bn, as of 31 January.1

Thematic investors view the investment universe from different perspectives. Some may observe the world’s evolution through the prism of the underlying innovation in business models or technologies. Others may pursue a social or demographic approach, seeing the world evolve in ways that reflect the needs of the millennial generation or patterns in urbanisation. Thematic investing is flexible, enabling investors to employ both a top-down and/or a bottom-up approach.

A framework for thematic investors

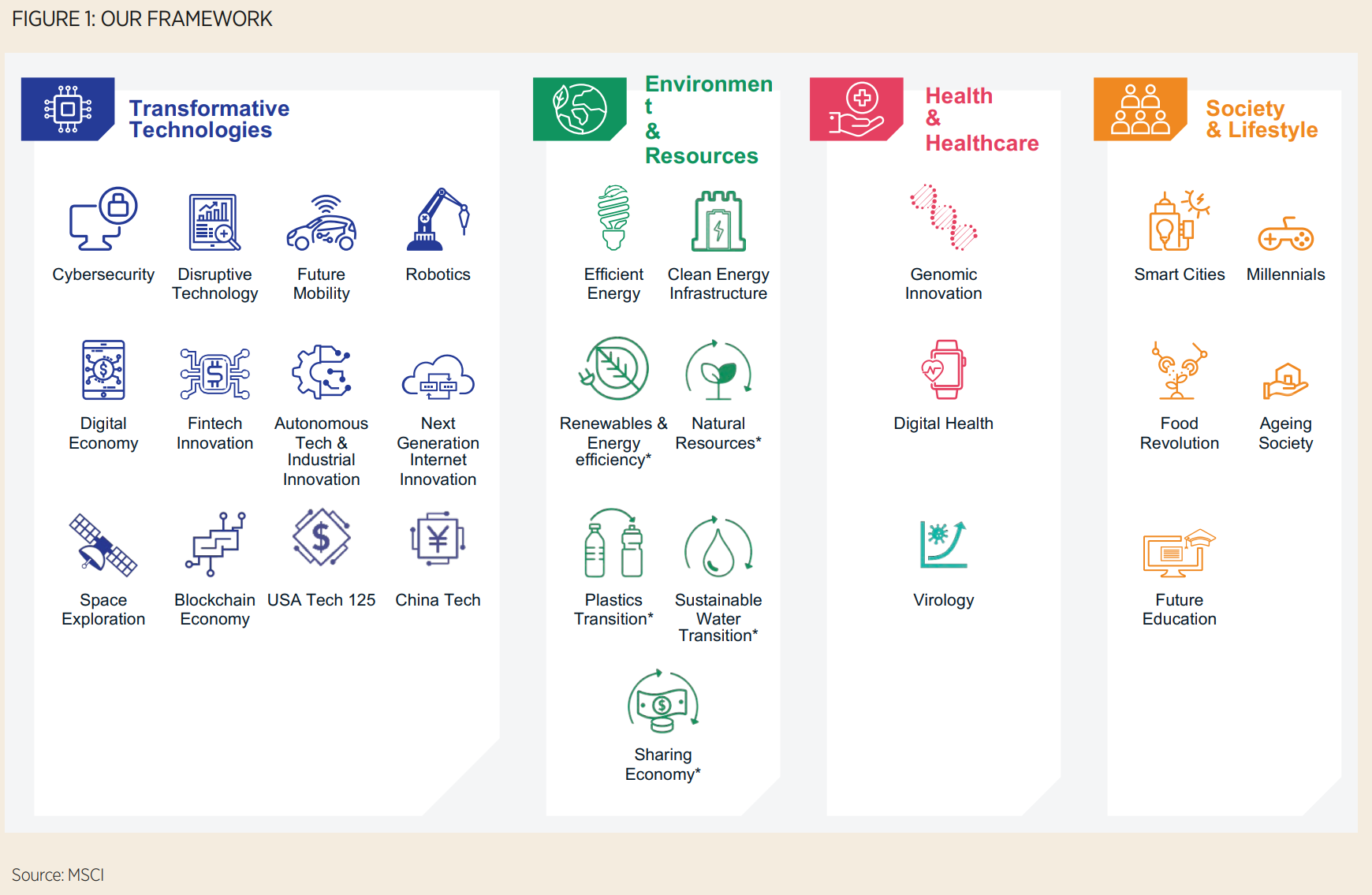

MSCI has adopted a broad-based classification system to assess exposure to four key megatrends.

As illustrated in Figure 1, these include transformative technologies, health and health care, society and lifestyle, and environment and resources.

Subcategories are further delineated under each of the four broad thematic ideas.

Increasingly, investment managers explicitly use themes to express their views. They may choose to tilt portfolio holdings toward certain megatrends or use thematic exposures as a lens to explain allocations and to gain additional insights into portfolio attributes. Asset managers and allocators also may consider funding thematic investments to gain exposure to potentially disruptive firms whose fortunes may not be captured by conventional fundamental growth measures.

Assessing a firm’s thematic exposure

For these investors, two questions arise. First, what are disruptive firms and how can we identify them? Second, what are the key opportunities – and challenges – that distinguish thematic from traditional growth investing?

Themes are derived from megatrends, which we define as long-term structural trends that are transforming global economies and daily life, impacting public and private businesses of all kinds.

The themes underlying these megatrends are not only long-term in nature, they also span industries, sectors and geographies, and often evolve quickly as the underlying trends create economic impact.

Once we identify megatrend categories and their underlying themes, the next step is to identify companies that have exposure to these themes.

While established fields such as factor investing can draw on a long history of academic research, data and theory, thematic investing is predicated on the emergence of new business models, technological advancements and changing consumer behaviour. Such information is not widely reflected in companies’ financial data. Key evidence may need to be found in a company’s discussion of early-stage corporate activities, capital expenditure or growth plans. It may also be difficult to identify companies that are buried deep in the value chain of a theme, and those that may have less of a direct linkage to the theme.

Measuring a company’s economic link to themes

MSCI has developed the Thematic Exposure Standard with the aim to assess the importance of a theme to a company’s business activities. It seeks to gauge the economic link between a company and a theme. We call this metric a company’s “relevance score”. These scores can be used to systematically measure, monitor and report on the thematic exposure of indices, portfolios and funds, as well as provide company-level thematic exposures for a broad universe of equities. The scores help capture both “upstream” activities such as capital expenditure and merger and acquisition plans, product development and competitive agenda, as well as established revenue or earnings streams disclosed at the business-line level.

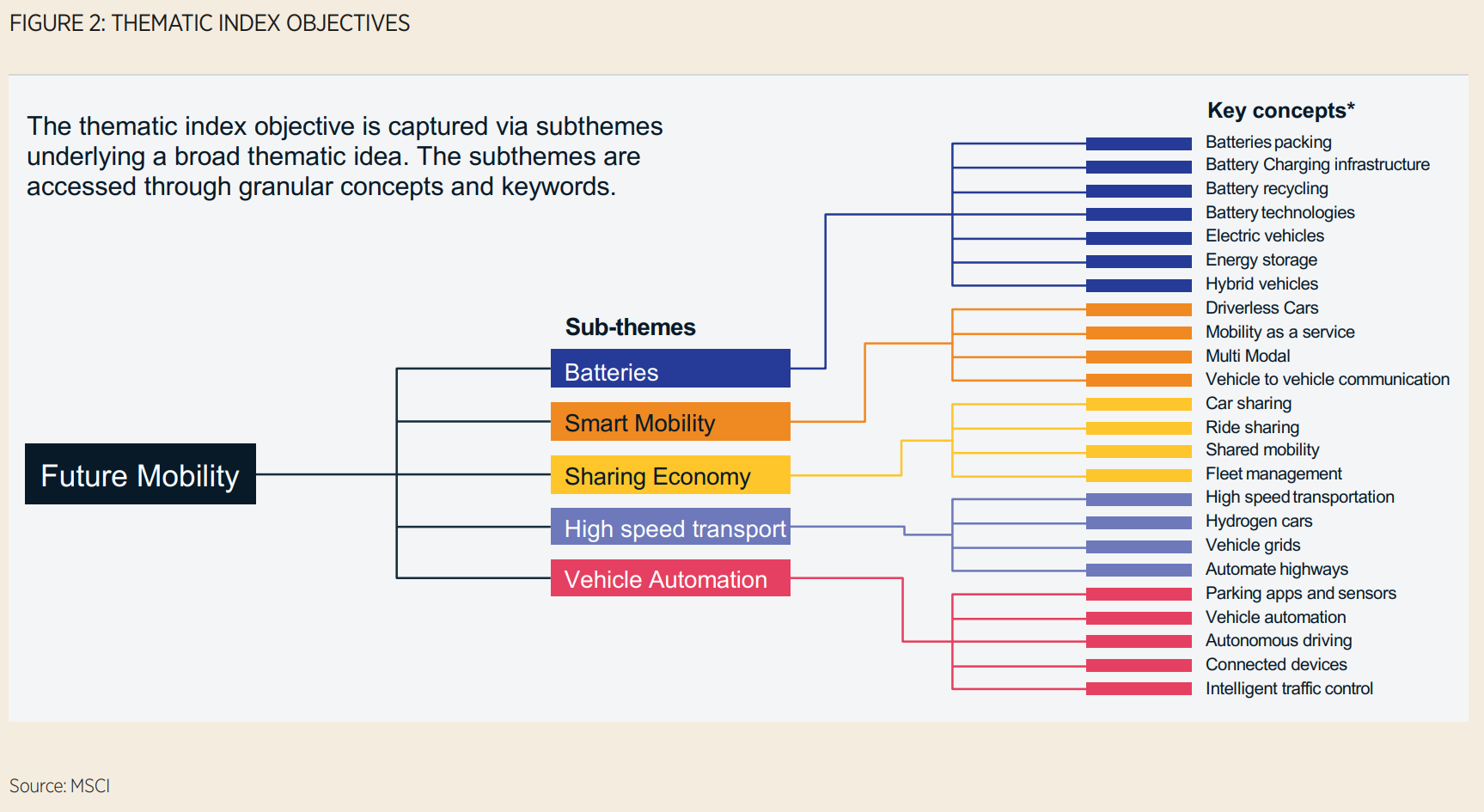

Thematic exposures are assembled with an assist from technology that has captured the imaginations of scholars, researchers and investors: natural language processing (NLP), an artificial intelligence technology. The first step in calculating exposure is to break down the theme’s scope into high-level concepts such as products, services and technologies in the value chain, as shown in Figure 2. We then use NLP to gather synonyms and other related concepts to expand the high-level ideas into a more granular pool of words and phrases. The use of NLP techniques accelerates the research phase of theme development and allows themes to be modelled in a scalable and cost-effective manner.

The next step is to compare companies’ self-declared business-line information and publicly sourced business description with this resulting large pool of words and phrases. We do this to find evidence of the company’s association with those products, services or technologies that are pertinent to the theme. This association is quantified in the exposure by estimating revenue attributable to the theme as a percentage of the company’s total revenue.

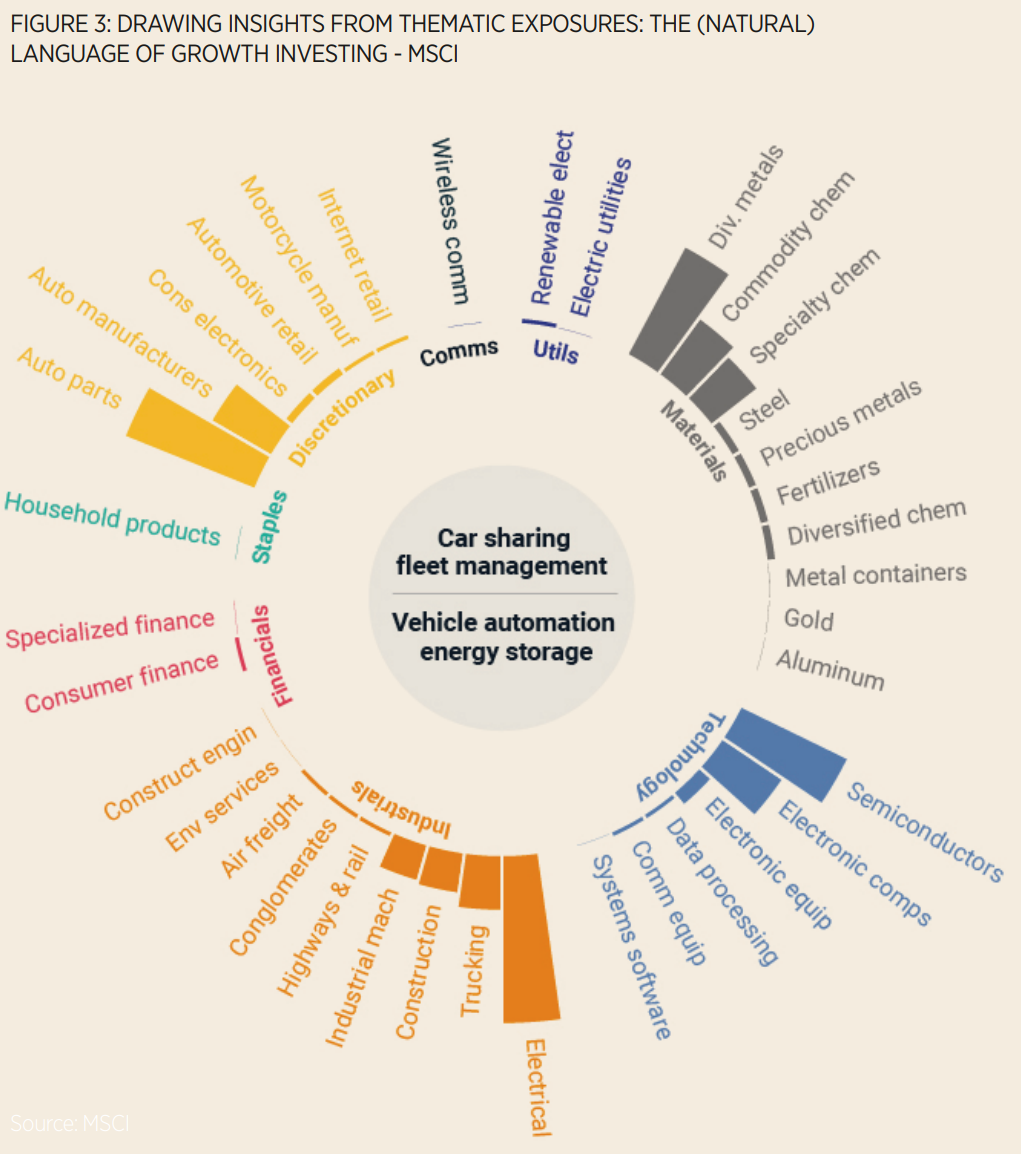

For example, consider a mobility-related theme (shown in Figure 3 using the constituents of the MSCI ACWI Investable Market Future Mobility index), which seeks to identify firms associated with the development of energy storage, fleet management and vehicle automation, among other concepts. The list of concepts that describe the theme is linked to several hundred firms, which span eight GICS® sectors and almost 40 sub-industries, from diversified metals to data processing.

Distinctions between thematic and growth firms

Growth firms usually have a track record of rising earnings and sales. In contrast, thematic firms typically have an economic link to a longer-term, structural megatrend, but without the prerequisite of recent growth.

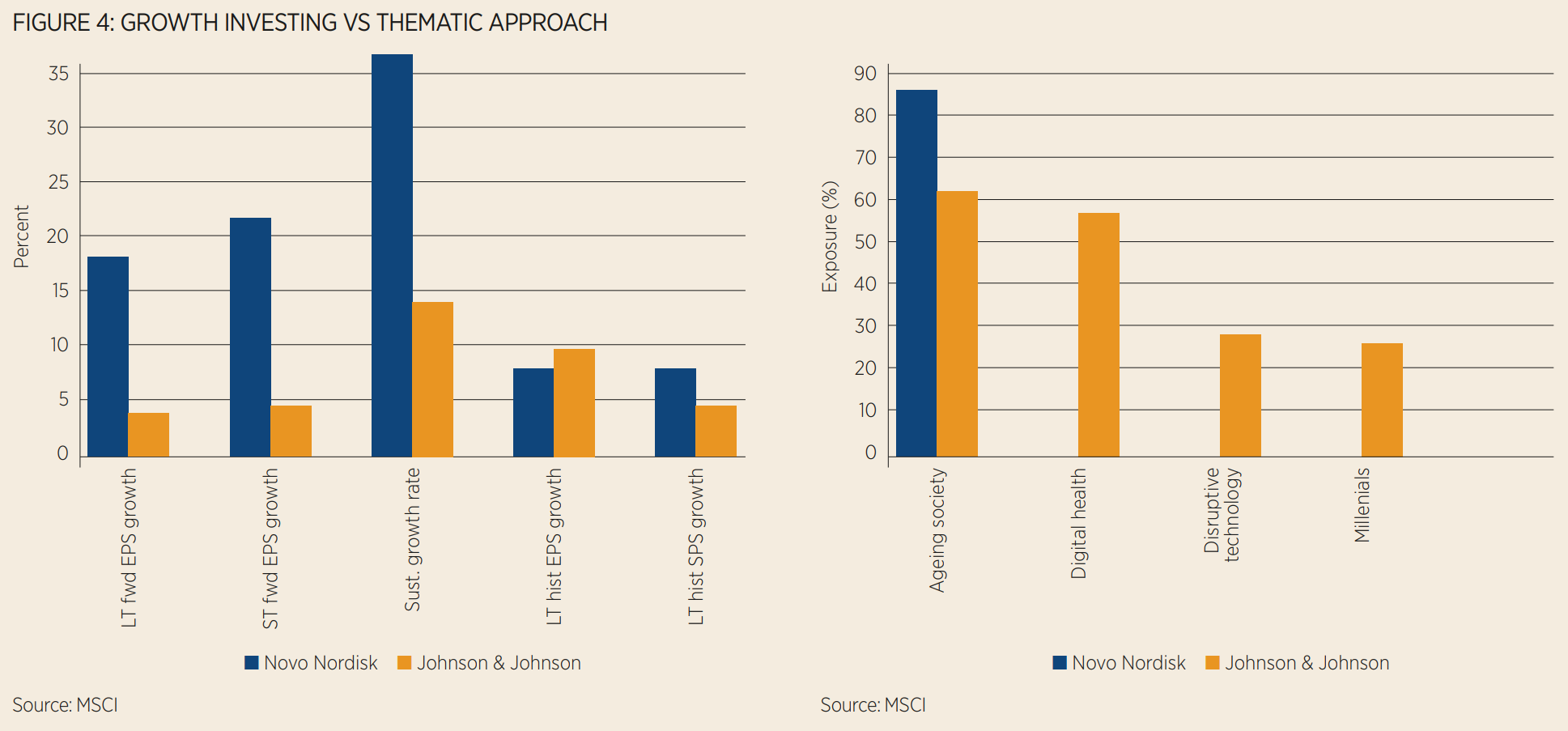

Still, institutional investors may ask: but what distinguishes thematic from growth investing? Thematic exposures can help explain. Our research highlights one clear example. Consider two venerable, century-old pharmaceutical firms, Denmark’s Novo Nordisk A/S and Johnson & Johnson of the US. As shown in Figure 4, Novo Nordisk handily bests Johnson & Johnson across most growth measures such as forward earnings estimates and sustainable growth rate. As a result, it was classified as a growth firm and included in the MSCI Growth indices, as of September 2022.

The picture is quite different, however, when viewed through a thematic lens. Far from being a dated centenarian, Johnson & Johnson has a sizeable presence in four themes based on MSCI’s Thematic Exposure Standard, shown above: ageing society, digital health, disruptive technology and millennials. Consequently, while it is not included in the growth index, it is included in corresponding MSCI indices based on its thematic footprint.

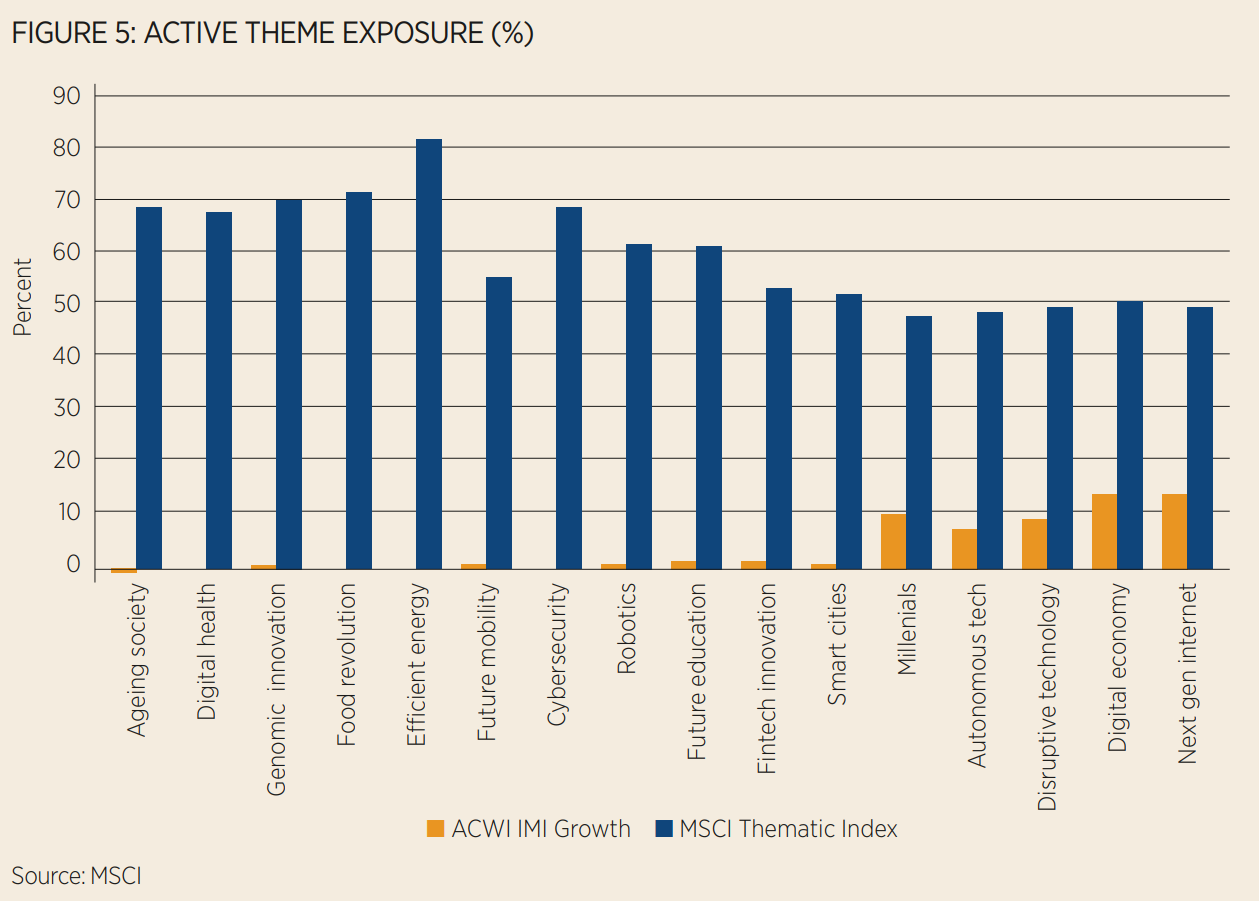

We examined the thematic composition of a growth index, a sector index and thematic indices (see Figure 5). We found that currently the MSCI ACWI IMI Growth index exhibits exposure to themes such as next-generation internet and digital economy but did not provide significant exposure to themes such as efficient energy, ageing society and digital health. Thematic indices, which use thematic exposures in their construction, provided significantly higher exposure to their respective single themes. That implies that traditional growth investing could have overlooked many themes.

Conclusion: Finding opportunities that other styles may overlook

Companies with new and disruptive technologies or products often take market share from incumbents, and this evolution has driven changes in equity indices over time. Thematic investing provides a powerful lens that seeks to identify these companies and other innovators that can be linked to specific themes – themes that span many products and services that no single country, sector or investing style may fully capture.

As we argue above, stocks with meaningful exposure to themes may help investors participate in the forces driving change. Thematic indices and tools, such as the Thematic Exposure Standard can also help implement investor allocation strategies and capitalise on investors’ higher-conviction views on specific themes.

This article first appeared in ETF Insider, ETF Stream's monthly ETF magazine for professional investors in Europe. To read the full article, click here.

We invite you to learn more about our thematic investing research, indices and tools at msci.com

1 Source: Morningstar

About MSCI

MSCI is a leading provider of critical decision support tools and services for the global investment community. With over 50 years of expertise in research, data and technology, we power better investment decisions by enabling clients to understand and analyse key drivers of risk and return and confidently build more effective portfolios. We create industry-leading research-enhanced solutions that clients use to gain insight into and improve transparency across the investment process. For more information, visit www.msci.com

Notices and disclaimer

The information contained herein (the “Information”) may not be reproduced or redisseminated in whole or in part without prior written permission from MSCI. The Information may not be used to verify or correct other data, to create any derivative works, to create indexes, risk models, or analytics, or in connection with issuing, offering, sponsoring, managing or marketing any securities, portfolios, financial products or other investment vehicles. Historical data and analysis should not be taken as an indication or guarantee of any future performance, analysis, forecast or prediction. None of the Information or MSCI index or other product or service constitutes an offer to buy or sell, or a promotion or recommendation of, any security, financial instrument or product or trading strategy. Further, none of the Information or any MSCI index is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. The Information is provided “as is” and the user of the Information assumes the entire risk of any use it may make or permit to be made of the Information. NONE OF MSCI INC. OR ANY OF ITS SUBSIDIARIES OR ITS OR THEIR DIRECT OR INDIRECT SUPPLIERS OR ANY THIRD PARTY INVOLVED IN MAKING OR COMPILING THE INFORMATION (EACH, AN “INFORMATION PROVIDER”) MAKES ANY WARRANTIES OR REPRESENTATIONS AND, TO THE MAXIMUM EXTENT PERMITTED BY LAW, EACH INFORMATION PROVIDER HEREBY EXPRESSLY DISCLAIMS ALL IMPLIEDWARRANTIES, INCLUDING WARRANTIES OF MERCHANTABILITY AND FITNESS FOR A PARTICULAR PURPOSE. WITHOUT LIMITING ANY OF THE FOREGOING AND TO THE MAXIMUM EXTENT PERMITTED BY LAW, IN NO EVENT SHALL ANY OF THE INFORMATION PROVIDERS HAVE ANY LIABILITY REGARDING ANY OF THE INFORMATION FOR ANY DIRECT, INDIRECT, SPECIAL, PUNITIVE, CONSEQUENTIAL (INCLUDING LOST PROFITS) OR ANY OTHER DAMAGES EVEN IF NOTIFIED OF THE POSSIBILITY OF SUCH DAMAGES. The foregoing shall not exclude or limit any liability that may not by applicable law be excluded or limited. Privacy notice: For information about how MSCI collects and uses personal data, please refer to our Privacy Notice at https://www.msci.com/privacy-pledge.