DWS, the asset management arm of Deutsche Bank, has launched two next generation Xtrackers thematic ETFs. The ETFs incorporate a screening methodology, designed to pick stocks most likely to cash-in promising technology advances, in the firm's bid to redefine how investors gain exposure to future trends.

The two specific areas of interest within technology advances include future mobility and Artificial Intelligence (AI).

The Xtrackers Future Mobility UCITS ETF (XMOV) and the Xtrackers Artificial Intelligence and Big Data UCITS ETF (XAIX) have listed on the Deutsche Boerse today, both with all-in fees of 0.35 per cent.

XMOV tracks the Nasdaq Yewno Future Mobility Index, which is comprised of companies which are likely to benefit from future mobility trends. Trends including the emergence of autonomous vehicles, the switch of electric and hybrid vehicles as well as the trend of electric and lithium batteries.

XAIX tracks the Nasdaq Yewno AI and Big Data Index, which is comprised of companies exposed to AI such as deep learning, cloud computing and image recognition to name a few.

The funds' underlying indices incorporate an AI processing methodology when selecting companies which comprise each index. The methodology also focuses on identifying companies with patents in place that are most likely to make those companies significant future revenue generators.

Michael Mohr, Head of ETF Product Development, said in a statement: "Our thematic ETFs are designed to focus in on up to 100 companies globally that are most likely to be the revenue winners of tomorrow, given the big societal shifts we're seeing on the back of rapid technological advancement."

Performance

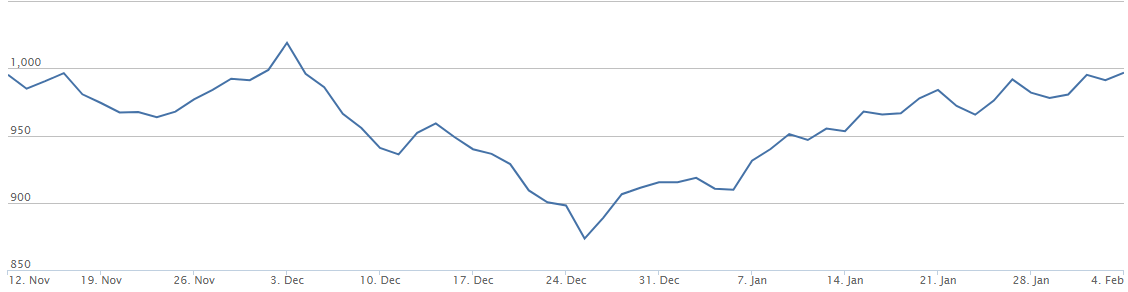

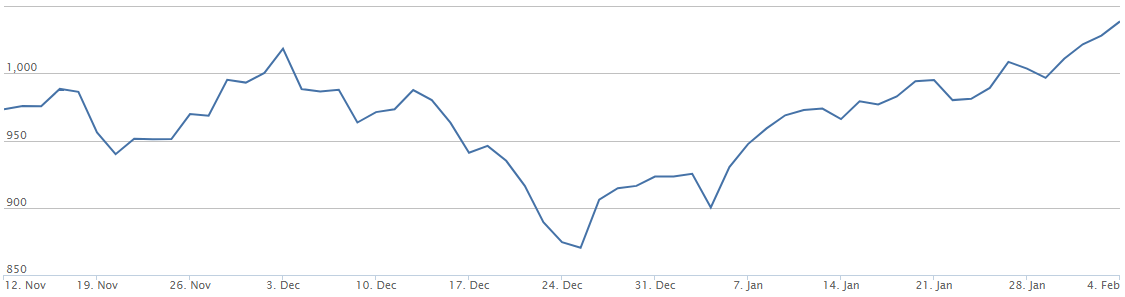

The Nasdaq Yewno Future Mobility Index and the Nasdaq Yewno AI and Big Data Index have had similar performances over the past three months. Additionally having significant upward performance of 8.73 per cent and 10.55 per cent, respectively, throughout January alone. The gains rectify the losses incurred during the choppy equity market in Q4 2018.

Nasdaq Yewno Future Mobility Index

Source: NASDAQ

Nasdaq Yewno AI and Big Data Index

Source: NASDAQ