Emerging market ETFs have recorded strong inflows this year boosted by China’s reopening and easing inflationary pressures globally.

Much of the inflows have come in the last week alone, with ETFs tracking emerging market equities accounting for six of the top 10 highest inflows in Europe in the week to 6 February, according to data from ETFLogic.

The UBS ETF MSCI Emerging Markets UCITS ETF (EMMUSC) has recorded the most of all ETFs tracking the region so far this year with inflows of $896.4m, as at 7 February.

EMMUSC is followed by its ESG counterpart, the UBS ETF MSCI Emerging Markets Socially Responsible UCITS ETF (UEF5), which netted the second-highest inflows at $548.3m.

Also piquing investors’ interest was the $16bn iShares Core MSCI EM IMI UCITS ETF (EIMI) which has gathered $444.7m net new assets this year, followed by the iShares MSCI EM ESG Enhanced UCITS ETF (EDG2), with $410.8m.

Elsewhere, $2bn HSBC MSCI Emerging Market UCITS ETF (HMEF) recorded inflows of $391.3m while investors piled $218m into the iShares MSCI EM UCITS ETF (IEEM).

Analysts expect investors to be buoyed by emerging market’s stronger growth predictions versus developed markets this year, with the International Monetary Fund expecting emerging markets to grow by 4% in 2023.

China, which accounts for roughly a third of the MSCI Emerging Market index, has seen its growth projections rise to 5.2% this year after the scrapping of its ‘Zero-COVID’ policy.

Dina Ting, head of global index portfolio management at Franklin Templeton, said: “China, as one of the larger international markets, warrants a closer look, given it was last year’s relative laggard.

“Its recent reopening marked the first time in three years that the new year was celebrated in such a large scale with increased spending and travel.”

However, there are signs investors may have missed the boat on Chinese equities with the China MSCI index up 52.5% in the three months to the end of January.

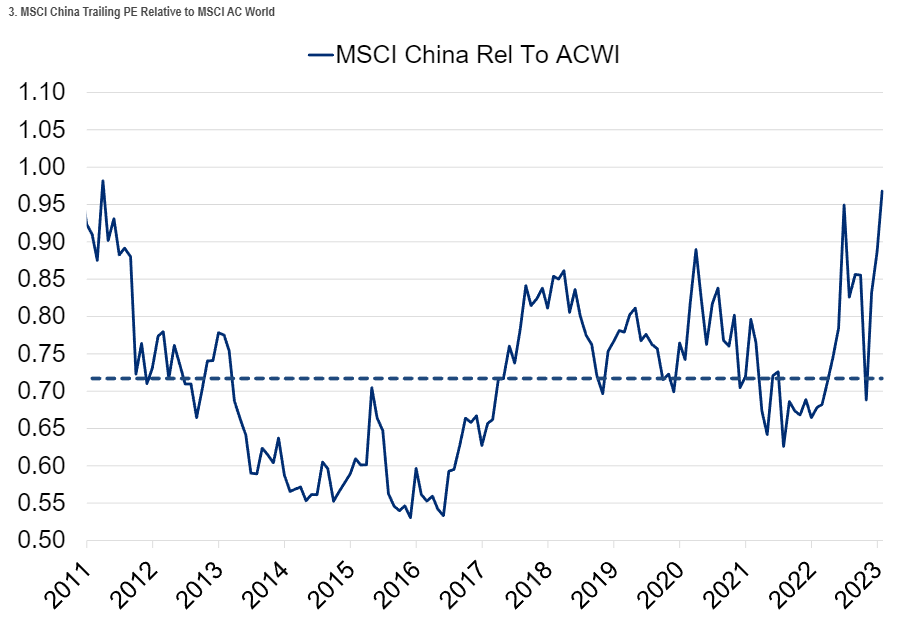

Improved earnings for Chinese companies also mean the country has gone from a deep value play in mid-2022 to looking much more expensive compared to the rest of the world.

Source: Citigroup

Elsewhere, Brazil is expected to be the emerging market outside of China to cut interest rates this year as inflation starts to ease towards its target.

Emerging market ETFs performance has been strong this year, with the Lyxor Emerging Market UCITS ETF (LEMA) returning 9.1%. However, thematic and ESG strategies are the top performers as investors go bullish on central banks becoming more slowing their rate hiking cycle.

For example, the FMQQ Next Frontier Internet & Ecommerce ESG-S UCITS ETF (FMPQ) has returned 12% since the start of the year, followed by the Rize Emerging Market Internet and Ecommerce UCITS ETF (EMRP) with returns of 10.5%.

Related articles