The active or passive debate will likely never be settled. Passive management is where no investment decision needs to be made, as your investment simply tracks an index, while active management employs a decision-based approach to change the portfolio in order to attempt to outperform the market. The fund manager camp argues active is best and that by picking stocks, they can beat the market over a market cycle and thus earn their relatively higher fees. The other camp says that active stock picking is like gambling, and every gambler can get lucky here and there but over the long run will lose.

The investment philosophy at Elkstone has us: a) requiring a positive return expectancy, b) looking to achieve exposure to the desired markets and risks in the cheapest way possible, c) looking for diversification when diversification is needed, and d) looking past the name of the market, strategy, investment process and investment vehicle type to analyse what risks and exposures are actually driving the return stream – oftentimes, a return stream can sound different, and therefore diversifying, but is driven by the same underlying drivers and is therefore not additive to a portfolio.

With this investment philosophy as governance, this short research note looks at whether we want to build our internal equity investment strategy through passive or active management and through ETFs or alternative investment vehicles.

ETF vehicle characteristics

As we always look at what we are getting from both a market/strategy and investment vehicle, we understand that with an ETF vehicle, we will get the following:

Trade Setup: Long/buy-only exposure

Cost: Cheap exposure relative to other vehicles

Liquidity: Daily liquidity, which is always welcomed

Management: Passive

Market characteristics

An equity index is a basket of stocks that are set by definition, for example, the largest 500 US companies based on market capitalisation; that index will always have the largest 500 stocks within it. When we think about what an equity index, like the S&P 500 or the DAX 30, is providing us in terms of its characteristics, we come to the following understanding:

Market support

Equity markets are incentivized to be long-term increasing; this comes from both fiscal and monetary policy support. The presence of this support has never been so clear than since the Global Financial Crisis.

Survivorship bias

Within equity indices, there is a survivorship bias that lends to a structurally long-term increasing market effect. The S&P 500, or the DAX 30 for example, always tracks the largest 500 or 30 companies, respectively. If a company within the index performs so poorly that its market capitalisation means it’s not in that top group anymore, that stock leaves the index and is replaced by the next company that meets the criteria. We now get exposure to that new company and its gains until something similar happens again – take Lufthansa as a recent example of this survivorship bias that we benefit from.

Embedded strategy

Due to the market capitalisation weighting structure of equity indices, there is an embedded momentum-type strategy that investors get exposure to; if a stock performs well, its market capitalisation goes up, and if a stock performs poorly, its market capitalisation goes down. As the index is weighted off market capitalisation, the better performer has a bigger impact on your return than a worse performer has. The S&P 500 is driven by its top five companies, which currently account for around 25% of the total weighting, which is why the index was up during 2020 when the average return [evenly weighted or average company return] was down.

Systematic risk

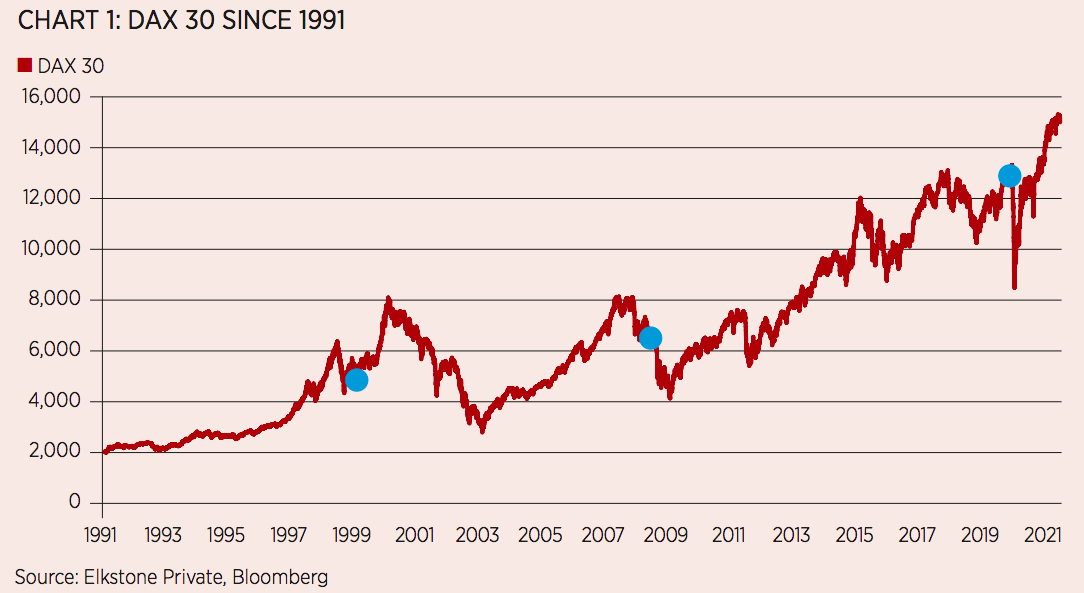

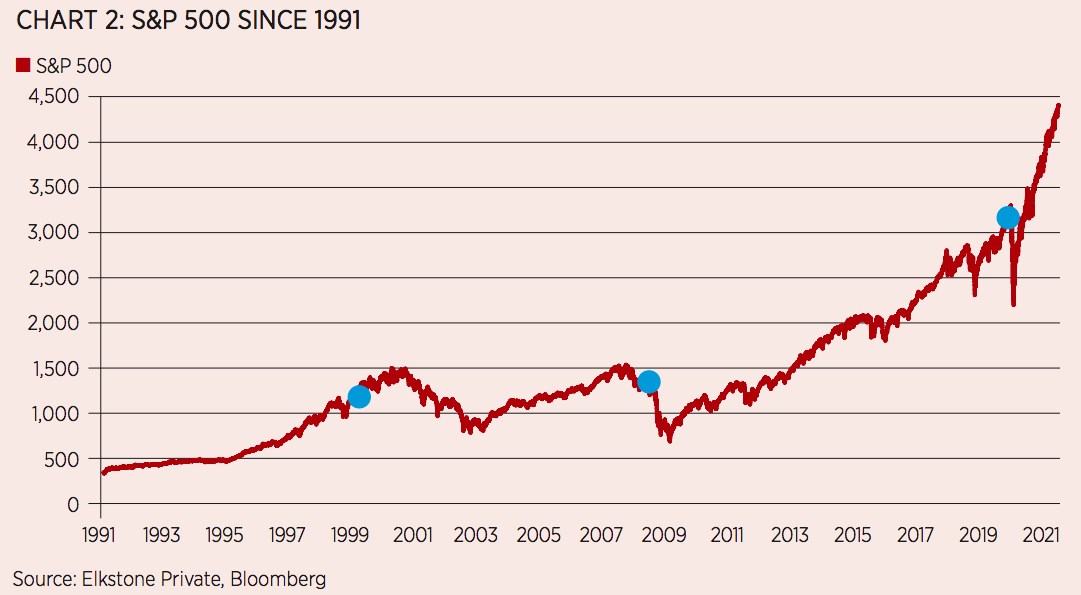

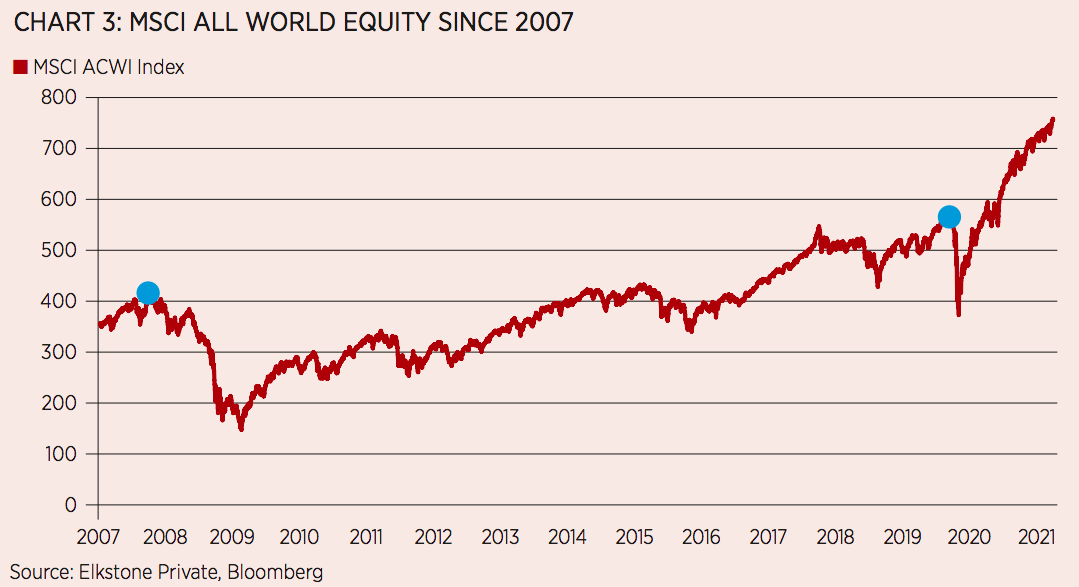

Theoretically, an equity index [diversified group of stocks] should only provide us exposure to systematic [‘market’] risk and none to idiosyncratic [‘individual company’] risk, as it’s diversified away. An argument can however be made that due to the embedded strategy above and the weighting structure, you are significantly exposed to the biggest stocks, as they have an outsized effect on the index from a weighting perspective. Given the market structure and characteristics outlined above, we believe that there is a positive return expectancy within equity markets and equity indices, i.e., they are long-term increasing and expected to continue in that manner. Chart 1, Chart 2 and Chart 3 look at the DAX 30, S&P 500 and the MSCI All Equity Index since 1991, 1991 and 2007, respectively.

Given that we believe there to be positive expectancy, we should see money invested over the medium term, regardless of when we invested be profitable.

Within each chart, an ‘X’ was added right before the past three significant equity market drops to illustrate this hypothesis. If we had invested in any of the equity indices right before any of the equity drops, we would have made a positive return on our investment as it stands today and before the next significant market drop.

Active management

The investment philosophy requires us to access our desired exposure as cheaply as possible. ETF access to equity markets is our way of doing that, but we understand that there are other tools to access equity market exposure, so we look at active management for stock picking to see if that can bring in an added return stream within our equity block that meets our investment philosophy.

Equity markets are the best-known investment market. Every asset manager has products within active equity management, and they tell you they can outperform based on their unique fundamental or quantitative process. With thousands of equity products, billions invested in actively managed equity investing and millions spent in infrastructure and R&D, it is the most competitive market out there to squeeze out the famous alpha return.

Given the liquid, transparent and efficient nature of equity markets combined with the highly competitive environment that is stock picking, we set out to see if stock picking does provide us increased and uncorrelated returns to warrant active management inclusion in our equity block.

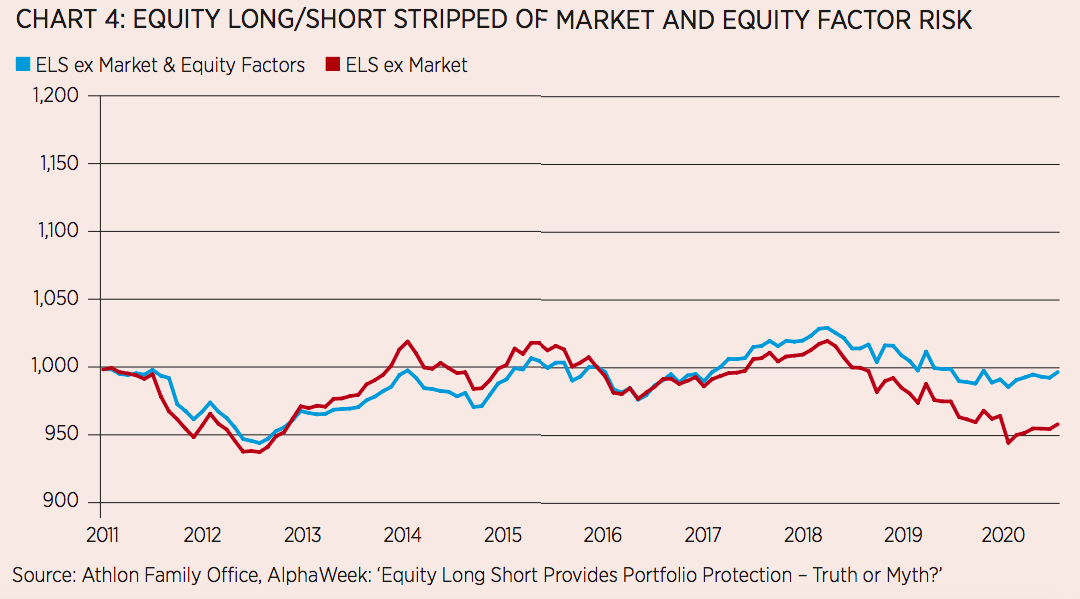

To analyse this, we look at equity long/short managers who pick researched individual stocks to buy and sell as a benchmark for stock picking performance. Chart 4 below shows an equity long/short index performance after stripping out the manager’s returns that are driven by the general market, i.e., what we have exposure to from our ETF. We can see that outside of general market returns, stock picking did not add any positive return.

The most common argument against this finding is an investor or manager coming to us saying, maybe they don’t outperform in general, but I am invested in, or I know Fund X that did really well in 2020 when the market didn’t do well, so their stock picking did outperform and bring in alpha. That may be true, however, this research is showing that over a 10-year period, they will likely even out to no alpha generation. Just because they did well in 2020 doesn’t mean they will do well in 2021 and 2022 and 2023 and so on. We ran some research on this hypothesis.

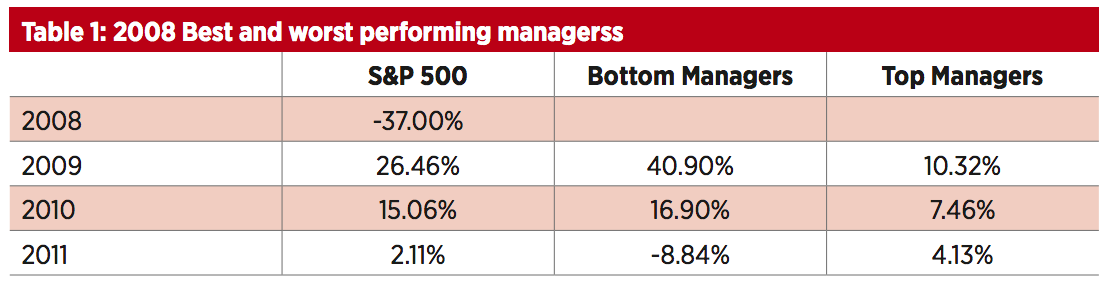

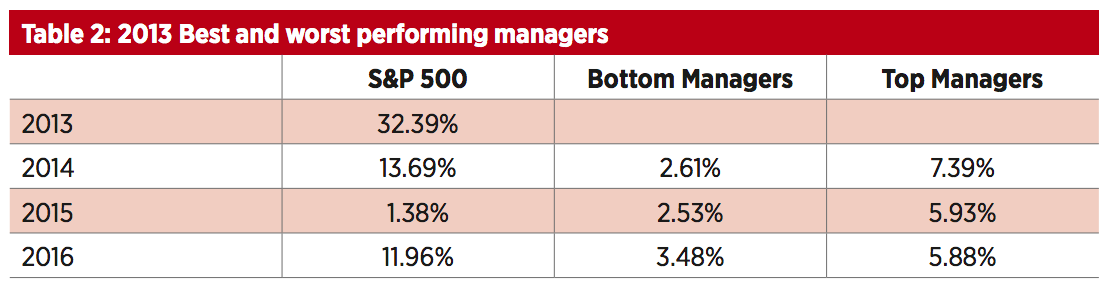

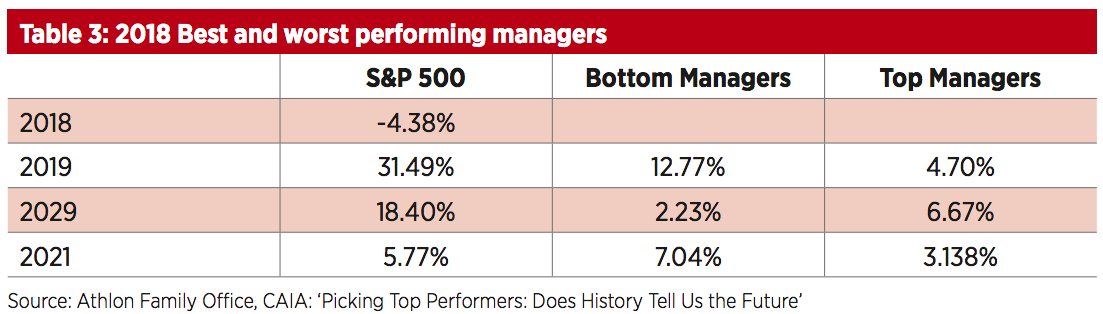

Table 1, Table 2 and Table 3 below are taken from a research note that analysed how picking the best and worst performing managers from extreme market years performed for the following three years compared to the benchmark. What is witnessed is that there is a lack of consistency in continued outperformance and what is most common is that the managers that outperformed recently end up underperforming against the benchmark in the following three years. To put it a different way, just because they did well previously or during a particular year does not mean they’ll do well in the future.

Conclusion and further thoughts

We are governed by our investment philosophy, and it is based on the philosophy on which market, strategy and investment vehicle decisions are made.

Explainable positive expectancy: Does public equity markets’ systematic risk have positive expectancy? In our opinion, yes.

Does stock picking/individual company risk within the public equity market have positive expectancy*? In our opinion, no.

Look past the name of the strategy, market, investment process and vehicle: Just because the names of the vehicles are different doesn’t mean we are getting different return drivers:

ETF return driver(s) = market risk Equity LS/active management return driver(s) = market risk + individual company risk

Access desired market or risk exposure in the cheapest possible way: As we do not believe there to be a positive expectancy in the individual company risk component, we only want access to the market risk component of the equity LS manager’s returns, and we want to get that exposure in the cheapest way possible. ETFs get us that exposure far more cheaply than equity LS manager fees, which is why we concentrate our liquid equity market exposure only in ETFs and not through active management.

As with every rule, there are exceptions, and there are three worth highlighting from us:

Despite company risk in public equity markets to be found not to have positive expectancy in general, we have identified a specific strategy that we believe provides positive expectancy on the company risk component for explainable reasons and that strategy is within our hedge fund portfolio.

Despite company risk to be found not to have positive expectancy in public equity markets, we do believe there is significant positive expectancy in stock picking within the private equity markets and for explainable reasons. Due to this, we have a very active illiquid venture/private equity book and provide this deal flow with our family office clients for co-investment in. A future piece will discuss this in greater depth.

*Active performance is hurt by strong broad market runs. This is driven by central bank policy in North America. When this force/support leaves and we see a market environment closer to that of 2000-2010, there will be a case of active management/stock picking over ETF investment, and we stand ready to change with the times.

Karl Rogers is CIO at Elkstone

This article first appeared in ETF Insider, ETF Stream's new monthly ETF magazine for professional investors in Europe. To access the full issue,click here.