The rapid rise of ETFs is helping to destabilise emerging markets, making them more vulnerable to global shocks, according to research from the Central Bank of Italy.

The paper, titled The Role of Non-bank Financial Institutions in the Intermediation of Capital Flows to Emerging Markets, found investment funds – which account for the bulk of flows to emerging market economies – were more likely to withdraw capital during periods of market stress than pension funds, insurance companies and banks.

Moreover, it found passive funds are more reactive than active funds to global financial conditions than mutual funds, meaning they reduce their exposure to emerging markets more than active funds if there is a change in the VIX.

“Our analysis builds on these results as we find evidence that the reliance on investment funds, in particular those benchmark-driven, makes emerging markets more vulnerable to global shocks,” Alessandro Moro and Alessandro Schiavone of the Central Bank of Italy wrote.

“As regards asymmetries across fund types, we find that ETFs, as well as passive funds, rebalance their portfolios substantially, reducing emerging market economies shares more than active ones.”

While the research does blame passive funds for “destabilising” emerging markets, it does note the role of investment funds and the rising share of ETFs within this.

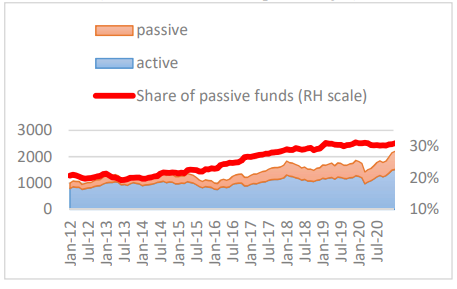

Since 2012, passive funds have increased their share of total assets invested in emerging markets from 20-30%, with ETFs alone growing from 14% to 21% and accounting for 72% of emerging market assets held by passive funds.

Funds’ assets invested in emerging markets by in investment (US dollar bn)

Source: EPFR

“The empirical evidence collected in our analysis points to the systemic risks connected with the pro-cyclicality, herding behaviour and highly correlated asset movements stemming from the non-banking financial industry,” the pair wrote.

According to the study, a one standard deviation increase of the VIX leads to a reduction of 2.8% and 1.5% of bond and equity shares invested in emerging markets by passive funds, respectively, compared to 1.8% and 1.2% by active funds.

It added the ETF wrapper’s semi-elasticity to global factors is even more reactive, with a standard deviation of the VIX accounting for a 2.8% reduction in bonds shares and 1.6% for equities.

“We conjecture that this result may be due to the fact that passive funds and ETFs investing in emerging market assets are more subject to redemption pressures during periods of market turbulence,” they wrote.

“Note also that passive funds and ETFs display a higher sensitivity to relative returns; this finding may suggest that these funds mechanically sell assets of countries that have seen their shares reduced in global indexes, whereas active funds tend to deviate from the benchmark in the attempt to deliver a better performance.”

Does emerging markets need a fresh overhaul?

The rise of investment funds’ influence in emerging markets has risen since the global financial crash after reforms meant banks scaled down non-core assets such as emerging market securities in their balance sheets.

Conversely, international investors increased their exposure to higher-risk assets, driven by a low yield environment that has seen investment funds triple their emerging market assets since 2008.

The paper suggested regulators should monitor the effects investment funds are having on the sector and the real economy.

“This implies the adoption of a macroprudential approach in the oversight of the asset management industry and a strengthened coordination among regulators and international organisations,” it said.

Emerging markets ETFs have been under the spotlight in recent months as geopolitical turmoil highlights the idiosyncratic risk associated with them, prompting questions over the relevance of broad emerging market indices.

Investors, however, are still drawn to their diversification benefits while others have moved to disaggregate emerging markets, taking a single-country approach in a bit to generate alpha.

Related articles