In stock market terms, it remains hard to be certain about what stage of the current crisis we have reached but factor performance to date can at least be assessed and it tells the story of a market more than willing to continue to ignore value.

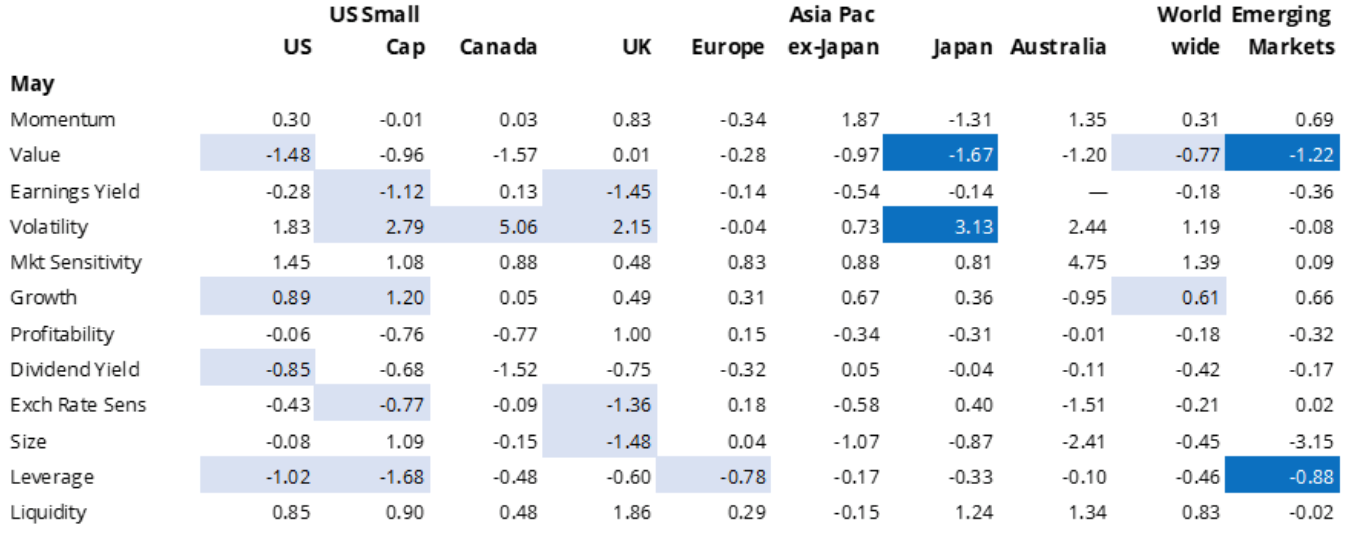

Data from financial intelligence firm Qontigo showed that both value and earnings yield have both underperformed since the start of crisis, aside from a few days in May, where value in the US made a strong comeback.

This in itself, Qontigo suggested, was not a full rebound and was confined to the US with other regions failing to follow suit. Indeed, for May as a whole, the only region where value managed a positive performance was the UK, and that by a hair’s breadth.

Factor performance in May 2020

Source: Qontigo

Unsurprisingly, the Qontigo data shows that high volatility and market sensitivity were outperformers both in May and for the year-to-date. Given the gyrations endured as the COVID-19 crisis has progressed this is not surprising.

Another sign of how violent investors have found the market swings comes from the performance of the size factor.

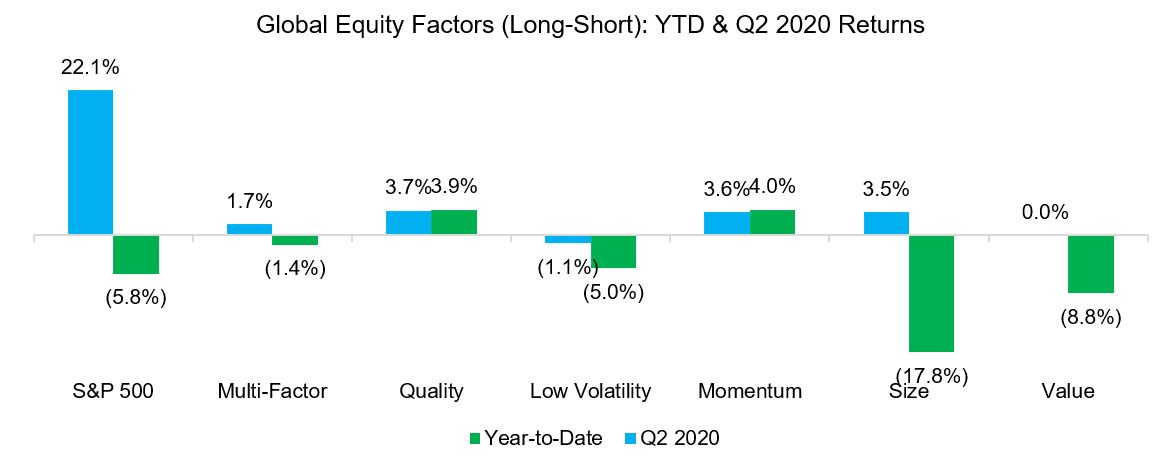

Data provided to ETF Stream by FactorResearch shows that in the second quarter to early June, the size factor was the worst performer.

Global Equity Factors (Long-Short): YTD & Q2 2020 Returns

Source: FactorResearch

“The value and size factors are still significantly negative on a year-to-date basis as investors continue to chase large growth companies, which are mainly tech stocks like Microsoft or Amazon that seem less affected by the crisis,” Nicolas Rabener, founder and chief executive at the company, said.

“However, in the second quarter small and cheap companies made a comeback as some of these were trading at very low valuations on a relative basis and would be a good bet if an economic recovery takes place.”

As he pointed out, though, many of these gains were swiftly lost in the early days of June as the market reacted negatively to comment from the US Federal Reserve Chairman Jerome Powell.

“Given this, it is not unexpected that the momentum and quality factors have performed well on a year-to-date basis,” he added. “It is worth mentioning that the spread between value and growth stocks has reached levels last seen during the Tech bubble in 2000, highlighting the extreme discrepancy in valuations.”

Value and growth dispersion

Indeed, exactly this point has been picked up by Research Affiliates who said last week that the already wide dispersion between value and growth had worsened during recent market movements. As the team suggested, should the valuation gap close it would imply an attractive opportunity for value investors.

However, as Vitali Kalesnik, director of research for Europe at the firm, argued that it is still early days in the crisis.

“What sets this period apart is that there was a very sharp drawdown early on and then a very sharp recovery,” he said. “And this recovery happened before any resolution of the uncertainty. The markets did see the government reaction to the crisis and the willingness of the government to spend money.”

“So, in terms of the market correction, February to March the market lost over 30%. The recovery, though, had to do with markets observing governments reaching deeply into their pockets.”

Value’s underperformance highlights systemic problem with smart beta

In effect, he said, the markets are in the position of searching for the light at the end of the tunnel – and part of that process has been to leave some growth companies “even more richly priced.”

But as he pointed out, the market recovery – such as it is – “has happened without any actual numbers being visible”.

Indeed, recent commentary from Mobeen Tahir, associate director of research at WisdomTree, said the disparity of outlooks between Wall Street and Main Street in the US is a puzzle.

“They now appear to exist in different realities,” he said. “Share prices forecast future activity. This depends heavily on the state of the underlying economy. What will determine how equity returns pan out in the second half of this year is this key issue: is the market getting ahead of itself, or are stock prices correctly forecasting what might end up as a quicker than expected recovery in economic activity?”

Kalesnik added: “That is a huge uncertainty that market participants are not fully appreciating. The likely surprises will not be in the sectors we have already seen being affected.”

In their words, it appears to be far too early in the current crisis to be making a call about which factors have performed better or worse. But once a recovery is underway, the RA team fully expect value, quality and small-cap factor strategies to outperform.

ETF Insight is a series brought to you by ETF Stream. Each week, we shine a light on the key issues from across the ETF industry, analysing and interpreting the latest trends in the space. For last week’s insight, click here.

Sign up to ETF Stream’s weekly email here