Invesco’s contingent convertible (CoCo) bond ETF has been in the fixed income winners’ circle in recent months as additional tier one (AT1) bond yields fall from some of their highest levels in a decade.

According to data from justETF, the Invesco AT1 Capital Bond UCITS ETF (AT1) returned 5% in the month to 25 January and 12.9% in the trailing twelve-week period, as a ‘risk-on’ spell in markets saw investors demand lower yields to hold convertible securities.

Tracking the iBoxx USD Contingent Convertible Liquid Developed Market AT1 index, Invesco’s ETF captures US dollar-denominated convertible bonds issued by European banks, capped at 8% per issuer.

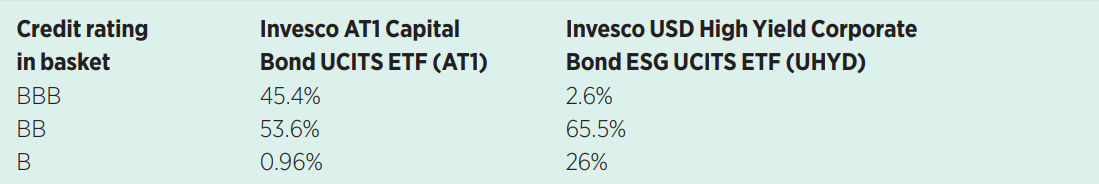

Although AT1’s basket has a higher average credit rating exposure than many high yield bond products, CoCo ETFs often offer higher yields due to their callable nature. This refers to the fact bonds are converted to equity if the bond issuer’s capital drops below a pre-determined strike price.

Source: Invesco

Given CoCos are usually issued by banks short of capital, these conversion events mean investors may take on equity in a distressed company. This goes some way to explaining why AT1 yields – and spreads versus conventional bonds – can be so attractive during periods of market volatility.

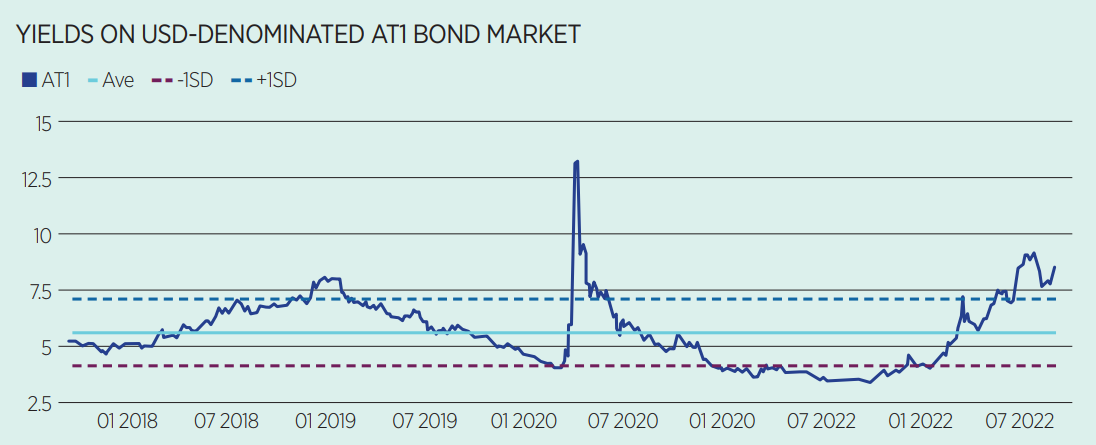

Amid the Russian invasion and energy price spike, China’s ‘zero-COVID’ and supply chain issues, and the US Federal Reserve hiking interest rates by 75 basis points four times, dollar-denominated CoCo bond yields spiked to 9.16% in July last year, according to Bloomberg data.

Source: Invesco, Bloomberg

Not only is this considerably higher than the 3.70% yield at the end of 2021 and the long-term average of 5.60% but was among the highest CoCo yields seen in a decade – peak COVID-19 volatility notwithstanding. However, despite their unique characteristics, AT1 ETFs have proven themselves to be reliable instruments for European investors.

Paul Syms, head of EMEA ETF fixed income product management at Invesco, said the issuers of the bonds themselves – European banks – are far more well-capitalised than they were during the Global Financial Crisis (GFC), with smaller balance sheets and higher quality assets being held meaning they tend to have a buffer of capital before the CoCo conversion to equity trigger is reached.

The two AT1 ETF strategies available in Europe from Invesco and WisdomTree have also amassed combined assets under management (AUM) of almost $2bn since launching in 2018, with increased scale bringing additional liquidity and the potential for institutional access via the wrapper.

Additionally, AT1’s recent rally has seen it retrace more than half of the fall from its all-time high in mid-2021. Yet more strong returns could be on the horizon if yields continue to normalise and central banks continue their path of slowing interest rate hikes.

This article first appeared in ETF Insider, ETF Stream's monthly ETF magazine for professional investors in Europe. To access the full issue, click here.

Related articles