Although the early-year rally of commodity ETFs has cooled as global productivity faltered, products such as the L&G Multi-Strategy Enhanced Commodities UCITS ETF (ENCO) have retained investor enthusiasm in a rare success story during a volatile year.

ENCO launched last July as a multi-factor play on capital market and cyclical demand dynamics on a basket of 23 commodities.

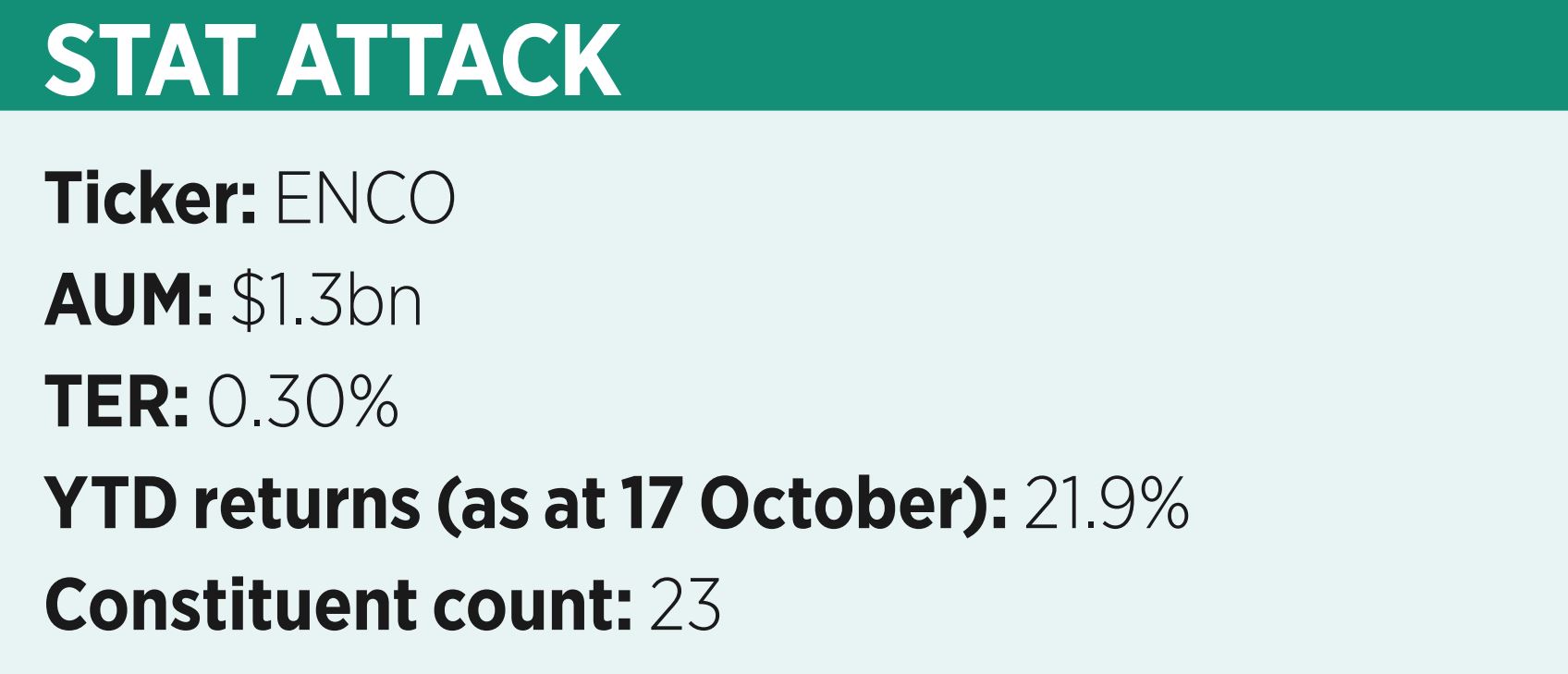

While being a more exotic take on diversified commodities, its methodology has garnered investor favour, with the product amassing $1.3bn assets under management (AUM) in little over a year and $506m over the past month, as at 18 October, according to data from ETFLogic, among the largest inflows in European ETFs during the period.

Furthermore, ENCO has been the bestperforming broad commodity product over the last 12 months and so far this year, returning 19.3% and 21.9%, respectively.

These early successes mean it is already rubbing shoulders with some of the continent’s more-established ETFs, with ENCO now the second-largest ETF on Legal & General Investment Management’s (LGIM) roster, after its cybersecurity thematic, as well as being the fourth-largest commodity basket ETF in Europe.

Its recent fortunes are also impressive when set against a difficult few months for commodity products, with Morningstar data showing €7.9bn net outflows for European exchange-traded commodities (ETCs) and commodity ETFs in Q3.

To find out what has been powering the product’s popularity and outperformance, investors need to look beneath ENCO’s bonnet at the mechanics that set it apart from its peers.

First, it tracks the Barclays Backwardation Tilt Multi-Strategy Capped index, which shifts its futures allocations to commodities at heightened periods in their production and demand cycle such as heating oil, gas oil and natural gas during winter.

It then employs a roll yield factor to invest in energy and industrial metals when futures curves are offering the best-implied roll yield.

Combined, these factors saw ENCO overweight energy commodities with a 48.3% allocation last December, before reducing to 34.5% by the end of January. After everything that has transpired with Russia’s invasion of Ukraine, fuel price inflation and winter fast approaching, the ETF has bumped its energy allocation up to 43.5%, with natural gas making up 17.6% of its basket.

Outside of production cycles and roll optimising on some commodities’ futures, the ETF also applies a momentum factor overlay to its agriculture and livestock allocations, whose performance are dictated by hard-topredict variables such as crop yields, weather and breeding cycles. It does this by investing in the best-performing futures contracts over the past year versus nearby futures contracts.

The combination of all these variables has helped ENCO outperform its peers since launch and saw it rank among ETF Stream’s top five ETF launches in 2021. The product has now been shortlisted for ‘ETF of the Year’ at the upcoming ETF Stream Awards 2022.

This article first appeared in ETF Insider, ETF Stream's monthly ETF magazine for professional investors in Europe. To access the full issue, click here.

Related articles