Attempting to bring together an index of more than 20,000 bonds and an environmental, social and governance (ESG) overlay is ETF Stream’s ETF of the month for September, the iShares Global Aggregate Bond ESG UCITS ETF (AGGE).

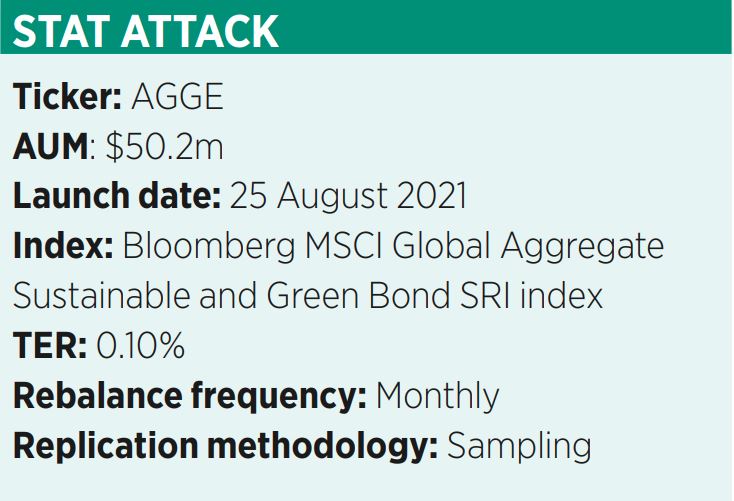

Launching on Euronext Paris and Deutsche Boerse on 25 August, AGGE is the first ETF in Europe to offer exposure to the ESG version of the Barclays Bloomberg Global Aggregate Bond index and carries a total expense ratio (TER) of just 0.10%. This fee is the same as its parent ETF, the iShares Core Global Aggregate Bond UCITS ETF (AGGG), which is impressive for a few reasons.

First, tracking the Bloomberg MSCI Global Aggregate Sustainable and Green Bond SRI index, AGGE has exposure to a potential universe of 20,000 bonds – versus 27,000 for the parent index – from 70 countries and more than 30 currencies.

While employing a sampling methodology means the entire index will not be included within the ETF’s basket, AGGE draws on an estimated 3,000 bond issuers, including governments, government-related and corporates as well as asset-backed, mortgage-backed and commercial mortgage-backed securities.

It also rebalances on a monthly basis, which is not only irregular for an ETF carrying such a low fee but also means its sample remains optimised and not allowed to stray too far from the performance of its underlying benchmark.

Second, AGGE bucks the trend of charging investors more for the inclusion of ESG characteristics, allowing participants to improve their sustainability profile while not affecting their risk profile or coming at any added cost.

To be eligible for inclusion in AGGE’s index, issuers must be awarded an ESG rating of at least BBB by MSCI and must not be involved in controversial weapons, civilian firearms, tobacco, adult entertainment, alcohol, gambling, nuclear power, genetically modified organisms, oil sands or thermal coal. Furthermore, the index aims to achieve a positive ESG impact by aiming to weight at least 10% to securities classed as green bonds.

AGGE broadly resembles its non-ESG counterpart, though it features some notable underweights on top issuers such as the governments of the USA, Japan, China, Germany, Italy and Canada – while French and UK government bonds are comparatively overweight.

There is an ongoing discussion about the appropriateness of combining sovereign debt and ESG criteria, given the subjective and ultimately politically norm-setting task index providers have when ranking the moral virtue of countries’ public policies.

This controversy is particularly pronounced in the context of Chinese government debt, with the L&G ESG China CNY Bond UCITS ETF (DRGN) having come under fire for greenwashing, given its assets may be directly contributing to human rights abuses on an industrial scale.

AGGE also invests in Chinese sovereign debt, though not directly. Instead, it has a 7% weighting to BlackRock’s own – non-ESG – iShares China CNY Bond UCITS ETF (CNYB).

Despite this contentious point, BlackRock’s new ESG behemoth remains an impressive entrant. Its fee and the size of the index it attempts to track evidence not only the scale BlackRock has achieved as a company, but also the kind of complex and all-encompassing exposure an investor can achieve with just a ‘passive’ wrapper.

This article first appeared in ETF Insider, ETF Stream's new monthly ETF magazine for professional investors in Europe. To access the full issue,click here.