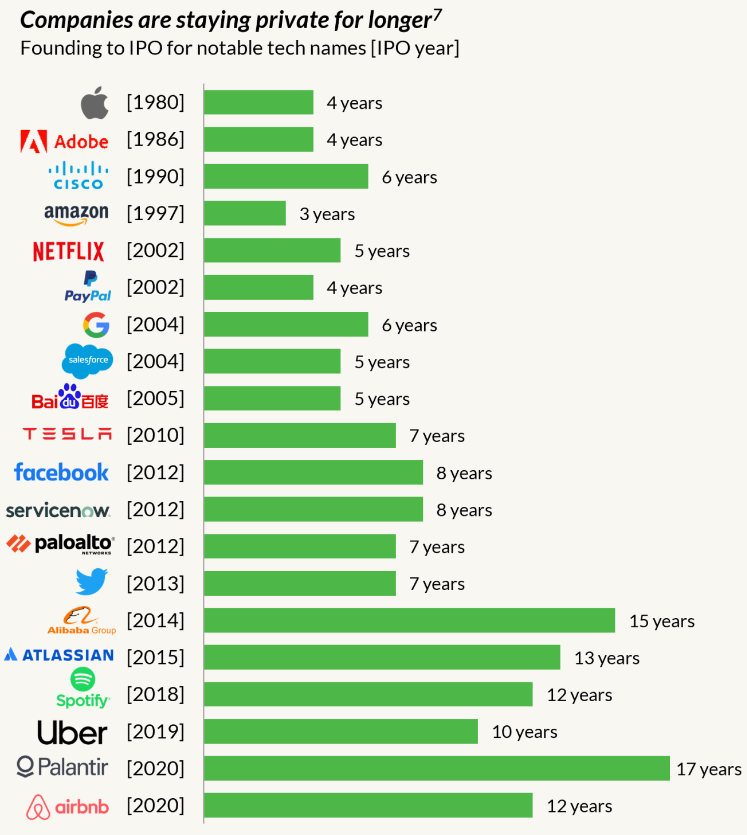

Thematic ETFs’ ability to capture the growth of disruptors should be called into question as tech companies now take twice as long to list as they did two decades ago, according to data from the University of Florida.

Findings from the study Initial Public Offerings: Technology Stock IPOs were quoted in research by venture capital firm Industry Ventures, which said the average tech company going public in 2021 was 12 years old and generated $200m in annual revenue, versus six years old and $30m in revenue in 1989.

This means tech startups are twice as old and generating three times as much revenue, on an inflation-adjusted basis, before considering an initial public offering (IPO).

Tech companies are also waiting until they are three to six times the size of their predecessors before going public, the research said, a problem for some thematic ETFs which rely on capturing the growth-stage performance of listed tech companies to outperform the broader market and vindicate their catchy narratives and higher fees.

Source: Industry Ventures, Company listings

The key reasons behind tech companies staying private for longer centre around improved access to venture capital, owing to maturing private market infrastructure.

Paul Cuatrecasas, CEO of tech-focused strategic advisory firm, Aquaa Partners, said crowdfunding and angel investing offer viable channels to early-stage companies to a widening range of investors.

Meanwhile, institutional investors involved in pre-IPO rounds can access liquidity on secondary marketplaces such as EquityZen – and accredited individual investors can access pre-IPO shares on platforms including Equitybee.

Speaking to ETF Stream, Cuatrecasas said: “Technology has allowed markets to evolve in a way such that good companies can more easily find the capital they need and shareholders and investors (of all types) can more easily find the liquidity they need or the risk-reward exposure they desire via the private markets.”

This probably goes some way to explaining why the number of venture-backed unicorns – private companies worth over $1bn – exploded from fewer than 15 in 2012 to more than 1,300 in July this year, according to Industry Ventures.

This boom coincided with the creation of 12,600 new venture capital funds between 2016 and 2021, up from 6,100 between 2010 and 2015.

While on a global scale and over a longer timeframe, these numbers somewhat dwarf the 122 thematic ETFs that launched in Europe between the start of 2018 and March this year, according to Bloomberg Intelligence.

This comparison is not entirely fair, however, given thematic ETFs are a much newer phenomenon, in discovery phase and still working through some teething issues.

For instance, capacity problems have seen the valuations of smaller listed companies held by ETFs being driven more by asset flows in and out of the ETFs they are featured in than anything related to their own fundamentals.

Setting the structural kinks of ETFs aside, Aquaa Partners’ Cuatrecasas suggested the more established nature of companies listing today – and in turn entering ETFs – means they may be of higher “quality” than those undergoing IPOs in decades prior.

“As a basket, investing in public tech companies today overall is “safer” than it was many years ago when companies went public earlier in their lifecycle,” he argued.

Overall, ETFs may not be the ideal instrument for capturing the full lifecycle of disruptive companies, but assuming the delayed IPO trend of the last 20 years does not continue in perpetuity, thematic ETFs offer a fairly cost and risk-balanced way to track the growth-to-maturity shift of entire disruptive industries, such as robotics, cyber security, semiconductors and more.

Related articles