From black holes and Schrodinger’s cat to machines capable of ‘teleporting’ information, quantum computing’s road from sci-fi to investable opportunity may be early stage but its potential to affect seismic change in products such as thematic ETFs should not be underestimated.

Physicist Richard Feynman famously said “if you think you understand quantum mechanics, then you do not”. This rings true for the study of subatomic behaviour that defies the laws of physics but even more so when trying to understand the machines harnessing this behaviour to revolutionise computing.

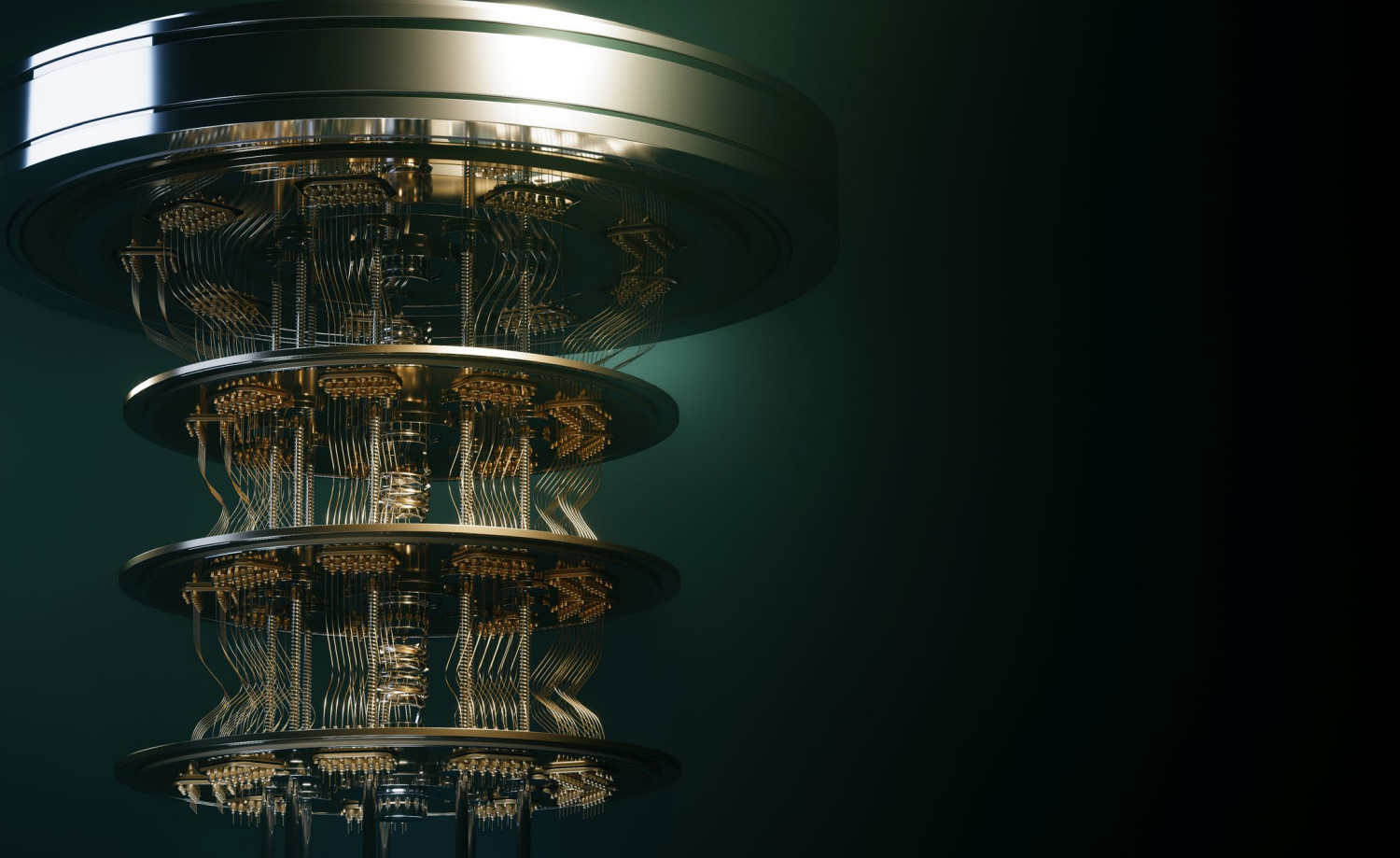

Exponentially scaling the processing power of classical computers will soon be impossible, with transistors in silicon chips already a thousandth of the diameter of a red blood cell. However, these computers rely on binary digits called bits – ones and zeros – as their units of information, whereas quantum devices rely on qubits which can be represented as ones, zeros or through superposition – the ability to be in multiple things at once – they can appear as a mix of the two simultaneously.

This article first appeared in ETF Insider, ETF Stream's monthly ETF magazine for professional investors in Europe. To read the full article, click here.