A hawkish JacksonHole keynote from Federal Reserve chairman Jerome Powell sent two-year US Treasury yields to a 15 year-high and likely caught out those rotating to longer duration on expectations of softening interest rates by the end of the year.

After the Fed implemented two consecutive hikes of 75 basis points (bps), its highest in almost three decades, the US entered a technical recession at the end of July and earlier this month, year-on-year consumer price inflation came in below forecast at 8.5%, also lower than the 9.1% reading for the previous month.

Responding with the assumption that ‘bad news meant good news’ – or that entering a recession would prompt the Fed to end its hiking cycle sooner than anticipated – many investors started looking to longer duration bonds less sensitive to interest rate hikes.

This ‘soft landing’ narrative saw European investors rotate $595m out of the iShares $ Treasury Bond 1-3yr UCITS ETF (IBTS) and $1.6bn into the iShares $ Treasury Bond 7-10yr UCITS ETF (IBTM) in the two months to 9 August, according to data from ETFLogic.

Some of the steam will certainly have come off this trade after Powell’s speech on Friday, which reminded markets the Federal Open Market Committee remains unconvinced inflation is moving down at a reliable trajectory.

The Fed chair said a hawkish approach would bring with it slower growth, softer labour market conditions and “pain to households and businesses” but would avoid greater pain by moving to restore price stability.

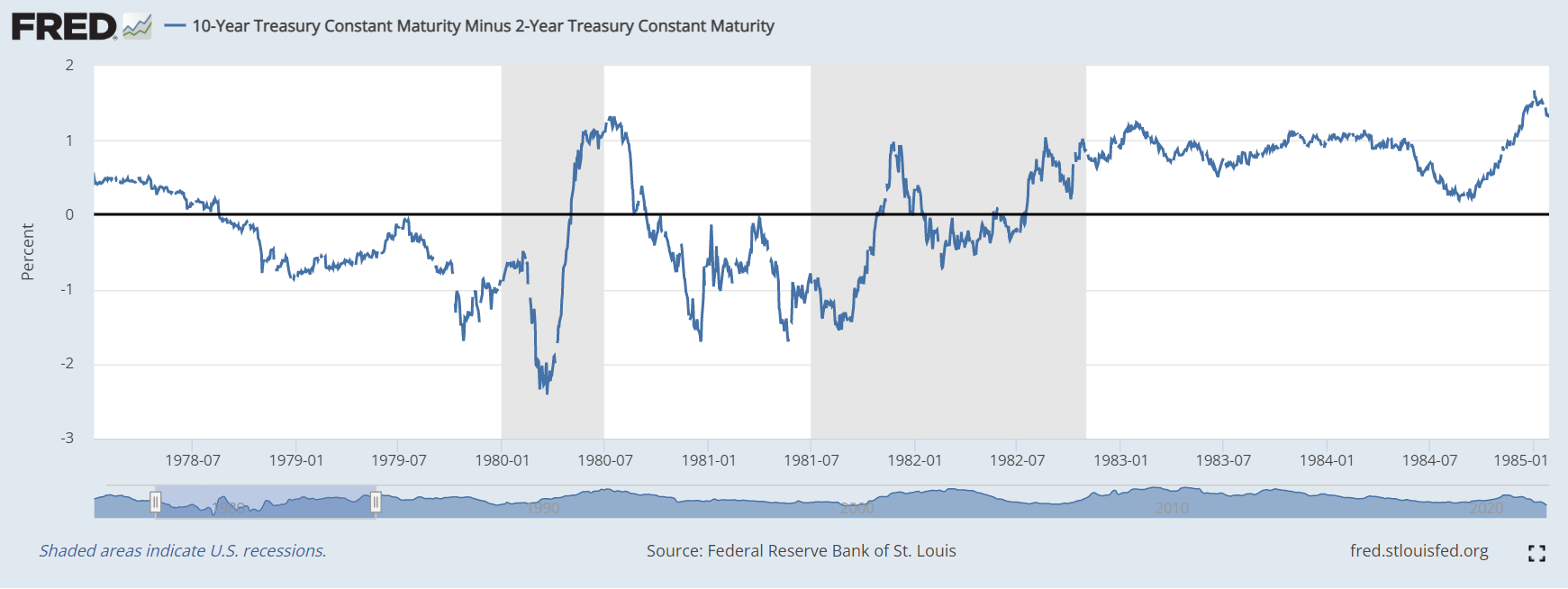

“The successful [Paul] Volcker disinflation in the early 1980s followed multiple failed attempts to lower inflation over the previous 15 years,” Powell said.

“A lengthy period of very restrictive monetary policy was ultimately needed to stem the high inflation and start the process of getting inflation down to the low and stable levels that were the norm until the spring of last year. Our aim is to avoid that outcome by acting with resolve now.”

Following Powell’s messaging, markets responded on Monday with the Fed funds rate increasing 7.1 bps to price in 3.70% for the FOMC meeting in December.

According to Jim Reid, managing director, head of global fundamental credit strategy at Deutsche Bank, two-year US Treasuries hit 3.48% intraday on Monday, their highest level since 2007, with markets currently pricing in a third 75-point hike at the Fed’s next meeting with a 60% probability.

“Strikingly, Minneapolis Fed president Kashkari said he was ‘happy to see how chair Powell’s JacksonHole speech was received’ in markets, stating it reflected an understanding of their commitment to return inflation to 2%,” Reid added.

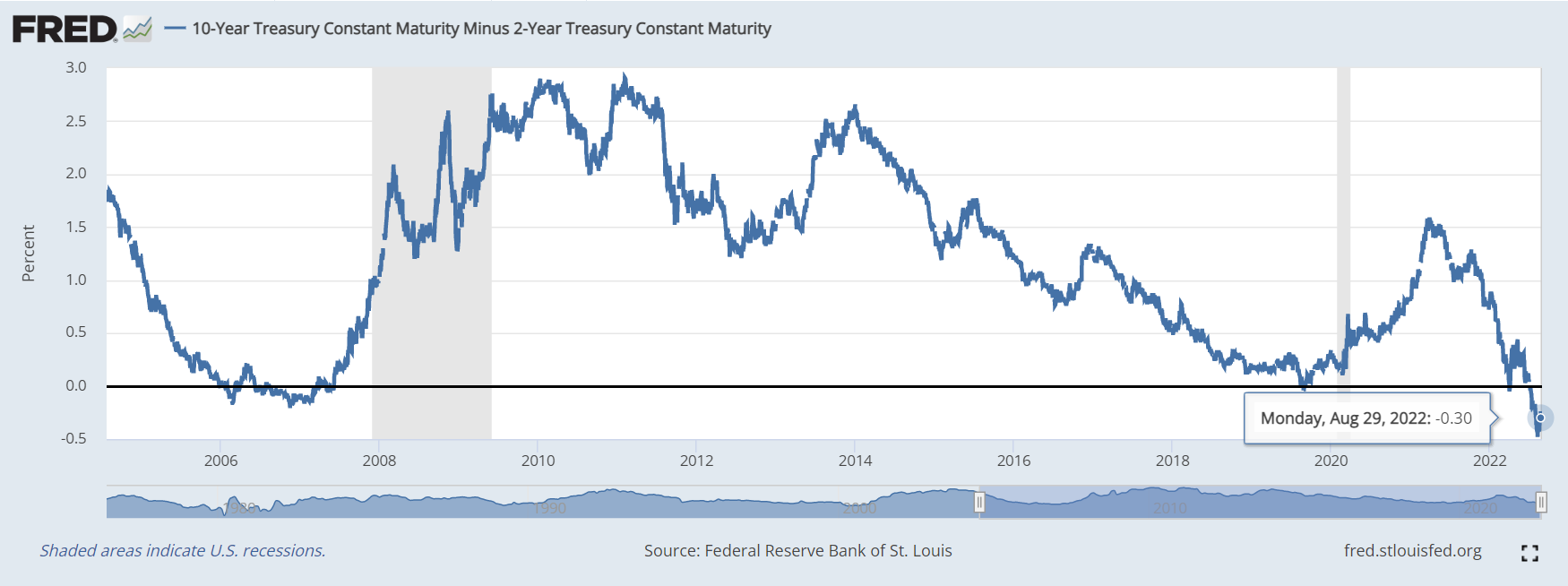

Another significant number to be noted is the spread between two-year and 10-year US Treasuries, which broke below -0.4% earlier this month. This level of yield curve inversion was last seen more than 20 years ago, preceding the bulk of the ‘dot-com’ crash, according to data from the Federal Reserve Bank of St. Louis.

Interestingly, each prolonged US Treasury yield curve inversion in the last 40 years has preceded a recession, which paints an unequivocal picture of which direction the US economy is headed over the next few months.

The question then becomes whether this recession will be followed by loosening monetary policy and a recovery, which tends to see the yield curve revert.

Unfortunately, the other route – as seen during Volcker’s time – is dictated by higher inflation for longer and in turn, an elevated Fed funds rate and negative US Treasury spreads for a prolonged period

While such a dramatic outcome is unlikely, there is every chance the Fed accepts higher inflation is here to stay for the foreseeable.

This assumption, if true, could mean that after the Fed approaches a funds rate of around 4% at its final meeting of the year, it may not rush to de-escalate this as quickly as many had hoped making the risk-on trades of the summer months start to look premature.

In the context of US Treasuries, this could see investors revert to their Q2 rotation into shorter-duration securities in a move BlackRock’s head of fixed income iShares EMEA Brett Olson previously described as a flight to safety.

At the other end of the spectrum, lower-than-expected US inflation numbers saw $366m flow into the iShares J.P. Morgan $ EM Bond UCITS ETF (SEMB) in the week to 12 August, a trend which could reverse as stickier rates support the US dollar and the spread between emerging market sovereign debt and US Treasuries widens, with investors likely to demand more yield to hold emerging market debt.

Aside from rate hikes, the Fed has ground to cover to chip away the almost $9trn balance sheet of Treasuries and mortgage-backed securities (MBS) it has accrued since the start of 2020.

This week marks a significant step in its quantitative tightening (QT) journey, with its monthly QT cap increasing from $45bn to $95bn starting from September.

The test now will be whether reversing its bond-buying – which made it cheaper for companies to borrow – will be done in such a way that alongside rising interest rates, company borrowing costs will not become unmanageable.

Earlier this month, BlackRock said it favoured investment-grade credit over US Treasuries as credit spreads were wider than they were at the beginning of the year.

Also, S&P Global data showed investment-grade issuance was down almost 20% versus last year and the number of defaults were at their lowest since 2014.

It will be interesting to see how corporate issuance and potentially defaults are impacted by the Fed’s two-pronged approach to tightening financial conditions. In turn, it could be challenging for the iShares $ Corp Bond UCITS ETF (LQDE) to repeat its success over the summer, after amassing $1.6bn inflows over the two months to 10 August.

This side of the pond, similar trends could play out but with a delay and in greater severity. Inflation is higher in continental Europe than the US and the European Central Bank (ECB) has been slow to counteract this with policy action.

In July, Christine Lagarde’s team increased rates by 50 bps, the largest hike in two decades, but bets are now ramping up on a 75-point hike at the policymaker’s next meeting in September, especially given eurozone inflation hit its highest ever at 9.1% in August, above market expectations.

Deutsche Bank's Reid noted: "The fact that a 75 bps move is being openly discussed ahead of next week’s decision just shows how the direction of travel has shifted, and overnight index swaps are now pricing in a 75 bps move as more likely than a 50bps one."

Related articles