Leading European investment bodies have strongly opposed the introduction of progressive cash penalties for ETFs under the Central Securities Depository Regime (CSDR).

The opposition – which argues its introduction could damage the region's competitiveness – comes in response to the European Securities and Markets Authority (ESMA) consultation launched last December, aimed at boosting settlement efficiency in Europe.

However, the proposals have been met with resistance from the ETF market, despite an acceptance that ETFs should be treated separately from equities when assessing settlement fails due to their unique market requirements.

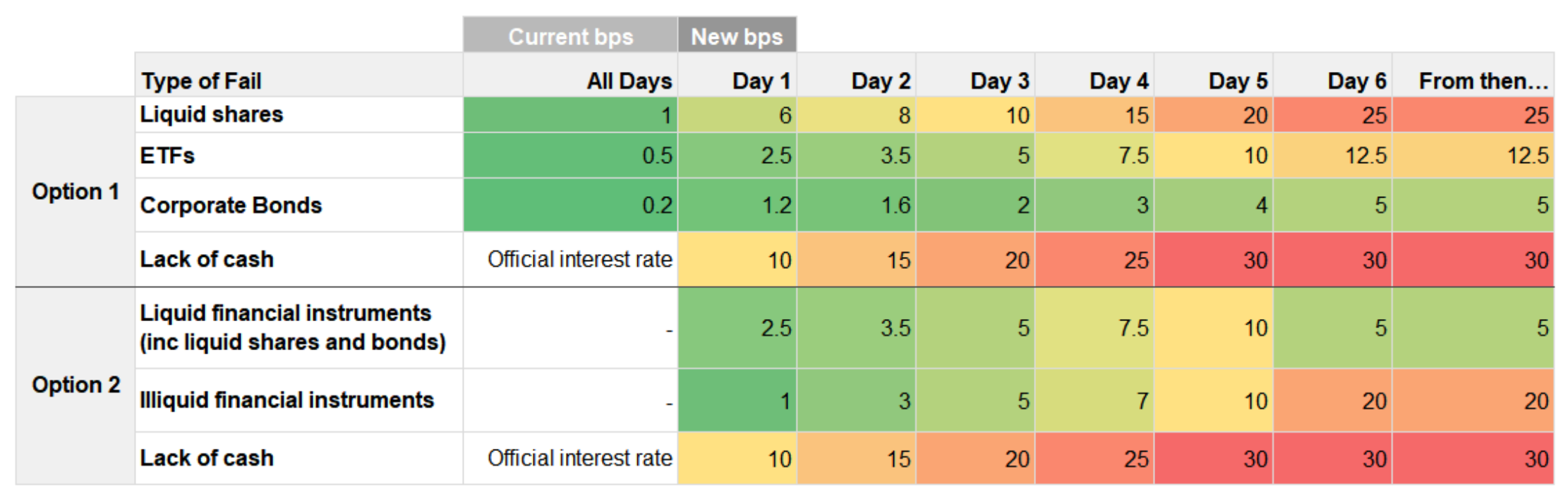

If introduced, penalty rates would increase progressively from 2.5 basis points (bps) on day one to 12.5bps per day if ETFs fail to settle six days after the intended settlement date (ISD).

Leading the opposition was the Association of Financial Markets Europe (AFME), which said the structural barriers to settlement efficiency should be addressed.

“We strongly believe that increasing penalty rates for ETFs will not have a positive impact on improving settlement efficiency. Instead, the primary effect would be an increase in costs to EU investors in ETFs, making the region less competitive,” it said.

“We believe that greater focus on addressing existing structural barriers to timely settlement is critical to improving settlement efficiency in ETFs.”

The comments echo Jane Street, which warned ETF trading costs would be set for a substantial increase under ESMA’s proposal to introduce progressive penalty rates.

This is due to authorised participants (APs) passing on the costs of settlement fails with wider bid-ask spreads.

The Investment Association also raised concerns about increased costs for investors.

“Additional cash penalties imposed on APs may force them to price this into the spreads offered to the end investor and make EU products less attractive when compared against jurisdictions without cash penalties,” it said.

The European Fund and Asset Management Association (EFAMA) agreed and called for a more detailed analysis of ETF settlement fails.

“We believe the potential costs associated with the proposed changes are disproportionately higher than the perceived benefits,” it said.

“Our analysis suggests a high volume of ETF orders are settled within three to four days of trade execution and progressive increase in penalties are unlikely to have any meaningful impact on expediting settlement.”

Chart 1: Illustration of current and proposed penalty models for days after ISD

Source: Jane Street

A new ETF category

Part of the issue with ETF settlement fails is due to the fragmented nature of the European ecosystem, leading many to agree the ETF wrapper should have its own category for settlement fails.

The European Union currently has 14 currencies, 17 central counterparty clearing houses (CCPs) and 31 central security depositories (CSDs), according to the Association of the Luxembourg Fund Industry (ALFI).

As a result, AFME said it supported ESMA’s proposal to introduce a new category for ETFs, which “takes into account the market specificities of the product and the role of market makers in providing liquidity”.

EFAMA agreed, adding: “This natural fragmentation means an appropriate settlement fail rate may be different to standard equity fail rates.

“Where settlement is non-standardised and subject to primary and secondary market trades, a different settlement fail rate should apply.”

The industry body also suggested considering the underlying exposure of the ETF, which can vary in liquidity profiles.

Settlement fails have been of particular importance to ETFs, which are prone to late settlement due to the connection between primary and secondary markets.

ALFI suggested exempting ETF primary market transactions – between the ETF issuer and its APs – of cash penalties, reserving them for the secondary market.

The Investment Association added a new category for ETFs “will naturally drive more focused action on improving settlement rules and practices underlying ETFs”.

“A more detailed analysis of ETF settlement fails must be carried out to understand and delineate various issues underlying ETF settlement fails,” it said.

“We also recommend a periodic review – every 12-24 months – of the settlement efficiency and the impact (and any changes) to the current penalty regime.

“Such a review will also help ESMA calibrate an appropriate roadmap to accelerating the settlement cycle for EU capital markets.”

ESMA said reducing settlement fails is now “essential” given the growing conversations around shortening the settlement cycle from T+2 to T+1 and eventually T+0 in Europe.

Cash penalties were established under CSDR in February 2022 but its introduction was plagued with issues during the first few months.

The controversial mandatory buy-in regime – which contractually requires authorised participants to source securities elsewhere in the event of a settlement fail – continues to loom over the industry.

The introduction of the regime has been described as a “last resort” by the regulator should settlement times not improve.