Gold’s comeback amid Russia’s war in Ukraine and monetary policy uncertainty, the role of gold exchange-traded commodities (ETC) in a multi-asset portfolio and combining precious metals with ESG were the topics discussed at ETF Stream’s recent webinar in partnership with HANetf.

The webinar, titled Inflation protection: Is gold still the best hedge?, started by looking at the dramatic return of gold ETCs to favour after a subdued COVID-19 recovery period in 2021.

Anthony Bamber, head of business development at The Royal Mint, which co-created the Royal Mint Physical Gold Securities ETC (RMAU), said: “Towards the end of February, we saw gold jump around 6% which was the largest monthly gain since May 2021.

“As everything in Russia and Ukraine began to escalate further in March, it got up to its record highs again. It was these escalations plus other underlying issues such as inflation and the energy crisis that caused this.

“We have seen it pull back a bit since then but there is just so much going on in markets and a lot of unknowns – and this is where gold comes into its own as a risk asset.”

An advantage of gold ETCs is they are easy to access and trade with the same liquidity as their underlying, whether this be in physical or futures format.

Jason Griffin, director of capital markets and business development at HANetf, which distributes a gold ETC and a gold miners ETF, said banks can access gold spot and futures markets and deliver gold to ETCs with ease.

Offering a case study, Griffin pointed to one day in March where $150m entered a gold ETC co-launched by HANetf in a single day which was executed at a cost of one basis point.

Gold vs inflation

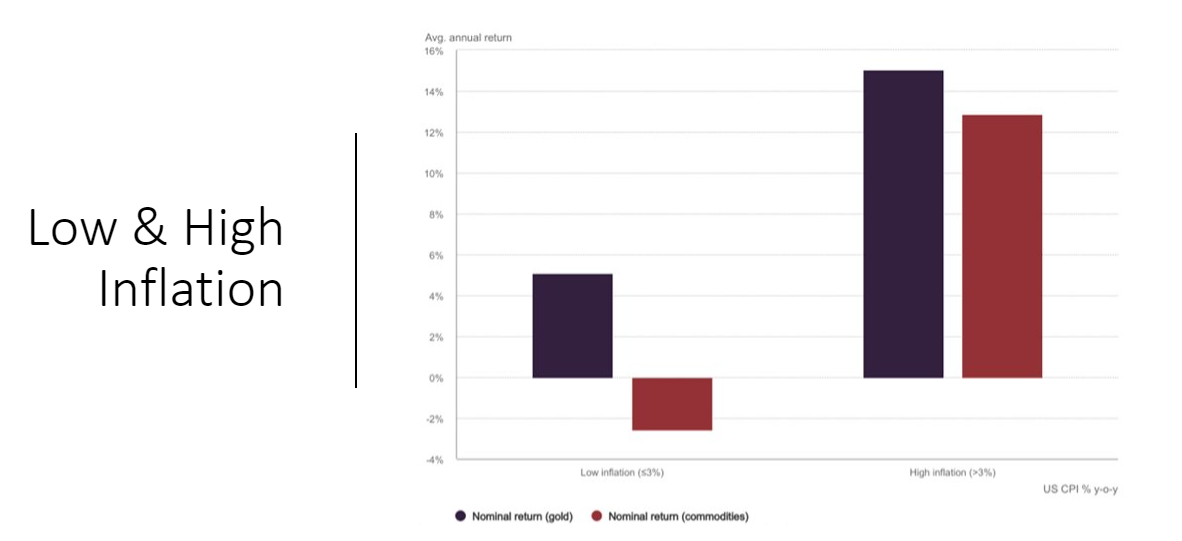

The Royal Mint’s Bamber highlighted the age-old comparison of gold and inflation and told attendees a World Gold Council study found in years where inflation exceeded 3%, gold had returned around 14%.

Eric Strand, CEO at AuAg Funds, which launched the AuAg ESG Gold Mining UCITS ETF (ESGO), then addressed some misconceptions around how gold behaves during periods of increasing inflation.

“What is interesting is people think high rates is not good for gold because gold has no dividend,” Strand said. “But actually, if you look at the last two cycles, gold had really good returns, both when interest rates started to increase and later when they had to lower rates – so this is really a perfect storm for gold.”

Source: AuAg

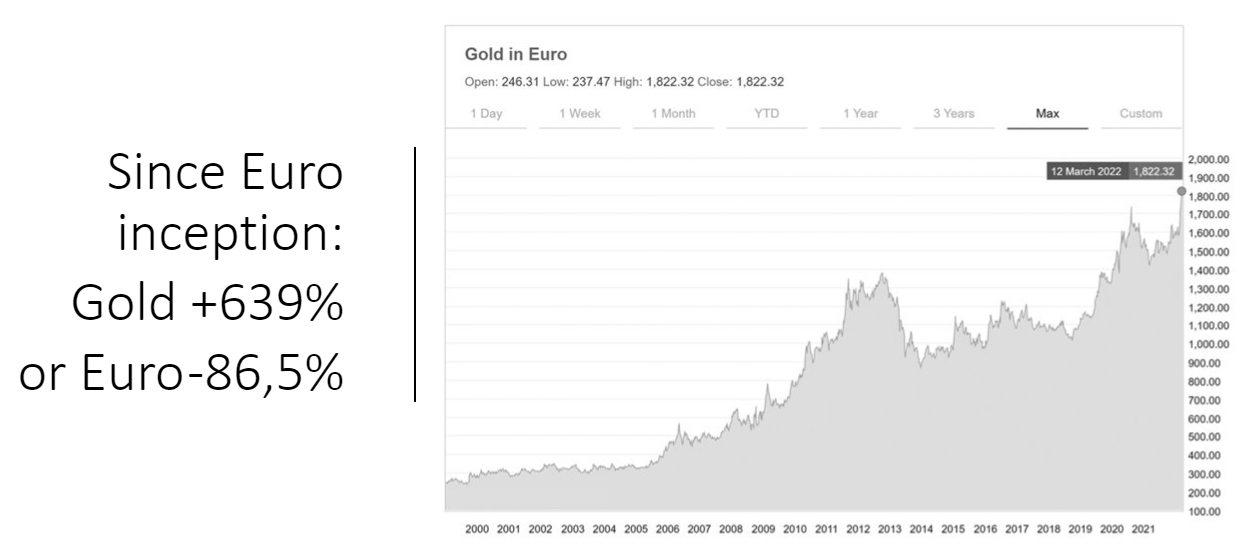

Strand added the challenge for gold comes with the discussion around rising rates, rather than the rates hikes themselves. Highlighting this, he illustrated gold’s vast outperformance versus currencies such as the euro and pointed to its price performance in euros versus the currency itself.

Source: AuAg

How a gold allocation might look

Strand continued, stating a key strength of gold is its low correlation with other assets. While more correlated, ESGO captures gold miner equities rather than gold itself. This normally results in outperformance during gold bull markets and vice versa during periods of underperformance.

“If you play precious metals for safety, 1:1 gold is the place to be. If you are playing the precious metals market for the returns, then mining equities have some things gold does not have,” Strand said.

“They pay dividends, for some portfolio managers it is easier to allocate to equity rather than a commodity, they are higher volatility so could also take up a smaller space in a portfolio.”

HANetf’s Griffin added: “We see some investors holding gold as a commodity and in equity form at a 70:30 or maybe even a 30:70 ratio. These allocations depend on investors’ views of where the gold price might be. If they are more bullish, they may increase their allocation to miners.”

Squaring the circle on ESG and gold

The webinar then looked at the ways to reconcile the process of mining precious metals with ESG characteristics.

One route is to choose issuers performing best-in-class practices regarding ESG metrics – as done by ESGO which captures the most ESG-compliant gold miners.

Griffin also suggested gold miners could buy voluntary carbon offsets or carbon credits – such as EUAs – to bolster their emissions reduction credentials, alongside existing net zero efforts.

Offering a unique approach, Bamber said The Royal Mint has partnered with a Canadian firm to recycle precious metal ‘e-waste’, by stripping gold out of electronic appliances to create new gold products.

Bamber also noted the LBMA’s recent decision to remove new gold bars from Russia from its good delivery list. While legacy Russian bars are still good delivery-compliant, The Royal Mint has already swapped out existing Russian gold from RMAU.

To watch the full webinar, click here.

Related articles