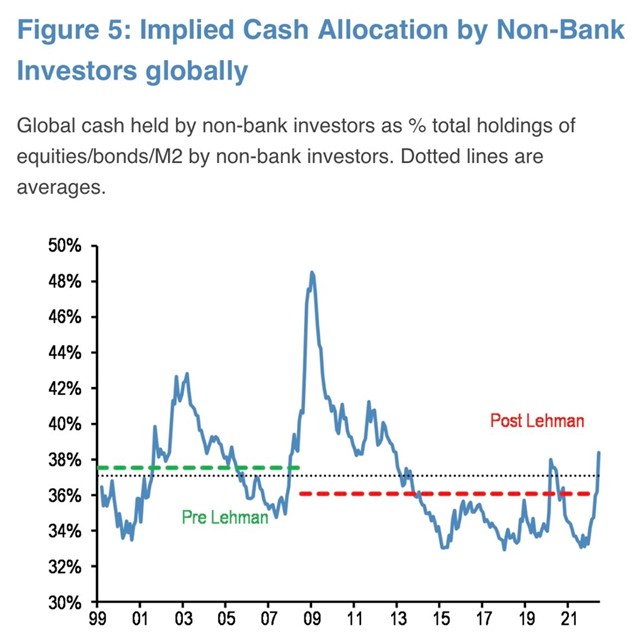

Investors are rushing to cash faster than during peak pandemic volatility in search of shelter from current market conditions and tactical readiness.

According to JP Morgan, non-bank investors are now piling into cash at a rate exceeding pre-Lehman Brothers-crash averages, with the percentage of cash relative to total holdings jumping around 6% since the turn of the year.

Significantly, current cash allocations are relatively higher than during the March 2020 sell-off and are at levels last seen in 2013.

Source: JP Morgan

These runs to liquid capital are a tell-tale sign of poor investor sentiment. During market volatility, many look to increase their tactical cash allocation and follow the ‘dry powder’ thesis – looking for opportunities as other asset classes after increasingly bleak returns.

Others also allocate to cash for relative cash preservation. While inflation of 8-10% is a loss of purchasing power in real terms, many would rather absorb this hit in the short-run than also weather bear-market-level performance currently being borne by broad equity indices.

Interestingly, investors are not just allocating to physical cash but cash and cash-like ETFs including money market products.

In Europe, the $439m Amundi ETF Govies 0-6 Months Euro Investment Grade UCIST ETF (C3M) tracks the performance of euro bills with very short maturities and has seen $112m inflows so far this year, as at 30 June, according to data from ETFLogic.

Other notable mentions include the $52m Lyxor Fed Funds US Dollar Cash UCITS ETF (FEDF), which has added $15m, and the $57m Invesco Euro Cash 3 Months UCITS ETF (PEU) which has amassed $22m so far this year.

In the US, Athanasios Psarofagis, ETF analyst at Bloomberg Intelligence, said: “Assets of the largest ‘cash type’ ETFs are back to where they were during the COVID-19 sell-off.”

Source: Bloomberg Intelligence

The behemothic $21bn SPDR Bloomberg 1-3 Month T-Bill ETF (BIL) added $7.5bn in new money during the first half of the year, with $2.1bn coming in the last month alone.

Similarly, the $22bn iShares Short Treasury Bond ETF (SHV) has seen $8.7bn inflows so far this year and $1.9bn over the past month.

Last time such large volume went into both ETFs was during the turbulent period of Q1 2020, as seen below.

Source: Bloomberg Intelligence

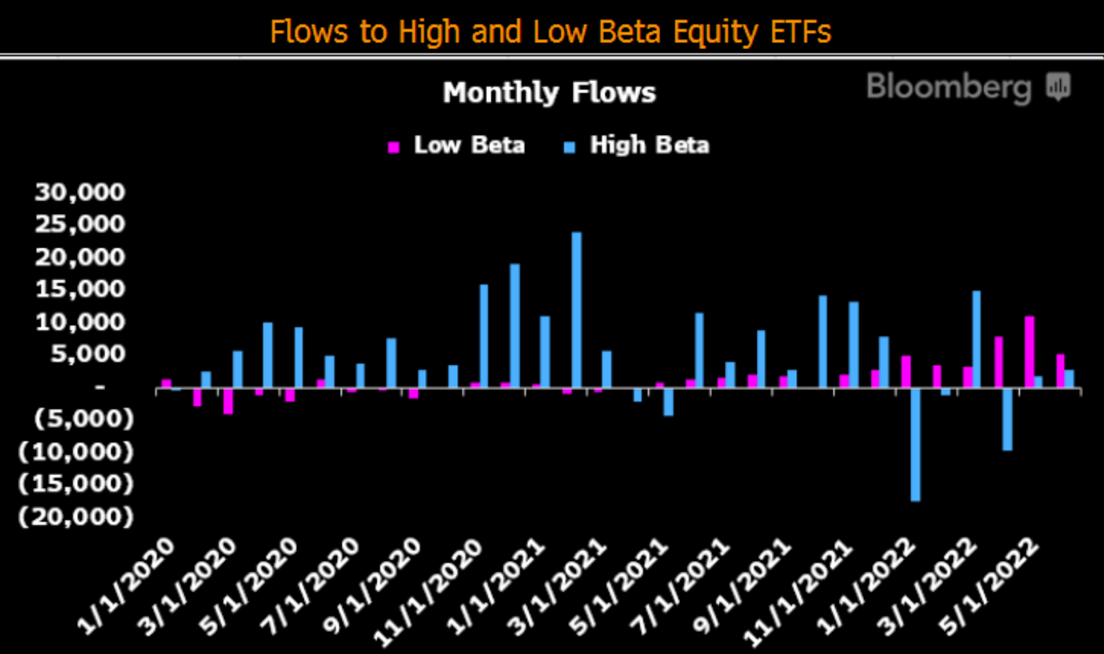

The trend into cash and money market instruments is also part of a broader shift to exposures with relatively low volatility, as seen with assets flowing into equity ETFs with lower beta than the S&P 500.

“ETF flows all about getting low cost, low beta and low duration,” Psarofagis added.

Source: Bloomberg Intelligence

However, Nigel Green, CEO of deVere, said investors should remain diversified rather than hoarding cash or running to safe havens.

“While you may be tempted to stash cash during periods of volatility, experience demonstrates that such attempts to ‘time the market’ almost always fail,” Greene suggested.

This warning bears particular significance at the moment as investors question whether we are approaching the ‘bottom’ of the current cycle or whether the potential for recession could see deflated returns persist for the long haul.

Related articles