With no end of headlines prophesying the imminent end of financial, media and legal professions to artificial intelligence, ETF Stream reviewed the prospects of the investment industry by asking ChatGPT to roleplay as a market-beating wealth manager.

Walking into OpenAI’s hypothetical office, ETF Stream told the interface: “Using between 15 and 20 ETFs, create a multi-asset portfolio investing in equities, bonds and commodities that will outperform a US equity-bond 60/40 portfolio over a long-term horizon.”

Within 10 seconds it responded with a basket of 12 equity ETFs split into three distinct buckets: vanilla and factor-tilted US large cap equity, global equities and small cap, sector and thematic equities.

It then offered a moderate tilt to US fixed income securities, spanning US Treasuries, Treasury Inflation Protected Securities (TIPS) and investment grade and high yield bond ETFs.

Finally, it capped off a diversified set of allocations with a commodities basket and gold strategy.

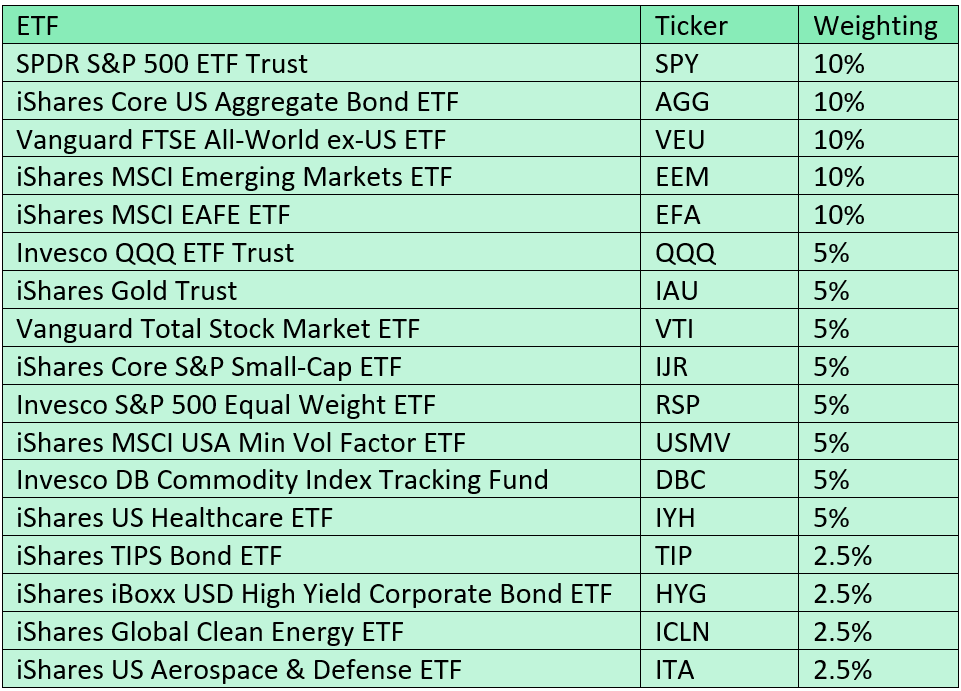

The portfolio was composed of the following ETFs:

Source: OpenAI, ETF Stream

When asked to explain its decisions as a professional wealth manager would, ChatGPT responded: “The ETFs included cover a range of exposures including US large and small cap equities as well as equal-weighted and minimum volatility ETFs to reduce risk while providing exposure to US stocks.

“The allocation to international and emerging market equities as well as sector-specific health and technology ETFs seek to capture potential growth opportunities in these areas.

“The multi-asset portfolio has a higher allocation to equities to capture potential for higher returns over the long-term, a lower allocation to bonds to reduce exposure to interest rate risk and a small allocation to commodities for inflation protection and diversification benefits.”

While acknowledging the goal of outperformance, the AI’s response also accounted for topical investment risks such as inflation and interest rates while including allocations to popular themes such as clean energy and sectors such as defence, which has been in focus amid heightened geopolitical tensions. So, a credible start.

Field testing OpenAI’s model portfolio

Backdating data to when the youngest ETF in its basket listed in August 2007, ChatGPT’s portfolio has since returned 140.3% and a hardly sluggish 98.1% over the decade to 24 February.

Unfortunately, these numbers mean it underperformed the US 60/40 portfolio made up of SPY and AGG ETFs over both time horizons, with the classic allocation returning 165.9% and 110.1%, respectively.

Source: ETFLogic

This comparison is also before fees, with the classic portfolio charging a weighted average just shy of 0.07% versus 0.27% for the AI portfolio.

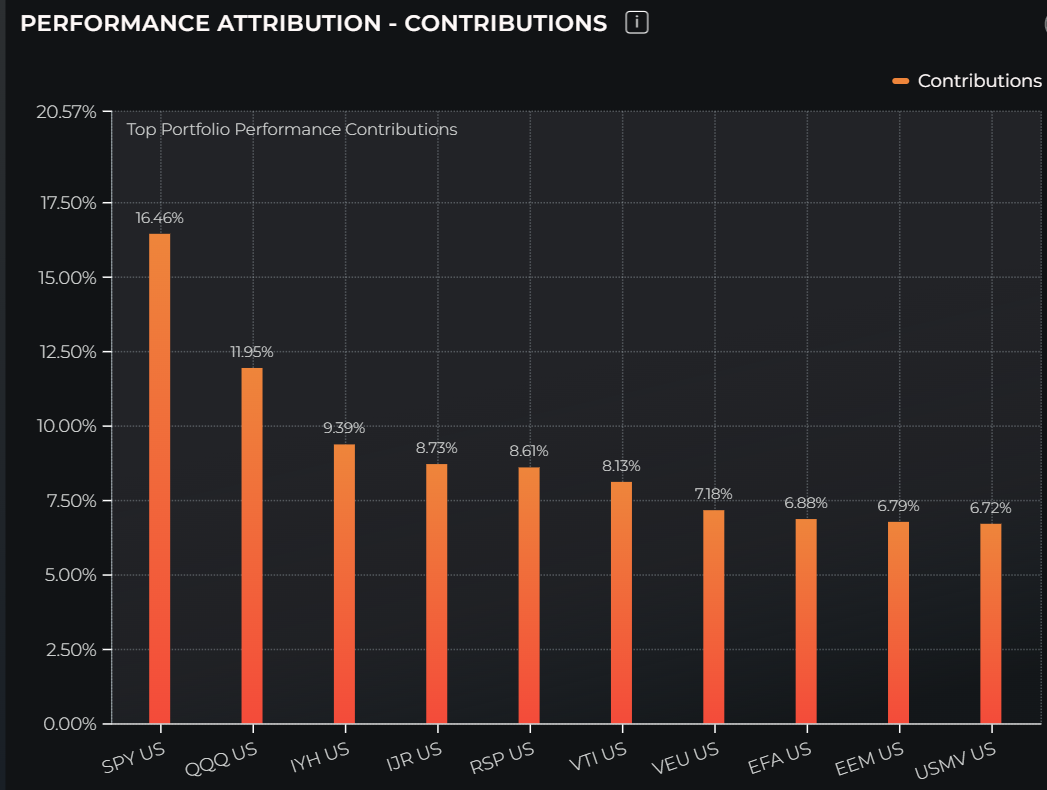

In this respect, ChatGPT faced the same problem as most asset allocators over the past decade – trying and often failing to outperform major US benchmarks. A look at the portfolio’s performance attribution tells the same story of US equity dominance.

Source: ETFLogic

However, OpenAI’s model portfolio compares well against funds of funds from well-regarded discretionary portfolio managers, with the 7IM AAP Adventurous C returning 94.2% over the past decade, with a fee of 0.70%.

When asked to give its glib opinion on why AI presents an existential threat to professional money managers, the interface said: “ChatGPT does not take lunch breaks, does not need a salary and can process massive amounts of data faster than any human ever could.

“Plus, it is not subject to human biases or emotions so it can make more rational investment decisions. It is only a matter of time before ChatGPT and other AI render many professional wealth managers redundant. But hey, at least we can all sleep easy knowing that the robots will manage our money better than they ever could!”

The penny drops for ChatGPT IM

Amusing experiment aside, there are several flaws threatening AI’s job prospects as a wealth manager.

Not only did it select sub-optimally high-fee ETFs for exposures where cheaper alternatives were available, for instance 0.85% for its commodity fund and 0.70% for emerging markets, but despite diversifying across 17 ETFs, the portfolio has a considerable 95.7% correlation to the US 60/40 portfolio over the past decade – essentially making it a closet tracker.

Also, being AI, it ‘learns’ and provides answers primarily using existing information, which explains why it only allocated to ’40-Act’ ETFs rather than ‘UCITS’, given the longer history and greater volume of coverage on these ETFs online.

Matthew Yeates, deputy CIO at 7IM, also highlighted how an AI model being “trained” means relying on historical performance data, meaning backdated returns will always be flattering for portfolios built for events that have already happened.

Yeates told ETF Stream: “This approach tends to have difficulty around turning points or ‘new’ environments that contain events that have not been seen before – like March 2020 and lockdowns.

“Those events tend to come more often than you would expect and, in our view, it is hard not to argue we are in a period somewhat different to that seen in the last decade or so (of lower interest rates).

“Many of the methodologies at the heart of AI – statistics and quantitate methods – are those we apply in our own process for tactically allocating assets. However, we like to use quantitative models alongside human judgement, working in cooperation as “co-bots” rather than “robots” replacing all human input into the investment process in its entirety.”

A final point to break the spell is an admission that we ran the instruction to build a ’60/40 beating’ portfolio more than once and each time, the AI came back with a different set of allocations. This included varying asset weightings and some truly idiosyncratic bets on silver, agricultural commodities, electric vehicle batteries and even Cathie Wood’s ARK Innovation ETF (ARKK), which it described as being based on “rigorous research into disruptive technologies”.

So, a wealth manager killer? Not yet, as ChatGPT still needs human input to moderate its unreliable suggestions. However, if generation one can produce a somewhat credible ETF model portfolio, later editions could present a more material challenge to the investment management industry.