Request-for-quote (RFQ) platforms are the dominant mechanism for ETF trading in Europe, driven by the fragmented and institutional nature of the market.

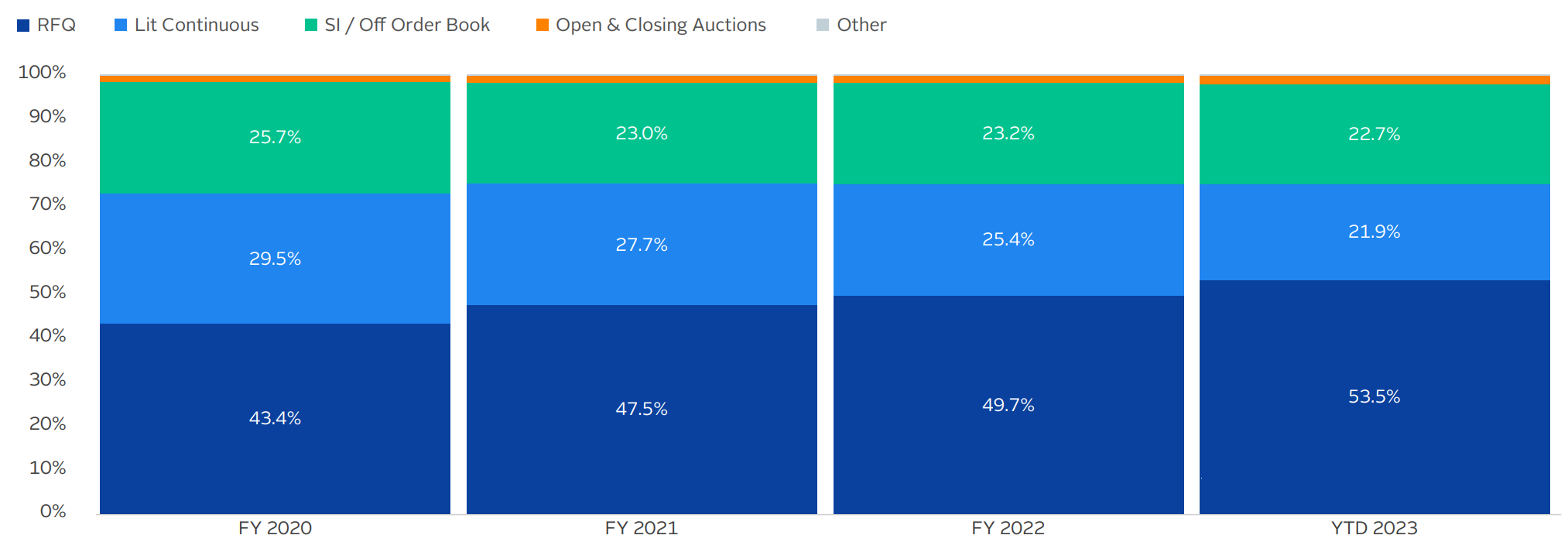

According to data from Jane Street, RFQ platforms have accounted for 53.5% of all ETF trades in Europe this year, as at the end of July, up from 43.4% in 2020.

The fragmented nature of the European ETF market is a key reason behind the significant market share. Over half of the 11,925 ETF listings on the continent trade less than 10 times a day while just 11% have more than 100 executions a day on average, Jane Street data shows.

Chart 1: Multiple listing example: US dollar corporate bond UCITS ETF

Source: Jane Street

This creates the need for liquidity providers to warehouse risk on their books because buyers and sellers on the secondary market are not arriving at the same time.

As Peter Whitaker, head of EMEA market structure at Jane Street, explained: “An underpinning reason for this is the broad distribution of liquidity across a large number of listings.

“Intermediaries bridge the gaps in terms of time, instruments and size by providing liquidity and warehousing risk. This is true across all trading protocols, including both risk provision via RFQ platforms but also for trading on exchange order books.”

Furthermore, the institutional nature of the European ETF market is another driver behind the preference for executing via RFQ platforms.

Approximately 80% of the market is institutional, an investor group that prefers the pricing, immediacy and certainty of execution benefits of RFQ platforms.

“There is a big focus on RFQ execution because Europe is a fragmented landscape with different exchanges and a broad offering of ETFs,” Alex Livingstone, head of trading and FX at Titan Asset Management, told ETF Stream.

“In Europe, there is a lot of institutional flow and executing via RFQ can be a good method to ensure an instantaneous transfer of risk for larger trades.”

Whitaker added ETFs – which are diversified – are “suited to risk liquidity” in a way cash equities are not as liquidity providers want to avoid exposure to any single security and therefore, idiosyncratic market risk.

“These portfolio effects mean ultimately that liquidity providers are willing to trade much more size in ETFs than in individual stocks or bonds,” he continued. “The need and demand for intermediation in European ETFs skews market activity to more risk-based protocols.”

Room for exchange volumes?

At the other end of the spectrum, on-exchange trading accounts for 22.7% of total ETF trades in Europe this year, down from a 25.7% market share in 2020.

While investors tend to execute large cash equity trades via periodic auctions and dark multilateral trading facilities (MTFs), the slow retail adoption is a major factor behind the lack of liquidity on exchange.

Chart 2: European ETF notional trend split by trading mechanism (FY2020-YTD end July 2023)

Source: big xyt and Jane Street, July 2023.

However, this is starting to change amid the sharp uptake of ETF savings plans across the continent as retail investors become more comfortable with the ETF wrapper.

Recent BlackRock research forecasted there will be 32 million ETF savings plans executed monthly in Europe by 2028, up from 7.6 million in September.

This combined with the rise of ETF algos and the impact of pre-hedging when executing via RFQ platforms could create an environment where on-exchange trading is more widely adopted as liquidity improves.

“There is an opportunity cost for not assessing liquidity on exchange before deciding to trade via RFQ platforms,” Thomas Stephens, global co-head of ETF capital markets at JP Morgan Asset Management, told ETF Stream.

Final word

Overall, the fragmented nature of the European ecosystem will be the reason why RFQ platforms will continue to dominate, at least in the short term.