Request for quote (RFQ) platforms remain the “dominant mechanism” for trading exchange-traded products (ETPs) in Europe after accounting for 50% of total traded value in 2022.

According to Bloomberg Intelligence, RFQ platform market share of ETP trading accounted for half of the €2.5trn turnover over the year as volatile markets boosted volumes.

The platforms, offered by the likes of Tradeweb and Bloomberg, have grown in popularity over the past few years by offering simpler execution compared to fragmented European exchanges.

This was originally an unintended consequence of the introduction of MiFID II in 2018 which attempted to push more flow onto ‘lit’ venues.

A separate analysis by Jane Street also found RFQ’s ETP trading market share had grown to 50%, up from 48% in 2021 and 44% in 2020.

“We have seen a preference for the RFQ protocol in Europe when it comes to ETF trading which has coincided with markets being very volatile and difficult to navigate,” Slawomir Rzeszotko, head of institutional sales and trading for Europe and Asia at Jane Street, said.

“You can see how the ability to transfer risk and seek immediacy fits very well with what investors in will need in difficult market conditions.”

Exchanges struggle to capture ETF volumes from RFQ platforms

Athanasios Psarofagis, ETF analyst at Bloomberg Intelligence, said the increase in RFQ platforms also highlights the institutional nature of the European ETF market.

While RFQ has grown market share, exchanges across Europe all saw an increase in trading volumes as ETP turnover increased 20% on the previous year to €2.5trn.

“This is a strong testament to ETPs, given they remained key sources of liquidity during the volatility, even as the complex structure of European markets kept trading fragmented across the region's multiple exchanges,” Psarofagis added.

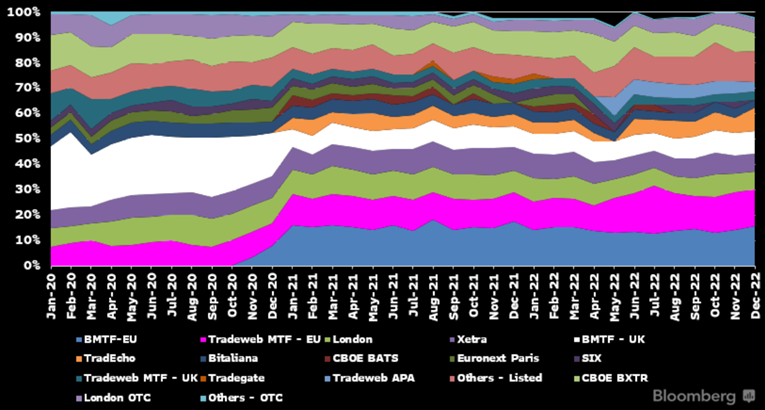

Fragmented European ETP Trading

Source: Bloomberg Intelligence

Meanwhile, the London Stock Exchange, Deutsche Boerse and Euronext all posted record trading volume in ETPs last year as turbulent fixed income and equity markets boosted turnover.

Deutsche Boerse led the way with ETF trading volume up 14% to €232.8bn last year, the highest annual turnover since the ETF segment was launched in 2000.

This was followed by the London Stock Exchange, which recorded the order book value of ETPs at €179bn in 2022, a 5% increase on the previous year.

Meanwhile, Euronext said trading volume in ETPs grew 6% year on year across its exchanges but did not provide an overall figure. Euronext Paris recorded an ETP trading volume of €60.5bn, according to Bloomberg Intelligence.

The firm said trading of ETPs on the Borsa Italiana remained stable with Paris seeing a sharp increase. According to Euronext, it has a 33.5% market share of all ETPs traded on exchange across Europe.

Silvia Bosoni, group head of ETFs at Euronext, commented: “We are confident that in 2023 we will further strengthen our position as the main European venue for these instruments, with an ever-growing offer.”

New product listings also grew substantially over the year, with both Deutsche Boerse and London Stock Exchange now housing over 2,000 ETPs respectively.

Deutsche Boerse listed a further 245 ETFs in 2022, 198 of which had a sustainability focus. Assets managed by ESG ETFs on the exchange were up 18% year-on-year at €236.5bn, with a trading turnover of the asset class up 11% to €37.3bn.

London Stock Exchange recorded 267 new listings, with 97 new ESG ETFs. The exchange said ETPs now account for 14% of the total London Stock Exchange order book turnover.

However, while choppy markets boosted trading volume, assets under management dipped on declining equity markets.

Assets within ETPs on the Deutsche Boerse fell by 6% over 2022, however, remained at just over €1trn while the London Stock Exchange houses just under the €1trn mark.

Related articles