For first time investors, deciding how to play the market can be a daunting task. The range of options out there means one can quickly become overwhelmed and even put off investing.

Multi-asset funds can be the perfect answer to this issue as they can solve the asset allocation conundrum along with choosing for you what investment vehicle is best to gain that exposure.

These “all-in-one” solutions, which provide portfolio construction and risk management, have proven very popular for the retail and independent financial adviser (IFA) segments of the market.

As the UK was about to see the introduction of the retail distribution review (RDR), US giant Vanguard was one of the first to recognise the demand for these type of funds in the UK at a low cost.

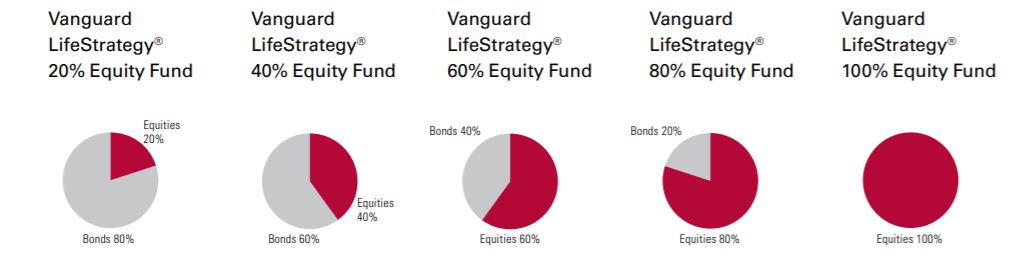

Therefore, in 2011, the firm launched its LifeStrategy range, which consists of five funds that invest solely in index funds and ETFs.

Each fund has a static asset allocation between equity and bonds, ranging from 20% equities to 100% depending on risk appetite.

Source: Vanguard

With ongoing charges figures (OCFs) of 0.22%, the strategies have been hugely popular in the UK gathering £15.5bn since launch.

Seeing the success of the LifeStrategy range, BlackRock decided to take on its rival directly with the launch of a similar suite in May, the MyMap range.

The world’s largest asset manager is offering investors these funds at 0.17%, undercutting its rival by five basis points. However, the range is yet to capture significant flows, with inflows of £31m since launch, as at 13 September.

BlackRock’s head of iShares UK intermediary sales Pollyanna Harper said the solutions will enable investors to “focus on their future…with the confidence that our expertise will take care of ‘how’ they get there”.

BlackRock’s MyMap range

MyMap3MyMap4MyMap5MyMap6Volatility Bands3-6%6-9%8-11%10-15%Bonds64%46%33%18%Stocks34%52%67%82%Alternative2%2%0%0%

Source: BlackRock

While the two ranges offer investors similar broad solutions, there are important differences investors should be aware of.

The first is around the way they fix the fund’s risk targets. Vanguard has taken the decision to fix the asset allocation meaning volatility can fluctuate.

Meanwhile, BlackRock has fixed the volatility bands. MyMap3, the least risky fund, has a volatility target of between 3-6%. This led to a portfolio of 34% equities, 64% bonds and 2% alternatives at launch, however, this can change if the risk profile of these asset classes do.

The allocation to alternatives, for example gold or real estate, enables the portfolio managers to stay within the volatility bands more easily than if the funds were allocated to just bonds and equities.

Furthermore, the volatility band targets enable BlackRock to be more reactive to big moves in interest rates, something Vanguard with its static allocation cannot do.

Despite this however, there is an argument to say retail clients investing for the long term do not need to make tactical allocations such as these.

Australia’s best US ETF: iShares’ IVV or Vanguard’s VTS?

In all, for investors wanting the simplicity of a static allocation to equities and bonds then one of Vanguard's LifeStrategy funds is certainly the way to go, however, those who want their fund to be slightly more tailored to their risk appetite should choose a MyMap strategy.