Global assets invested in ETFs are expected to grow by 50% to $15trn in just five years, with Germany among the fastest-growing countries. As a result, more Germans realise that ETF savings plans are an indispensable building block for their retirement provisions. As this boom continues, ETFs are likely to become a bigger part of investors' portfolios.

ETFs have grown enormously in popularity over the past two decades. The total amount invested in ETFs has grown from around $200bn globally in 2003 to more than $9.5trn in 2022. This translates to an annual growth rate of more than 20%. There are many reasons for this development. Risk and cost considerations are among the most important.

ETFs allow you to build a broadly diversified portfolio of stocks, bonds or commodities with a single transaction, effectively spreading the risk of an investment. And they do so at a minimal cost compared to traditional funds. This is because ETFs track an index – such as the DAX – rather than actively trying to beat it, which is costly but rarely successful.

Largest growth in Asia, followed by Europe

Given the rapid growth in recent years, the question is as to whether the end of the line is approaching or whether growth will continue. A recent survey by professional services firm PwC entitled ETFs 2027: A World of New Possibilities suggests the latter. More than 70 senior executives from around the world were surveyed, the majority from ETF providers or asset managers that use ETFs. Their estimates of global ETF volumes in 2027 ranged from $11trn to more than $18trn, with an expected value of around $15trn.

Annual growth rates to 2027 vary by region. The Asia-Pacific region is expected to see the strongest growth, with an annual growth rate of 17%, followed by Europe at 14%. The ETF market in the US, which accounts for two-thirds of global ETF assets and likely to be closest to saturation, is expected to grow at a respectable 13% annually. Three-quarters of the money is presently going into equity ETFs. However, demand for bond ETFs, which currently account for 20%, is expected to grow steadily, particularly in North America.

Germany: ETF savings plans are the trend

Where will growth come from? According to the respondents, the main growth potential lies in attracting retail investors. This is particularly true in Europe, where institutional investors still dominate the ETF market. To achieve this, providers should raise awareness of their brands and communicate the benefits of ETF investing.

Respondents also expect digitalisation to further reduce the cost of ETFs and therefore the barriers to entry. ETFs, which are a low-cost investment vehicle compared to actively managed funds, could therefore become attractive to even broader groups of investors. Germany in particular is seen as one of the fastest growing markets, driven by the increasing popularity of ETF savings plans and the growing trend towards capital market investments.

More active, thematic and ESG ETFs

Large institutions will expand their product range by using their expertise to develop active, thematic and ESG ETFs. The respondents see particular potential in crypto products and less so in commodities.

Active ETFs in particular are expected to see a significant increase in demand over the next few years. They offer access to a wider range of investment strategies, including those not traditionally available through passive ETFs. These hybrid products would appeal to investors who want to benefit from the expertise of active portfolio managers while taking advantage of the liquidity and transparency offered by ETFs.

Will retail investors play along?

Whether these predictions will come true remains to be seen. After all, what can you expect when mostly ETF providers are being asked about the outlook for their industry? The arguments for continued growth are entirely plausible. But things could turn out differently. Capital market investors tend to be shy creatures – especially in the retail sector. After all, when stock markets sputter, nerves begin to flutter.

The savings account is then quickly favoured again as the more trusted alternative to capital market investments. And the ETF sector will not be spared from this. Also, the expectation that actively managed ETFs will become a major growth driver may not materialise, as the straightforward distinction between traditional active funds and passively-managed ETFs is becoming blurred.

Nor will an ever-expanding range of products, such as new thematic investment strategies, necessarily trigger the hoped-for surge in demand. On the contrary, investors may become unsettled as they lose oversight. And if they then desperately turn to their bank adviser, this will not help ETF sales. Also, the expectation that actively-managed ETFs will become a major growth driver may not materialise.

The straight distinction between traditional active funds and passively managed ETFs becomes blurred and – especially hampering – the running costs of active ETFs are likely to move in the direction of the traditional world. Ultimately, however, the key question will be whether thematic or active ETFs outperform their conventional passive counterparts in terms of return and risk over the long term.

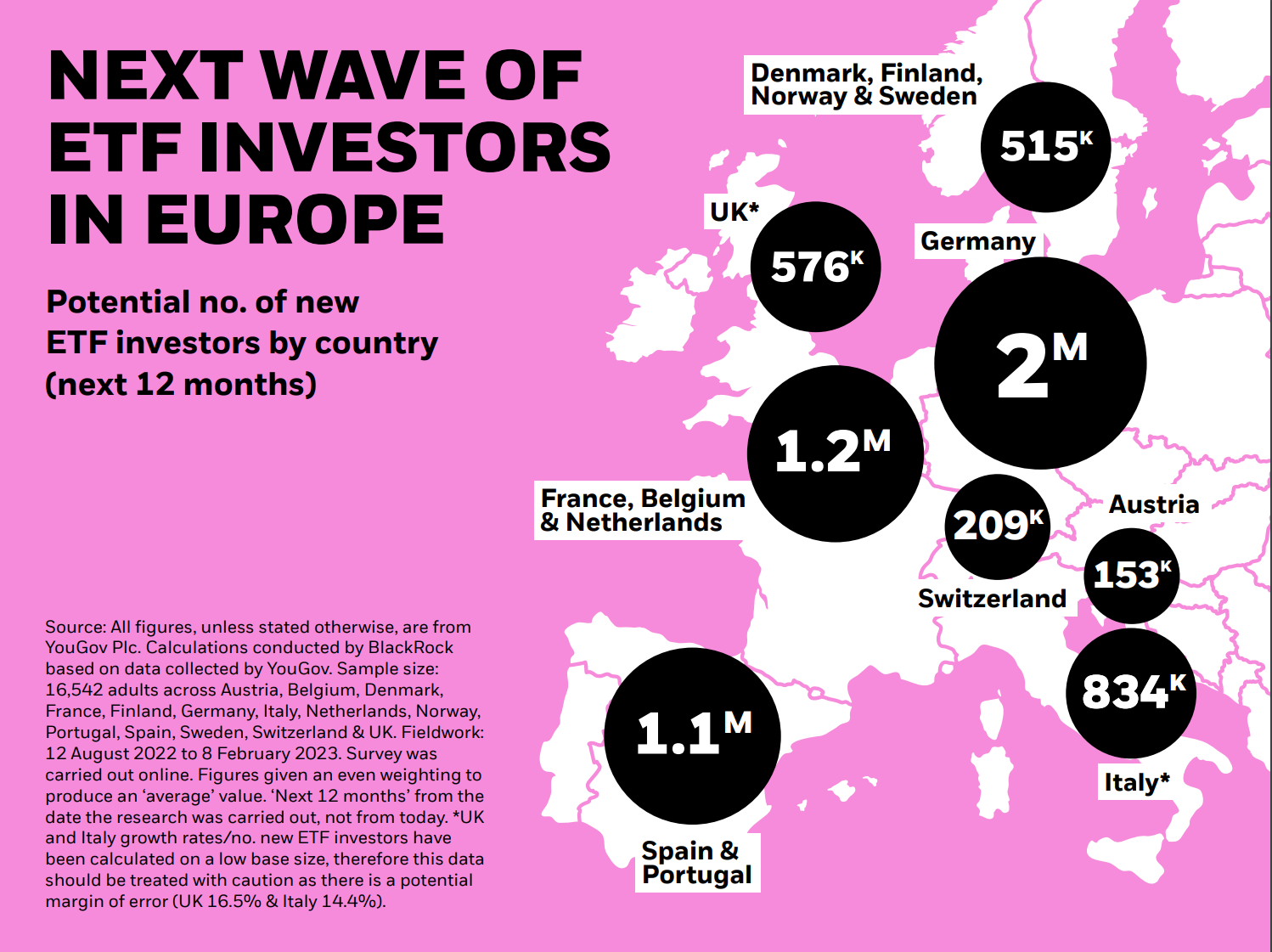

Stock market newbies make the market grow

A YouGov survey of 14 European countries, including Germany, commissioned by Blackrock, identified first-time investors as the main source of growth in the European ETF market. Their numbers will continue to grow in the future, and they find ETFs particularly attractive due to easy market access and low costs.

A look at the relative figures also shows that there is still a lot of growth potential. Globally, assets under management in ETFs represent only a fraction of the financial market. In Europe, only 4.1% of equity assets are held in ETFs and only 1.7% of fixed income assets. So, there is still a long way to go.

Stefan Mittnik is professor emeritus of financial econometrics at the Ludwig Maximilians University Munich and co-founder of Scalable Capital