Factor investing, also known as smart beta, has made a huge splash in the ETF world. With over 1000 ETFs and more than $2trn invested, it is clear this approach has gained significant traction.

The foundation of factor investing lies in academic research, particularly the groundbreaking Three-Factor Model by Eugene Fama and Kenneth French. This model has not only laid the groundwork for factor research but also opened up a whole new world of quantitative research, using mathematical and statistical techniques to analyse financial data and develop systematic investment strategies.

For quant investors, developing these strategies is captivating, yet the real challenge lies in their post-launch performance.

Despite historical outperformance, many factor strategies underperform after their introduction. The pressing question for asset allocators is: which strategy should you choose, or should you diversify across them all?

The momentum factor: My top choice

When it comes to factor investing, momentum is hands down my favourite. This love affair started over a decade ago, inspired by Jegadeesh and Titman's 1993 paper, Returns to Buying Winners and Selling Losers: Implications for Stock Market Efficiency. Here is why I think momentum is so special:

Behavioural bias: Investors exhibit a natural tendency to follow the herd, chasing after the stocks that are performing well. Even fund managers are guilty of it, especially those who have underperformed recently might sell their losing positions and jump on the bandwagon of winning stocks to catch up with their peers. Retail investors often do the same, picking stocks that are in the news and showing strong returns. These behavioural biases are deeply ingrained and create opportunities for those who know how to exploit them.

Trending economic fundamentals: Some industries and companies benefit from long-term structural trends, which can lead to sustained earnings growth. Such companies with strong earnings growth often gain market capitalization and in turn reduce their cost of capital. This makes it easier for them to raise funds for new business opportunities, which ultimately fuels the next leg of earnings growth.

Sector and theme agnostic: Many people associate momentum with tech stocks, but it is actually sector and theme agnostic. Momentum does not care about sectors, themes, or valuations. For example, after the COVID-19 market rebound in mid-2021, momentum portfolios shifted from growth-oriented tech names to more cyclical sectors like materials and financials driven by bullish commodity markets and low interest rates. Today, it has captured the AI rally, a trend that initially faced scepticism but has since gained widespread acceptance. I find momentum incredibly useful to capture the next big trend.

The risks of riding the wave

While momentum has a lot going for it, it is not without its risks. Here are a few things to keep in mind:

Volatile markets: Momentum’s biggest enemy is volatility. When markets are volatile, it often means there is a structural shift or economic shock happening, which can disrupt existing trends. For example, the 2022 inflation shock saw the market rotate out of high-growth tech stocks into value-oriented energy stocks. Momentum strategies can get caught off guard by these sudden shifts. Tip: To manage this risk, keep an eye on market volatility—spikes in the VIX Index above 30 often signal potential Momentum crashes.

Implementation costs: Momentum strategies involve high turnover, meaning they frequently buy and sell stocks. This can lead to higher trading commissions and potential slippage – from large bid/ask spreads – in less liquid market conditions, which can erode returns over time. Tip: Understand the turnover and associated frictional costs of the momentum strategy you are using to avoid surprises later.

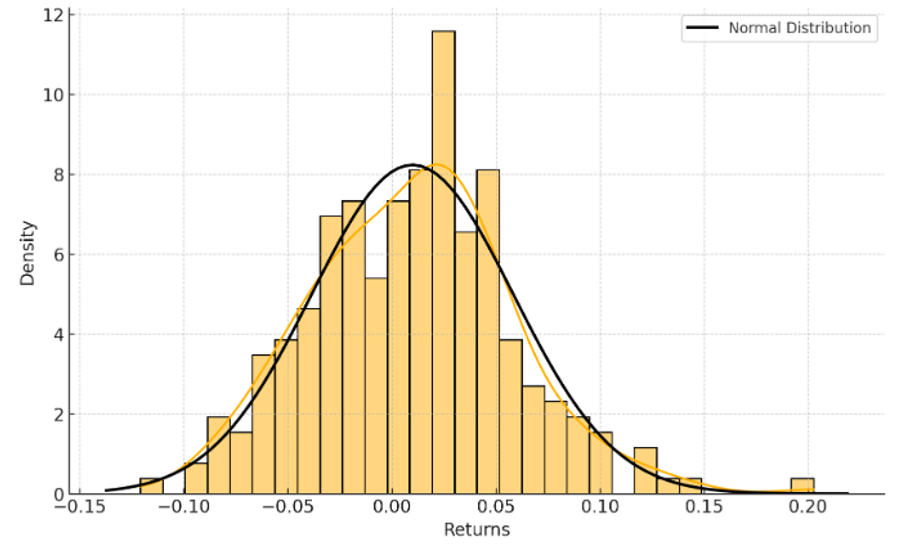

Cost of Alpha: Momentum alpha is not free; it comes with risks. The figure below shows the distribution of monthly returns for the momentum factor over the past 20 years. It shows:

Returns are positively skewed. You get more months of positive returns than negative returns. This is great for an asset allocator as you want consistent alpha capture. Median returns imply an alpha of 15.7% per annum. Another way of saying this is, 50% of the time you will make 15.7% or more every year!

Returns have excess kurtosis – fat-tails. The downside of using the momentum factor is that there will be a few times when the returns are much worse than the market. Approximately 95% value-at-risk (VaR) of momentum factor is 27.5%. This implies in a worse-case scenario – 5% chance – you would lose more than 27.5% in a year. This simply says when returns are bad, they are really bad!

Chart 1: Distribution of momentum factor returns with normal distribution overlay

Source: Elston research, Fama-French data library

Overall, even though the momentum factor has risks, it still offers some of the best opportunities for generating alpha. However, it takes a skilled asset allocator to know how and when to incorporate this strategy into a portfolio.

Hoshang Daroga is investment director at Elston Consulting