In our previous partner insights article on ETF Stream, Securities lending: Enhanced returns through active engagement, we described the factors that may impact the performance of the securities lending programmes that ETF managers participate in, and how through a process of ‘active engagement’ with their providers, managers can increase revenue and materially improve that performance.

In the article, we briefly touched on the subject of regulatory capital, and the associated risk-weighted-asset (RWA) considerations that are being factored into the trading decisions and evolving business models of certain market participants.

That topic was talked about on and off for many years within securities lending circles, and indeed was something we at eSecLending talked about more than most, given our advantages in the area. Since our article was published last November however, the RWA acronym – and in particular with respect to counterparty indemnities – has rarely been out of the headlines including being the topic of a number of podcasts produced by the asset owner community[i], sent a six-month-old paper on the topic briefly viral[ii] and caused the reallocation of billions of dollars of loan balances as certain agent banks repriced parts of their general collateral (GC) business.

Some 15 years after the Lehman Brothers default, indemnification is once again front and centre for the securities lending industry. We look at why this matters, how the current agenda is manifesting in securities lending programmes and what actions ETF managers can take to mitigate the drag on performance their funds may be suffering.

Indemnification

Borrower default indemnities are an important risk management tool, and a long-standing feature of most securities lending programmes, effectively providing lenders with a financial backstop in the event of borrower default.

Historically these indemnities incurred little-to-no capital charge for the lending agent providing them and were ostensibly seen as a ‘free’ service provision.

That was then, this is now

Due to the regulatory requirement for banks to allocate more capital in support of these indemnities, combined with a general increase in the value of capital, borrower default indemnities now inflict a material cost on the securities lending programmes managed by custody banks. In order to maintain profitability and offset these costs, banks have a variety of options open to them, all of which can negatively impact the performance of asset owners that participate in those lending programmes.

These changes, as well as the impact they may have on programme participants, are outlined below.

Modified trading strategies that focus on transactions that are most capital efficient for the bank.

Reduces revenue for client, lowers performance, bifurcates alignment of interest between agent bank and asset owner.

Higher bank fees via adjusted fee split.

Reduced revenue, reduced performance, increased agent costs borne by asset owner.

Reduce or limit counterparty indemnification.

Transfers counterparty default risk to asset owner.

Where to now?

With this in mind, what steps can ETF managers take to mitigate the negative impact of this dynamic on their securities lending performance? Although the easiest option may be to maintain the status quo and refrain from taking any action, this is likely to be unappealing to most managers. With rising operational costs and downward pressures on fees, revenue from securities lending can play an important role in bolstering their bottom line, and optimising this revenue stream is therefore crucial.

Based on conversations we have had with managers regarding this topic, we have identified two key areas where measures can be taken to enhance revenues.

Enhance programme parameters to increase relative attractiveness of portfolio

As we discussed in our previous article, managers that actively engage in their securities lending programme will typically outperform those that do not. Expanding eligible collateral sets, lending in new markets and lending to new counterparties can all lead to increased distribution, and ultimately, revenue.

Lend via a different lending agent/accessing alternative routes to market.

Treatment of RWA, and the subsequent actions taken on their securities lending programmes, is not the same across all lending agents, and managers may be able to realise a better outcome by lending through a different provider, as a product of both indemnification and pricing.

There is a third path, though to date we are not aware of any ETF managers taking this option, namely dispensing with counterparty default indemnification altogether. While this should produce a better economic outcome, it significantly increases the risk profile for the manager, and likely increases the resource (and expense) required to oversee the lending programme – arguably even less appealing than making no changes to the lending programme.

eSecLending’s position

As a specialist securities lending agent, our use of insurance-backed indemnification has long been a differentiator, providing the benefit of independent, high-quality underwriting of counterparty risk.

In recent years, that benefit has amplified due to the capital constraints described above that are being imposed on other market participants that we are not subject to. We, and our clients, are seeing increased balances, revenues, and deal flow, which by every measure is expected to continue into 2024 and beyond.

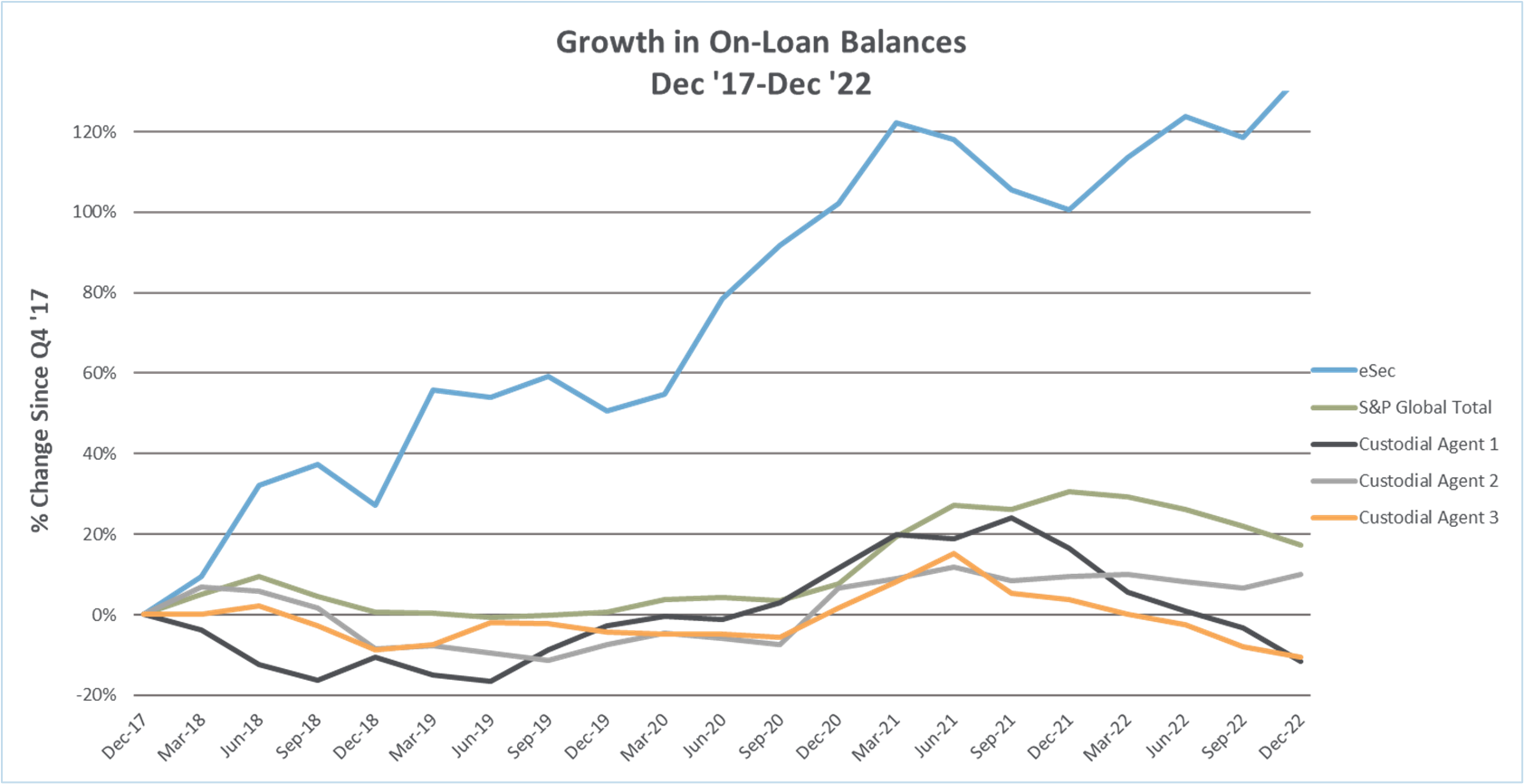

As highlighted in the chart below, lending balances across three of the largest custodial lending agents have, for the most part, tracked the S&P Global benchmark for the last 5 years, notably trending downward since the latter half of 2021. Over that same period, we at eSecLending have seen 120%+ growth in our balances, being a combination of new client programmes and increased business for existing clients, all of which translates to increased revenues and improved performance for our clients.

For those ETF managers seeking to address declining performance from their securities lending programme, have concerns regarding counterparty indemnities or are just interested in ways of better optimising their existing activities, eSecLending may be able to offer potential solutions to help them overcome current challenges and realise the full potential of their securities lending programmes.

Simon is managing director and head of business development for the EMEA and APAC regions at eSecLending

[i] Global Peer Financing Association (2022, December 19). Something has started changing. Retrieved May 17, 2023, from https://globalpeerfinancingassociation.org/podcast/something-has-started-changing Global Peer Financing Association (2023, January 19). Indemnification can no longer be ignored. Retrieved May 17, 2023, from https://globalpeerfinancingassociation.org/podcast/indemnification-can-no-longer-be-ignored [ii] Faulkner, M. (2022, June 1). Something Better Change. Retrieved May 17, 2023, from https://www.creditbenchmark.com/wp-content/uploads/2022/06/Something-Better-Change-13.6.22.pdf