The S&P 500 rally began with growth showing resilience in 2020 and value stocks staging a comeback at the turn of the year, however, its uptick increasingly relies on optimistic recovery sentiment, and this is subject to change as the hazard lights flash.

Having booked one of its strongest years on record – returning 69.8% during the 12 months to 20 March – and taken a tech stock dip in its stride, contrarians are convinced a correction remains just around the corner and some indicators would suggest there is more to this than empty pessimism.

Highlighting this, short positions against the world’s largest ETF – SPDR S&P 500 ETF Trust (SPY) – hit their highest point of the year in the final week of May with some 4.8% of the ETF’s shares were out on loan versus 1.7% at the start of the year, according to data from IHS Markit.

Likewise, a chart published by Lohman Econometrics at the start of the month shows S&P 500 constituent earnings minus inflation have turned negative in recent months.

As the chart illustrates, the three occasions this happened previously since 1985 were followed by periods of valuation dips for the index.

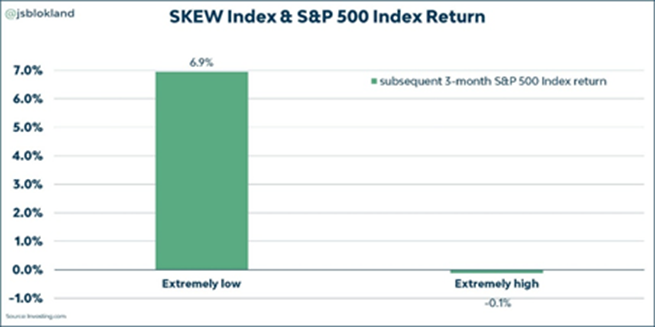

Furthermore, the SKEW index hit one of its highest levels on record at the start of June. A spike in the option-based indicator, which reflects the ‘cost’ of protection against tail risk in the S&P 500, means investors are willing to pay a premium to protect against a large drawdown in equity markets.

This, in turn, means the odds of a significant decline are believed to be relatively high and there is some credence to this. Of 15 observations of a SKEW surpassing 150, the subsequent three-month return of the S&P 500 was negative 80% of the time.

As the chart shows, the negative returns seen did not resemble the significant drawdowns some investors were preparing for. On average, the three-month S&P 500 return after a very high SKEW reading was -0.1%.

While this dip sounds modest, the fact this is over an entire quarter is significant, given the index’s 10-year average annual returns would imply an average three-month yield of 3.4%, according to data from Goldman Sachs.

End of the honeymoon period?

At the very least, indicators such as these should encourage investors to apply some caution when internalising the recovery narrative.

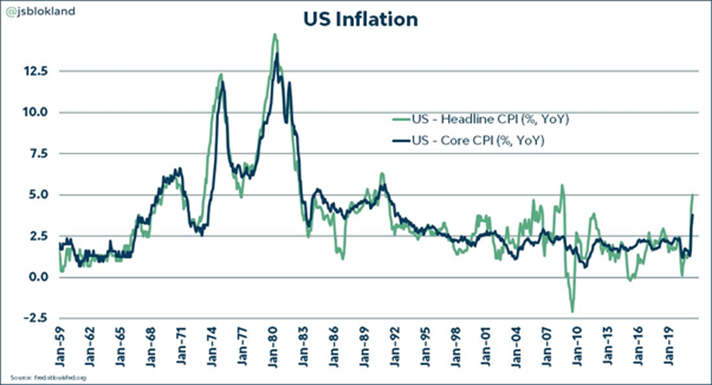

Likewise, the Federal Reserve’s commitment to a rates freeze is under increasing strain following last week’s inflation reading, which showed the US consumer price index was up to 3.8%, its highest level since 1992.

While the Fed stood fast by its monetary policy in the past, keeping rates below 0.5% between 2009 and 2017, fears of an ‘overheating economy’ and price inflation are leading some to question its commitment to a dovish approach.

A change of tactic and resulting rates hikes would increase borrowing costs and hamper S&P 500 valuations.

While offering some words of caution on current valuations, Chris Beauchamp, chief market analyst at IG Group, said the recovery trajectory looks resilient.

“Of course, a correction is always ‘just around the corner’ in one sense since a surprise development could easily prompt some volatility,” Beauchamp noted. “But the improving economy in the US and indeed globally supports an expectation that earnings will continue to improve, continuing to bolster valuations as they have done over the past year.

“The ‘average’ year tends to see at least one big correction of at least 10%, and 2021 has been devoid of that so far, but while caution might be warranted at these highs it looks like dips will continue to be bought.”