State Street Global Advisors’ (SSGA) latest move has caught the attention of the European ETF market, however, its decision to slash fees across three S&P 500 ETFs has been made from a position of weakness.

The US giant is set to offer the cheapest ETF in Europe on 1 November after it reduced fees on its S&P 500 product by two-thirds.

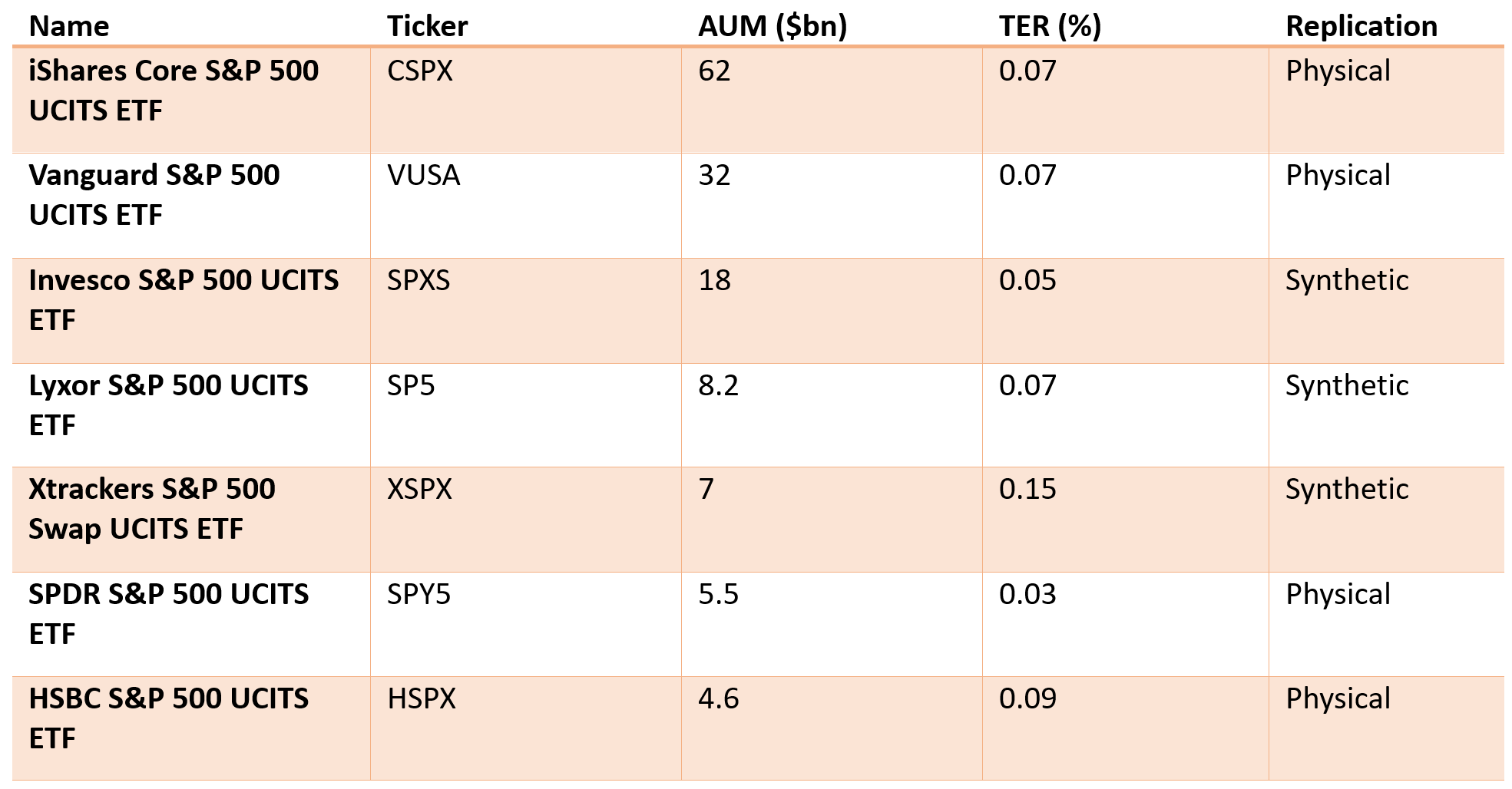

The SPDR S&P 500 UCITS ETF (SPY5) will see its total expense ratio (TER) cut from 0.09% to 0.03% while the fees on the SPDR S&P 500 EUR Hdg UCITS ETF and the SPDR S&P 500 ESG Leaders UCITS ETF (SPPY) have been slashed to 0.05% and 0.03%, respectively.

Matteo Andreetto, head of SPDR EMEA business at SSGA, said: “While these announcements enhance our market competitiveness, they also demonstrate our commitment to improving accessibility and delivering institutional-quality investment solutions at competitive price points.”

In order to make the move economically viable, SSGA has incorporated SPY5 along with 66 other ETFs into its securities lending programme.

The aggregate outstanding value of loaned securities for SSGA’s equity ETFs cannot exceed 40% of the fund’s total net-asset value (NAV) with the lending agent State Street receiving 25% of the revenues and the fund receiving the remaining 75%.

SPY5 now moves ahead of the Invesco S&P 500 UCITS ETF (SPXS), which synthetically replicates the S&P 500 and has a total expense ratio (TER) of 0.05%.

Synthetic US equity ETFs domiciled in Ireland such as SPXS pay zero withholding tax on dividends as the substitute basket of the ETF is restricted to non-dividend paying stocks.

Meanwhile, physical ETFs domiciled in Luxembourg pay 30% withholding tax on US equity dividends while Irish-domiciled ETFs pay 15%.

Its nearest rival that also physically replicates the S&P 500 is the Xtrackers S&P 500 UCITS ETF (XDPP) which has a 0.06% TER while Europe’s largest S&P 500 ETF, the iShares Core S&P 500 UCITS ETF (CSPX) carries a 0.07% fee.

“And just when we thought the price war in mainstream indices was over,” Ben Seager-Scott, head of multi-asset funds at Evelyn Partners, said.

Chart 1: Europe’s largest S&P 500 UCITS ETFs by issuer

Source: ETFbook

While the US ETF market has become accustomed to aggressive fee cuts like this, the war in Europe has been relatively sanguine in recent years.

However, something had to give for SSGA. The US player, a mainstay in Europe since 2001, is starting to lag behind its rivals amid fierce competition for a greater share of the $1.6trn market.

According to data from ETFbook, the firm currently houses $61bn assets under management (AUM) across its UCITS ETF range, as at the end of Q3, behind Invesco and UBS Asset Management with $71bn and $86bn, respectively.

This goes some way to explaining why SSGA would give up two-thirds of the revenues on its largest UCITS ETF, before securities lending.

To compete in the most saturated areas of the market, ETF issuers need to offer something different and SSGA’s move certainly does this.

Time will tell whether this will deliver SSGA more assets, however, as always, the big winner when it comes to fee cuts are end investors adopting the ETF wrapper.