Last year was a tough 12 months for emerging market (EM) equities. The MSCI EM Index fell by 20% in US dollar terms over the full year, battered by the Russia-Ukraine conflict, an unexpected COVID-19 resurgence in China and tightening US monetary policy.

Now, we see reasons to be optimistic. While these issues are not fully behind us, we feel that the stars are aligning for the asset class.

1. FALLING INFLATION ALLOWS EM CENTRAL BANKS TO CUT AGGRESSIVELY: Consumer price indices are falling across the world. The major issues of supply chain constraints, high shipping and energy costs and commodity scarcity seem mostly resolved. Within EM, Latin America and EMEA inflation rates rose dramatically in the second half of 2021 and into the first half of 2022.

While the rates of inflation seen in 2022 were staggeringly high at their peaks, they have come down to much lower levels. More importantly, inflation is expected to continue falling across the regions throughout 2023 and beyond.

Policy rates are at decade-high levels: After three years of aggressive rate increases, EM central banks have room to cut. We think some EM central banks could cut rates in the region of 100-400 basis points. This will support domestic growth and, in some cases, lower deposit rates may urge domestic investors to pivot into domestic equities.

2. THE US DOLLAR HAS PEAKED: In October 2022, the US dollar hit its highest valuation since the 1980s. Since then, it has been depreciating quickly. Typically EM equities perform well when the US dollar is not rising. US growth outperformance and a swiftly hiking Federal Reserve supported the US dollar’s rise over 2022. The US dollar’s broad real effective exchange rate (REER) ratio – the value of the currency measured against a weighted average of other major currencies compared to its own history – hit its highest level since the 1980s, in October 2022.

Since then, the US dollar’s weakness has been sharper than we had anticipated. As US inflation continues to show signs of falling and the Fed’s message turns more towards a pause rather than continued rate hikes, the US dollar can weaken further, or at least stay at similar levels. For EM equities, a flat or falling dollar allows earnings translated back into US dollars to remain high.

The US dollar could strengthen if geopolitical risks escalate or the US recession is worse than expected, but these are not currently our base case.

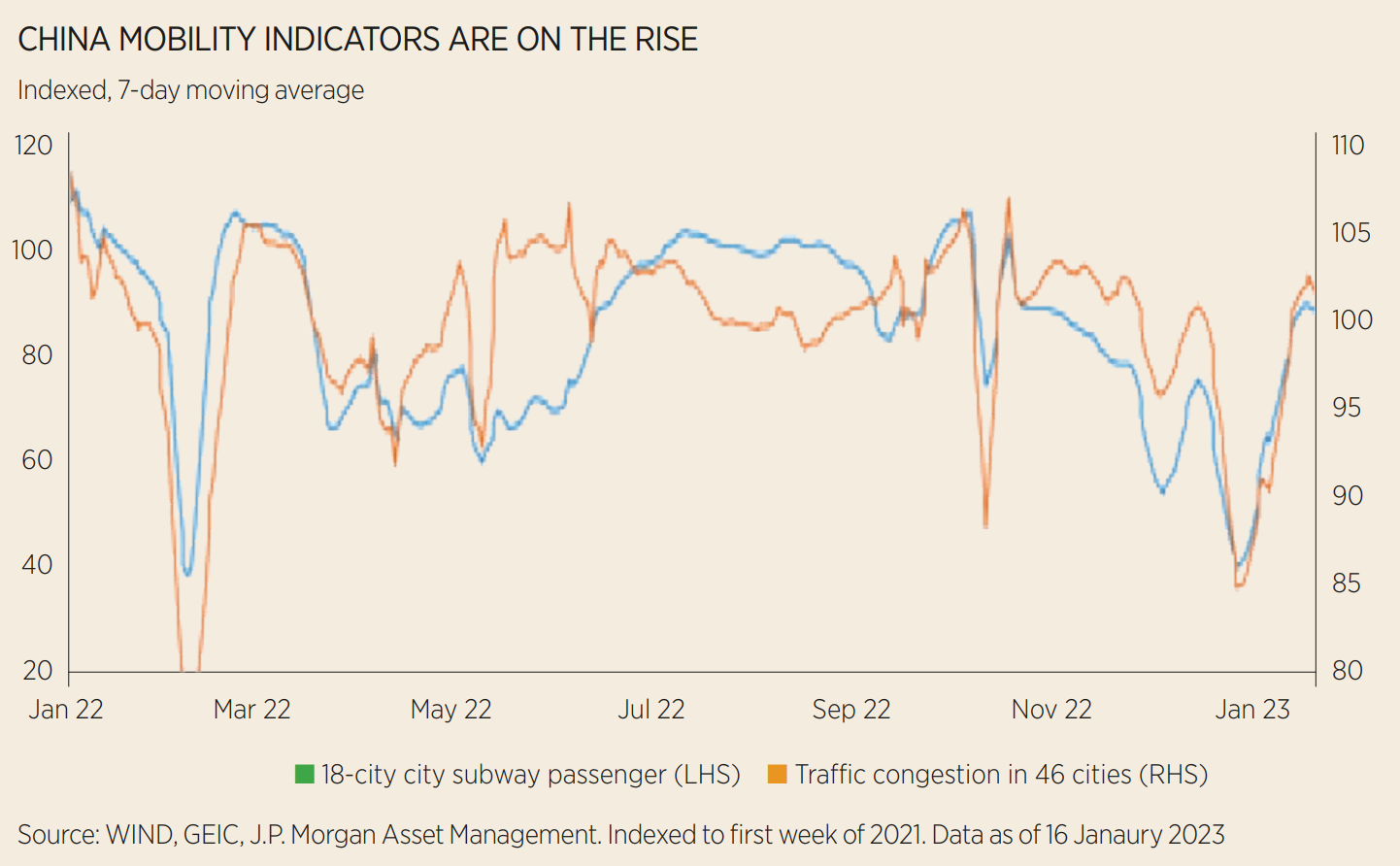

3. CHINA’S GROWTH OUTLOOK IS PROMISING AMID REOPENING: China’s reopening has been long-awaited after a tough 2022, and we think it will strongly boost the country’s macroeconomic trajectory and have wider benefits for Asia and EM. Overall, we see four pillars to China’s outlook: Geopolitics, growth versus value, regulations and macroeconomics.

4. EM VALUATIONS ARE ATTRACTIVE: EM valuations are near average levels at the aggregate, but individual countries offer an even greater opportunity. The dispersion between EM price-to-book ratios is significant, meaning regional and country approaches to EM can create further value.

5. EM EARNINGS EXPECTATIONS HAVE POTENTIAL TO GROW FROM A LOW BASE: The earnings outlook for EM is more positive than other regions in 2023, mostly because EM experienced earnings downgrades throughout 2022. Looking ahead, there is less potential for repeated downward revisions and in fact, there is likely upside in some sectors and countries due to China’s reopening.

EM earnings already took a hit. Throughout 2021 and 2022 EM EPS (earnings-per-share) were continuously being revised lower. Looking ahead into 2023, we expect a global growth slowdown. The fact that EM EPS expectations are much more conservative vs developed markets should hopefully mean fewer downside surprises when a slowdown occurs.

Conclusions

Many things have gone wrong recently for EM, particularly in 2022. However, 2023 is different.

We think the stars are finally aligning for EM equities: falling global inflation provides EM central banks room to cut aggressively, the US dollar is coming off its peak, China is reopening, valuations are attractive and EM earnings have some upside. Together, these factors create one of the best opportunities for EM equity investors in over a decade.

Active ETF investing in emerging markets

J.P. Morgan Asset Management offers active EM Research Enhanced Index ETFs for global emerging markets, Asia-Pacific ex-Japan and China A-Shares. Please contact your J.P. Morgan Asset Management contact for further details.

This article first appeared in ETF Insider, ETF Stream's monthly ETF magazine for professional investors in Europe. To read the full magazine, click here. This is a marketing communication. Please refer to the prospectus of the ETF and to the KID or KIID before making any final investment decision.

FOR PROFESSIONAL CLIENTS/ QUALIFIED INVESTORS ONLY – NOT FOR RETAIL USE OR DISTRIBUTION

This is a marketing communication and as such the views contained herein do not form part of an offer, nor are they to be taken as advice or a recommendation. The value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Past performance is not a reliable indicator of current and future results. There is no guarantee that any forecast made will come to pass. Investment decisions shall solely be made based on the latest available Prospectus, the Key Information Document (KID), any applicable local offering document and sustainability-related disclosures, which are available in English from your J.P. Morgan Asset Management regional contact or at www.jpmorganassetmanagement.ie. A summary of investor rights is available in English at https://am.jpmorgan.com/lu/investor-rights. J.P. Morgan Asset Management may decide to terminate the arrangements made for the marketing of its collective investment undertakings. Purchases on the secondary markets bear certain risks, for further information please refer to the latest available Prospectus. Our EMEA Privacy Policy is available at www.jpmorgan.com/emea-privacy-policy. This communication is issued in Europe (excluding UK) by JPMorgan Asset Management (Europe) S.à r.l. and in the UK by JPMorgan Asset Management (UK) Limited, which is authorised and regulated by the Financial Conduct Authority. In Switzerland, JPMorgan Asset Management Switzerland LLC (JPMAMS), Dreikönigstrasse 37, 8002 Zurich, acts as Swiss representative of the funds and J.P. Morgan (Suisse) SA, Rue du Rhône 35, 1204 Geneva, as paying agent. With respect to its distribution activities in and from Switzerland, JPMAMS receives remuneration which is paid out of the management fee as defined in the respective fund documentation. Further information regarding this remuneration, including its calculation method, may be obtained upon written request from JPMAMS.

Registered in England No. 01161446. Registered address: 25 Bank Street, Canary Wharf, London E14 5JP.

09bf231804085107