The return of inflation has marked a truly turbulent year for fixed income investors. Ongoing supply chain disruption, spiralling energy costs and tight labour markets have resulted in significant pricing pressures across much of the global economy.

Stubbornly high-cost inflation has forced central banks to aggressively tighten monetary policy. From January 2021, eleven developed market central banks have hiked rates 57 times between them resulting in a combined 2,700 basis points of interest rates increases, according to Bloomberg, as of 21 October.

The unprecedented pace of tightening has had significant knock-on effects on global credit markets, which have been forced to sharply reprice as underlying government bond yields have risen. The Bloomberg Global Corporate index has fallen 17% in 2022, according to Bloomberg as of 18 October, hedged to USD, on track for its worst year on record.

Fundamentals rolling over but valuations

Investment grade (IG) credit markets entered this downturn in a relatively robust position following a period of deleveraging since peaking just after the pandemic. As of June 30, 2022, US IG, gross leverage has fallen to 2.5x EBITDA (earnings before interest, taxes, depreciation and amortisation), below the pre-Covid level of 2.8x.

European companies have seen similar levels of deleveraging, falling to 2.5x EBITDA, its lowest levels since late 2017 (J.P Morgan Asset Management). Despite meaningful improvement in leverage ratios, deteriorating economic conditions and ongoing margin pressure has stalled further de-leveraging. This tougher economic backdrop and worsening credit fundamentals are reflected in current IG valuations. As of 17 October 2022, the option-adjusted spread (OAS) of US IG corporates had reached 164 basis points, implying a 50% probability of recession within the US (Bloomberg). Valuations in Europe are at even more elevated levels as investors look to factor in the ongoing energy crisis. European IG OAS are at 232 basis points, according to Bloomberg, as of 17 October, implying a 90% probability of a recession in the region.

However, overall yields are beginning to look historically attractive. The yield-to-worst on US IG corporates rose to 6.13% as of 19 October, its highest level since June 2006 (Bloomberg). While valuations are beginning to look historically attractive, investors need to have a plan for navigating potential downgrades in the coming quarters.

Dodging downgrades

During recessions, the biggest concern for credit investors is avoiding potential “fallen angels”, issuers that are downgraded from investment grade to high yield following a deterioration in their credit fundamentals. Having exposure to issuers that are transitioning from investment grade to high yield can often be highly disruptive for investors unfortunate enough to be holding onto the debt of downgraded companies, either via direct, active exposure or passive benchmark holdings. For example Ford, which underwent a downgrade to high yield in March 2020, saw spreads on its 10-year bond widen by 803 basis points between 3 March and 23 March 2020 (Bloomberg).

Ongoing central bank tightening and slowing growth may create more fallen angels.

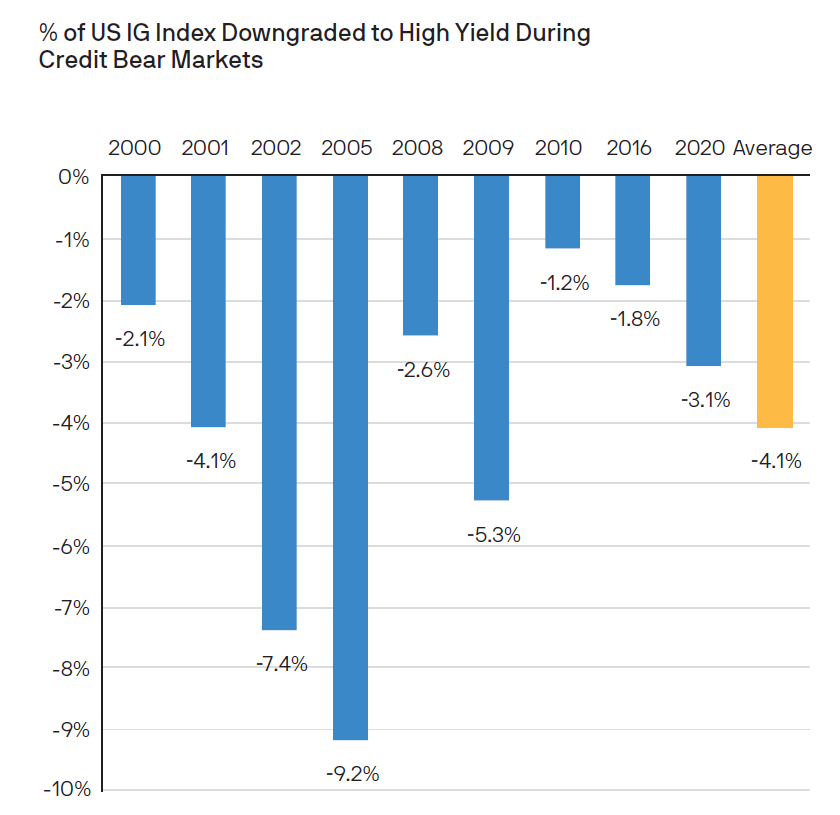

As the chart demonstrates since 2000 IG credit has undergone nine credit bear markets. Historically during credit bear markets, approximately 4% of the US investment grade universe has been downgraded to high yield. However, not all downgrade cycles are made equally. During more recent downturns in 2016 and 2020, the level of downgrades has been relatively muted as loose monetary policy and generous fiscal programmes have helped mitigate the impact on credit markets. In the coming downturn, the total number of downgrades may look closer to the long-run average of 4% as stubbornly high inflation prevents policymakers from significantly easing financial conditions, potentially leading to more downgrades.

Source: JPMAM, Barclays. Credit bear markets defined as periods where fallen angels outweigh rising stars by at least $5bn over a calendar year (2000, 2001, 2002, 2005, 2008, 2009, 2010, 2016, 2020).

The average is based on those years. Severe recession is mid to high single-digit EBITDA T12m YoY % deterioration at an index level. Opinions, estimates, forecasts, projections and statements of financial market trends are based on market conditions at the date of the publication, constitute our judgment and are subject to change without notice. There can be no guarantee they will be met.

Some active management can go a long way

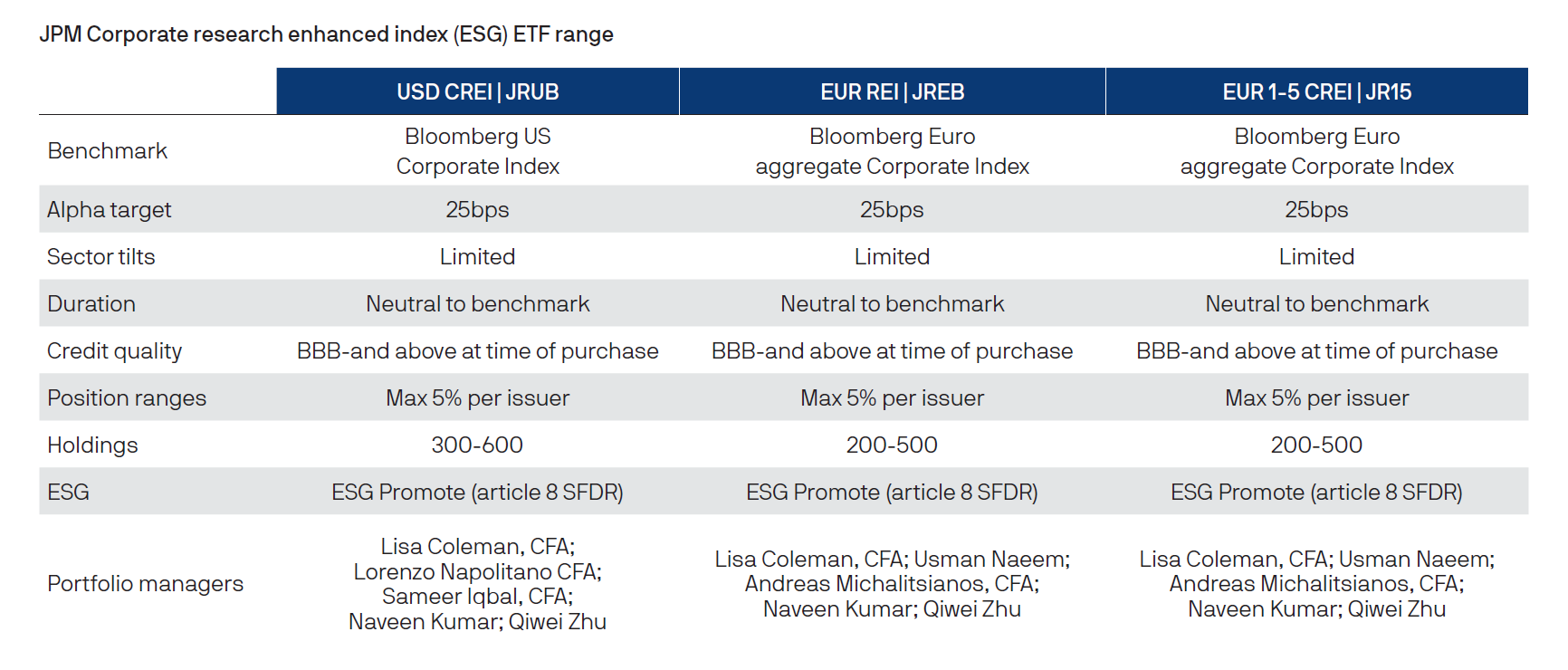

While challenging market conditions and the possibility of a heightened level of downgrades do present a problem for investors, a small amount of active management can go a long way in helping protect a portfolio from the disruption caused by falling angels. Our JPM Corporate Bond Research Enhanced Index (ESG) ETFs*,** (CREIs) focus on efficiently replicating the risk profile of the credit investment universe whilst adding value predominantly through security selection. By systematically incorporating our proprietary security rankings produced by our credit research analysts, we aim to tilt the portfolios towards issuers we believe will outperform away from those we think will underperform, particularly issuers at risk of being downgraded. This approach can help investors navigate these challenging markets by avoiding the losers rather than just picking the winners.

The CREI range includes three exposures investing in EUR, EUR 1-5yr and USD Corporate Bonds**. Our credit scoring approach incorporates financially material ESG considerations, social and governance (ESG) considerations into its assessment of individual issuers. The JPM Corporate Bond Research Enhanced Index (ESG) ETFs*,** are classified as Article 8 under the SFDR regulation, due to the exclusion of controversial industries and integrating financially material ESG factors throughout the investment process.

Find out more about EUR Corporate Bond Research Enhanced Index (ESG) UCITS ETF:

This is a marketing communication. Please refer to the prospectus of the ICAV and KIID before making any final investment decisions.

* FOR FRANCE ONLY: Investors should note that, relative to the expectations of the Autorité des Marchés Financiers JPM Global Emerging Markets Research Enhanced Index Equity (ESG) ETF present disproportionate communication on the consideration of non-financial criteria in its investment policy (Cette presentation convient aux investisseurs parlant couramment anglais).

** FOR BELGIUM ONLY Please note the acc share class of the ETF marked with an asterisk (**) in this page are not registered in Belgium and can only be accessible for professional clients. Please contact your J.P. Morgan Asset Management representative for further information. The offering of shares has not been and will not be notified to the Belgian Financial Services and Markets Authority (Autoriteit voor Financiële Diensten en Markten/ Autorité des Services et Marchés Financiers) nor has this document been, nor will it be, approved by the Financial Services and Markets Authority. This document may be distributed in Belgium only to such investors for their personal use and exclusively for the purposes of this offering of shares. Accordingly, this document may not be used for any other purpose nor passed on to any other investor in Belgium.

***Integrating financially material ESG factors into their usual forms of analysis to identify risks and opportunities in different investment, but without changing the investment objective or constraining the universe of potential investments. ESG determinations may not be conclusive and securities of companies/ issuers may be purchased and retained without limit by the investment manager regardless of potential ESG impact.

This is a marketing communication and as such the views contained herein do not form part of an offer, nor are they to be taken as advice or a recommendation, to buy or sell any investment or interest thereto. Reliance upon information in this material is at the sole discretion of the reader. Any research in this document has been obtained and may have been acted upon by J.P. Morgan Asset Management for its own purpose. The results of such research are being made available as additional information and do not necessarily reflect the views of J.P. Morgan Asset Management. Any forecasts, figures, opinions, statements of financial market trends or investment techniques and strategies expressed are, unless otherwise stated,

J.P. Morgan Asset Management’s own at the date of this document. They are considered to be reliable at the time of writing, may not necessarily be all-inclusive and are not guaranteed as to accuracy. They may be subject to change without reference or notification to you. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Changes in exchange rates may have an adverse effect on the value, price or income of the products or underlying overseas investments. Past performance and yield are not a reliable indicator of current and future results. There is no guarantee that any forecast made will come to pass. Furthermore, whilst it is the intention to achieve the investment objective of the investment products, there can be no assurance that those objectives will be met. J.P. Morgan Asset Management is the brand name for the asset management business of JPMorgan Chase & Co. and its affiliates worldwide. To the extent permitted by applicable law, we may record telephone calls and monitor electronic communications to comply with our legal and regulatory obligations and internal policies. Personal data will be collected, stored and processed by

J.P. Morgan Asset Management in accordance with our EMEA Privacy Policy www.jpmorgan.com/emea-privacy-policy. As the product may not be authorised or its offering may be restricted in your jurisdiction, it is the responsibility of every reader to satisfy himself as to the full observance of the laws and regulations of the relevant jurisdiction. Prior to any application investors are advised to take all necessary legal, regulatory and tax advice on the consequences of an investment in the products. Shares or other interests may not be offered to or purchased directly or indirectly by US persons. All transactions should be based on the latest available Prospectus, the Key Investor Information Document (KIID) and any applicable local offering document. These documents together with the annual report, semi-annual report, instrument of incorporation and sustainability-related disclosures, are available free of charge in English from JPMorgan Asset Management (Europe) S.à r.l., 6 route de Trèves, L-2633 Senningerberg, Grand Duchy of Luxembourg, your financial adviser or your J.P. Morgan Asset Management regional contact or at www.jpmorganassetmanagement.ie. A summary of investor rights is available in English at https://am.jpmorgan.com/lu/investor-rights. J.P. Morgan Asset Management may decide to terminate the arrangements made for the marketing of its collective investment undertakings. Units in Undertakings for Collective Investment in Transferable Securities (“UCITS”) Exchange Traded Funds (“ETF”) purchased on the secondary market cannot usually be sold directly back to UCITS ETF. Investors must buy and sell units on a secondary market with the assistance of an intermediary (e.g. a stockbroker) and may incur fees for doing so. In addition, investors may pay more than the current net asset value when buying units and may receive less than the current net asset value when selling them. In Switzerland, JPMorgan Asset Management (Switzerland) LLC, Dreikönigstrasse 37, 8002 Zurich, acts as Swiss representative of the funds and J.P. Morgan (Suisse) SA, Rue du Rhône 35, 1204 Geneva, as paying agent of the funds. JPMorgan Asset Management (Switzerland) LLC herewith informs investors that with respect to its distribution activities in and from Switzerland it receives remuneration which is paid out of the management fee as defined in the respective fund documentation. Further information regarding this remuneration, including its calculation method, may be obtained upon written request from JPMorgan Asset Management (Switzerland) LLC. This communication is issued in Europe (excluding UK) by JPMorgan Asset Management (Europe) S.à r.l., 6 route de Trèves, L-2633 Senningerberg, Grand Duchy of Luxembourg, R.C.S. Luxembourg B27900, corporate capital EUR 10.000.000. This communication is issued in the UK by JPMorgan Asset Management (UK) Limited, which is authorised and regulated by the Financial Conduct Authority. Registered in England No. 01161446. Registered address: 25 Bank Street, Canary Wharf, London E14 5JP.

LV–JPM53943 | 10/22 | 0969222810142138