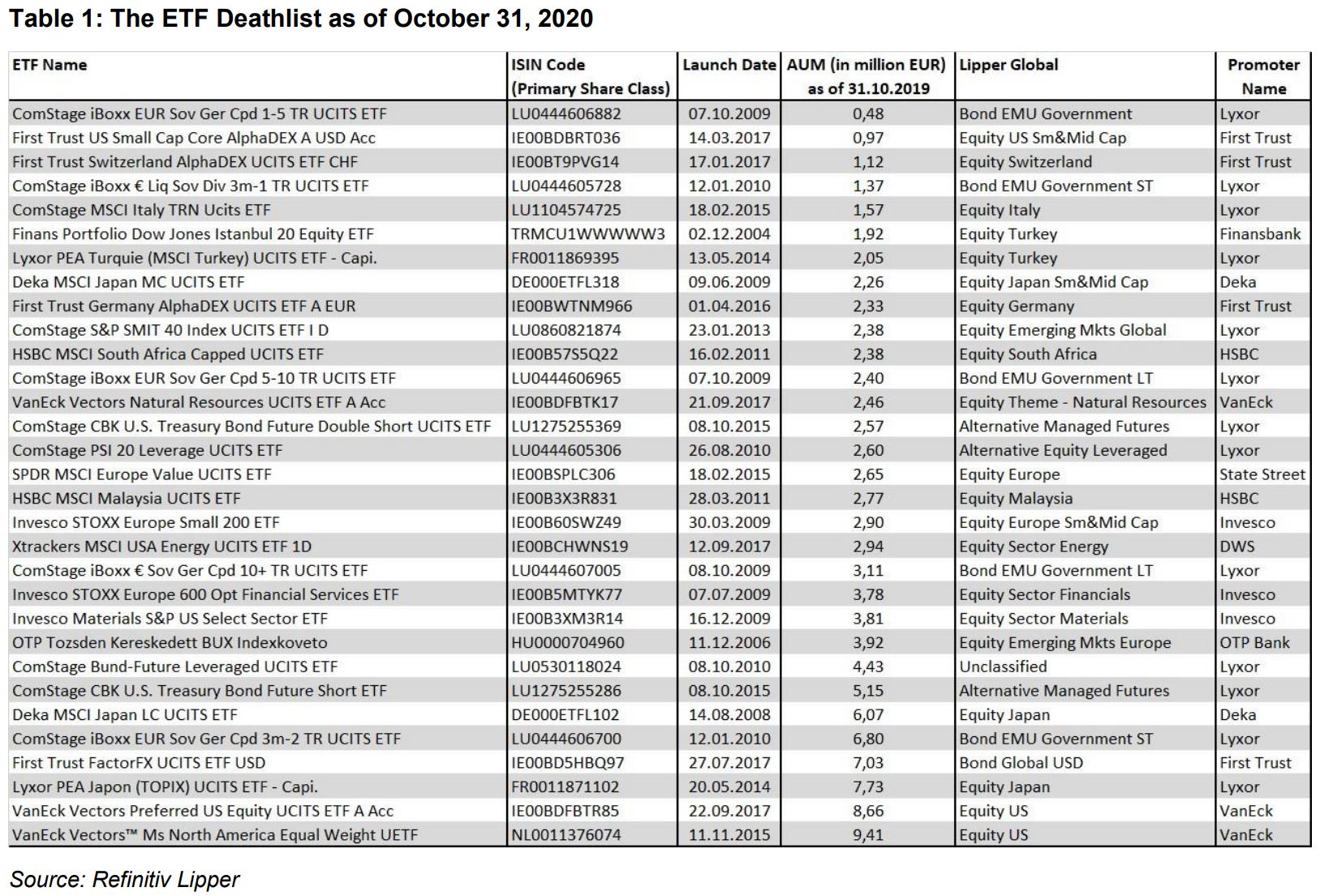

There are 31 ETFs in Europe at risk of closure over the next 12 to 18 months, according to research conducted by Refinitiv, as ETF issuers review their product ranges amid the tough market environment.

The 31 ETFs have been listed on Refinitiv’s ‘ETF Deathlist’ because they have failed to gather significant assets under management (AUM) over a sustained period of time.

To calculate the ‘ETF Deathlist’, Refinitiv removed all ETFs less than three years old and any ETF that had over €10m AUM, as at the end of October.

Of the 1,689 ETFs in the universe, just 88 ETFs were left. The final strategies were screened for a minimum threshold of €10m AUM at the end of every month over the past three years.

This left 31 ETFs, ranging from single-country to short-duration bond exposures, that have failed to gather more than €10m AUM at any point over the past three years.

Despite the small AUM, Detlef Glow, head of Lipper EMEA research at Refinitiv, who was named in ETF Stream’s Industry 30 2020, said not all the ETFs on the ‘ETF Deathlist’ were at risk of closure.

He explained ETF issuers may keep a strategy running because they want to be a one-stop shop for clients or to maintain a presence in a market.

Furthermore, some short and leveraged strategies do not require high AUM to be profitable due to the high trading activity involved.

Finally, Glow pointed to product overlap between Lyxor and ComStage ranges following the completion of the merger last year as a reason why a number of ComStage ETFs were included on the list.

“One needs to take into account that this list does only show the smallest ETFs in the European ETF industry,” Glow continued. “This, however, does not mean that any of the other products may not be at risk for a closure, because even larger ETFs may not fulfil the profitability expectation of the respective promoter.”

ETFs in Europe closing at record pace as issuers struggle to attract assets to new products

This was highlighted by Vanguard earlier this week when it announced plans to close four active factor ETFs next February which have a total of $367m AUM.

Glow concluded: “Despite the higher number of ETF closures in 2020 so far, I would not speak about a consolidation, as the European ETF industry was always very innovative and not all ETFs launched may meet investors’ demand or risk appetite. Because of that, they will be closed.”