S&P Dow Jones Indices (SPDJI) has revealed Tesla will not be an automatic addition to the ESG version of its flagship S&P 500 index highlighting the wide divergence in ESG scoring methodologies between the different index providers.

The electric vehicle manufacturer joined the S&P 500 to much fanfare on 21 December taking the fifth-largest weighting in the index, however, it may not meet the scores required for inclusion in the S&P 500 ESG index.

The criteria for inclusion is based on Tesla’s SPDJI ESG score which is derived from SAM’s – a part of S&P Global – yearly corporate sustainability assessment (CSA).

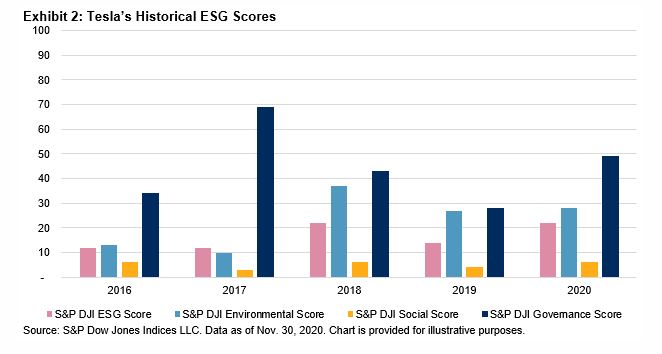

In 2020, Tesla had an SPDJI ESG score of 22 out of 100, up eight points from the previous year’s score.

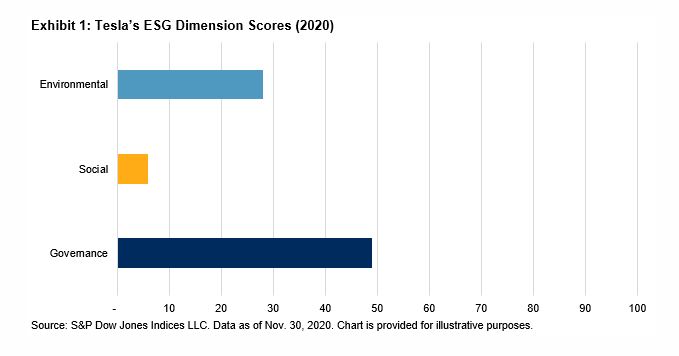

Diving a bit deeper, the company had an environmental score of 28, a social score of 6 and a governance score of 49, which was up 21 points from 2019.

Daniel Perrone, head of operations, ESG indices, at SPDJI, explained the low environmental score for Tesla was driven by its low scoring in the environmental reporting, climate strategy and environmental policy and management systems sections.

“Many may be surprised to see such a low overall ESG score (and environmental score) for Tesla, given its focus on electric vehicles,” Perrone continued.

“Specialising in ‘green’ products, however, does not automatically ensure that companies will score well from an overall ESG perspective.”

For Tesla to be included in the S&P 500 ESG index, which rebalances at the end of April, it will have to score well on an absolute and relative basis.

The index’s methodology means the bottom 25% of companies in each GICS industry are screened out. Subsequently, companies are ranked by their ESG score within the S&P 500 and then selected from the top down to get as close as possible to 75% of the industry group’s original market cap.

All eyes will be on SPDJI at the end of April especially in Europe with demand for this strategy developing at a rapid rate.

UBS Asset Management and Amundi own the largest ETFs with this exposure, the $1.4bn UBS S&P 500 ESG UCITS ETF (5ESG) and the $1.4bn Amundi S&P 500 ESG UCITS ETF (S500), which was switched from the firm’s physically-replicated S&P 500 ETF in October.

Product Panel: UBS S&P 500 ESG ETF

Invesco also offers this index to investors in Europe through the Invesco S&P 500 ESG UCITS ETF (SPXE).

Elsewhere, State Street Global Advisors (SSGA) launched the SPDR S&P 500 ESG Screened UCITS ETF (500X) last year which tracks the S&P 500 ESG Exclusions II index.

This index simply excludes companies involved in controversial weapons, tobacco products, small arms, and thermal coal so Tesla has been added and currently has a 2% weighting, as of 7 January.

Perrone concluded: “Will Tesla become a member of the S&P 500 ESG index? Next April, we will know. The index has no early-entry rule that would afford Tesla extra privileges; it will be treated the same as any other company.”