Access to alternative asset classes is becoming increasingly easy with the rising number of ETFs giving access to the space. There are now over twenty alternative ETFs on the London Stock Exchange. But what benefit do they offer?

The number of ETFs available has really increased in the last year with JP Morgan offering a slew of products in the middle of last year.

Alternative ETFs track indices covering a range of assets including private equity, real estate, commodity funds, hedge funds, and long/short strategies, among others.

They are essentially non-traditional assets. But until recently, access to these assets has been difficult and/or expensive. If you want to get into a hedge fund you have to pay a minimum amount, with ETFs this isn't the case. Similarly, investing in private equity often requires a minimum amount. Often your money is tied up for several years and you may have less information on your investment than you're used to.

ETFs have made the historically difficult to access space more open, transparent and liquid. These ETFs in particular also help with diversification, dampen volatility and provide access to non-traditional markets.

So, why invest in them now?

The idea is that they display different return characteristics to equities and bonds. If markets start downward trending, then you want something in your portfolio that can potentially act as a buffer.

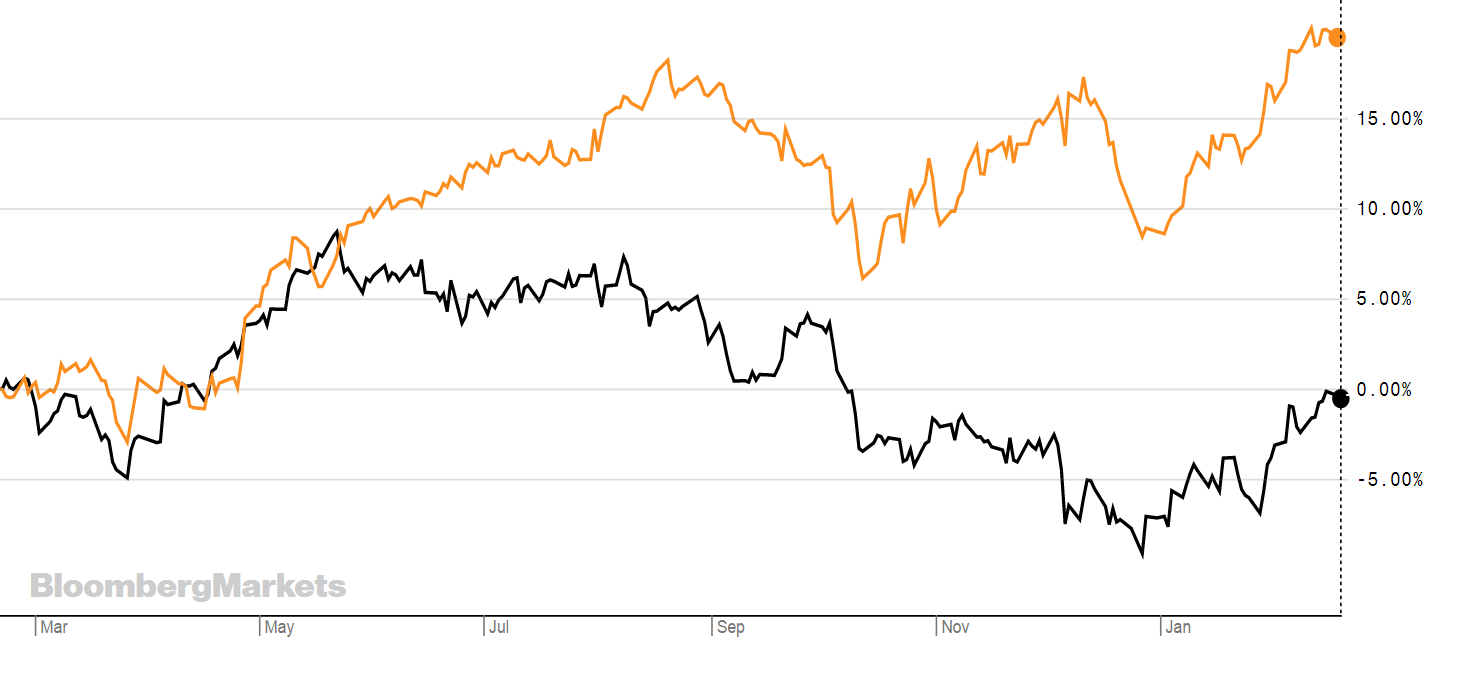

The graph below shows the FTSE 100 (in black) over the last year compared to Amundi's Index FTSE EPRA NAREIT Global Ucits ETF (EPRA) in orange over the same time horizon.

Source: Bloomberg

This year is predicted to be more volatile than previous years.

FT Adviser wrote earlier this week: "Today, the uncertainty inherent in investment flows, in forecasts by economists and financial analysts, and in investor perceptions, is back in town - bringing with it a higher level of average market volatility."

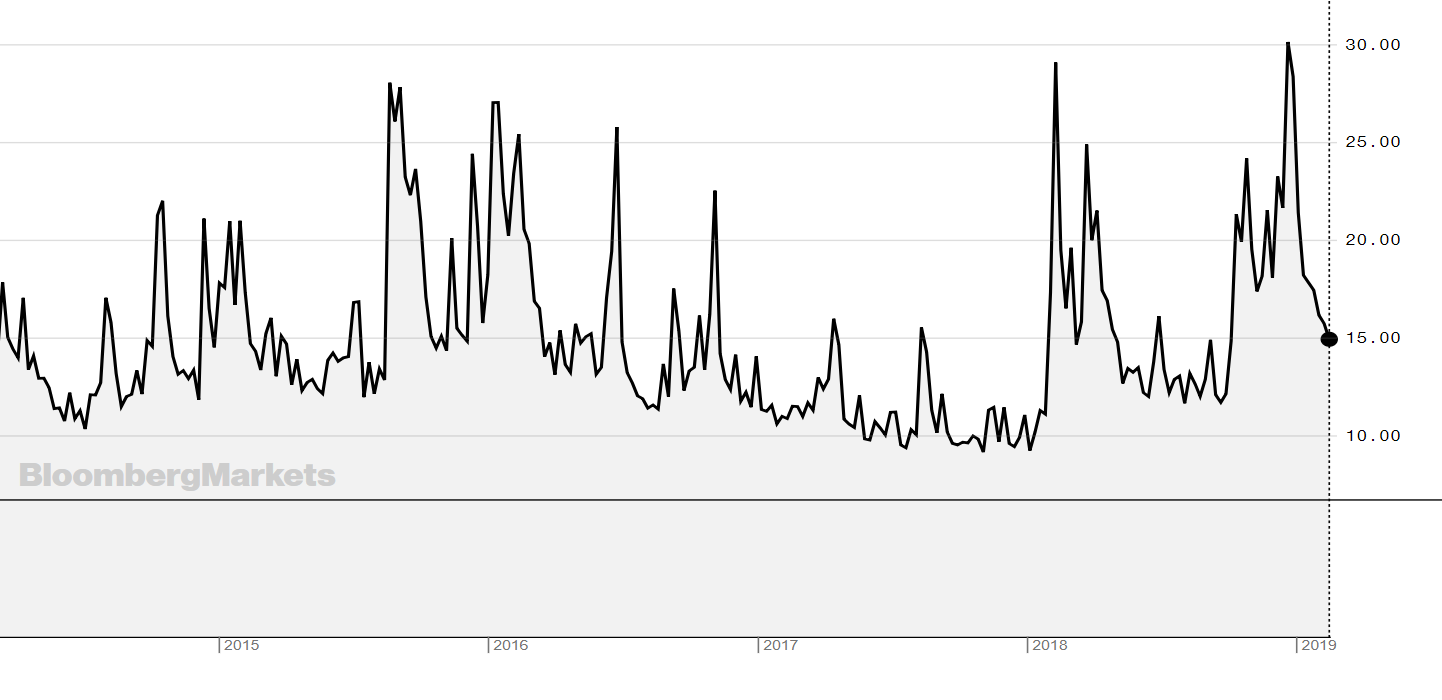

The VIX (a measure of implied volatility) is currently sitting at around 15.32. That's relatively high for the last few years and the graph below shows what it looks like now compared to the past five years. It also shows volatility hitting its highest level at the end of 2018 in the last five years.

Source: Bloomberg

Alternatives can help act as a diversification tool in times of volatility.

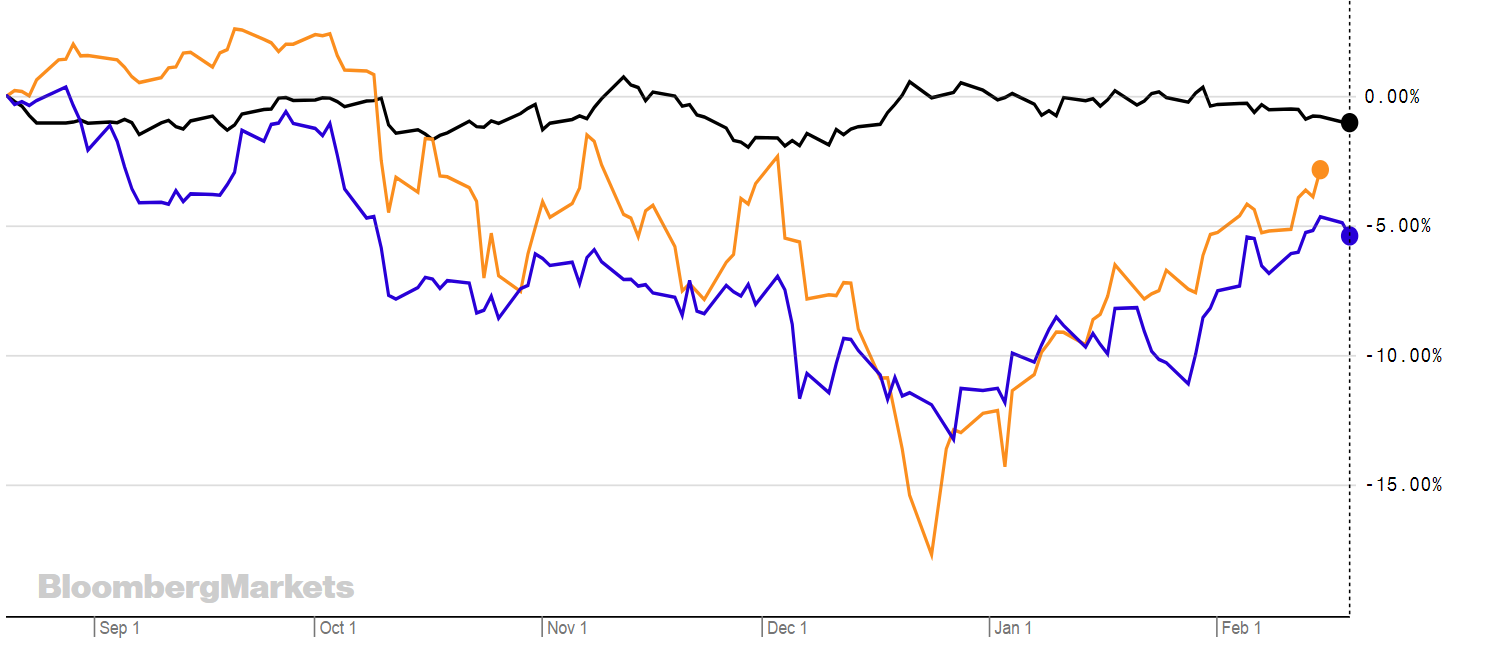

For example, the chart below shows the JPMorgan Equity Long-Short UCITS ETF (JELS) in black compared with the S&P 500 index (in orange) and the FTSE 100 (in purple). While there hasn't been huge uptick it remained fairly steady during the bouts of volatility. Its strategy exploits price inefficiencies between global developed market equity securities by maintaining long and short positions in respect of equity securities, based on a systematic investment process.

This type of strategy would typically only be available to high net worth individuals through a hedge fund, it would also have a minimum investment amount and investors are typically tied in for a certain time period. However, the ETF - launched last year - gives investors access to the strategy and returns but with more flexibility and no minimum investment amount. In terms of the hedge fund market performance, data from BarclayHedge shows that hedge funds started the year well with the Barclay Hedge Fund Index climbing 3.88% and all 31 indices in the BarclayHedge hedge fund universe posting positive results in the first month of the year.

The cost is also not as high as it would be accessing these sectors directly.

Below is a non-exhaustive list of the available alternative ETFs on the London Stock Exchange.

ETFTER3m RTNIndexXtrackers LPX Private Equity Swap UCITS ETF

XLPE0.50% (m'ment fee)

0.7% (expense ratio)1.65%LPX Major Market Total Return IndexiShares Listed Private Equity UCITS ETF USD Dist

(IDPE)0.75%3.60%S&P Listed Private Equity IndexiShares Listed Private Equity UCITS ETF USD Dist

(IPRV)0.75%2.83%S&P Listed Private Equity IndexFirst Trust Indxx Innovative Transaction & Process UCITS ETF (BLOK)0.65%2.86%Indxx Blockchain IndexHSBC FTSE EPRA/NAREIT Developed UCITS ETF

HPRO0.40%5.49%FTSE EPRA/NAREIT Developed IndexHSBC FTSE EPRA/NAREIT Developed UCITS ETF

HPRD0.40%6.26%FTSE EPRA/NAREIT Developed IndexAMUNDI INDEX FTSE EPRA NAREIT GLOBAL UCITS ETF

EPRA0.24%5.56%FTSE EPRA NAREIT GLOBAL IndexAmundi Ftse Epra Europe Real Estate UCITS ETF

EPRE0.35%0.42%FTSE EPRA/NAREIT Developed Europe IndexiShares UK Property UCITS ETF

IUKP0.40%1.33%FTSE EPRA/NAREIT UK IndexiShares Developed Markets Property Yield UCITS ETF

DPYA0.59%6.29%FTSE EPRA/NAREIT Developed Dividend+ IndexSPDR FTSE EPRA Europe EX UK Real Estate UCITS ETF

EURL0.30%0.23%Listed real estate market in Europe excluding the UKSPDR FTSE EPRA Europe EX UK Real Estate UCITS ETF (€)

EURE0.30%1.79%Listed real estate market in Europe excluding the UKLYXOR Scientific BETA Developed Long/Short UCITS ETF USD Acc

MFLS0.55%0.67%Scientific Beta Multi-Beta Multi-Strategy Managed Volatility L/S Equity Market Neutral (x 3.5) IndexJPMorgan ETFs ICAV - Managed Futures UCITS ETF (GBP Acc Hedged)

JMFP

0.57%0.41%The objective of the Sub-Fund is to seek to provide long-term total return through a portfolio of long and short exposures to multiple asset classes across global markets.JPMorgan ETFs ICAV - Managed Futures UCITS ETF (EUR Acc Hedged)

JMFE0.57%0.07%The objective of the Sub-Fund is to seek to provide long-term total return through a portfolio of long and short exposures to multiple asset classes across global markets.JPMorgan ETFs ICAV - Managed Futures UCITS ETF (USD Acc Hedged)

JPMF

0.57%0.89%The objective of the Sub-Fund is to seek to provide long-term total return through a portfolio of long and short exposures to multiple asset classes across global markets.JPMorgan ETFs ICAV - Managed Futures UCITS ETF (USD Acc Hedged) GBP

JPFM

0.57%0.17%The objective of the Sub-Fund is to seek to provide long-term total return through a portfolio of long and short exposures to multiple asset classes across global markets.JPMorgan Equity Long-Short UCITS ETF

JLSE0.67%-1.81%The Fund seeks to achieve its investment objective by exploiting pricing inefficiencies between global developed market equity securities by maintaining long and short positions in respect of equity securities, based on a systematic investment processJPMorgan Equity Long-Short UCITS ETF

JLSP0.67%-1.31%The Fund seeks to achieve its investment objective by exploiting pricing inefficiencies between global developed market equity securities by maintaining long and short positions in respect of equity securities, based on a systematic investment processJPMorgan Equity Long-Short UCITS ETF

JELS

0.67%-1.15%The Fund seeks to achieve its investment objective by exploiting pricing inefficiencies between global developed market equity securities by maintaining long and short positions in respect of equity securities, based on a systematic investment processJPMorgan Equity Long-Short UCITS ETF

JLES

0.67%-1.86%The Fund seeks to achieve its investment objective by exploiting pricing inefficiencies between global developed market equity securities by maintaining long and short positions in respect of equity securities, based on a systematic investment processLyxor EUR 2-10Y Inflation Expectations UCITS ETF

INFL0.25%-3.53%Markit iBoxx EUR Breakeven Euro-Inflation France & Germany Index Nominal_TRI.

Lyxor USD 10Y Inflation Expectations UCITS ETF

INFU0.25%-1.71%Markit iBoxx USD Breakeven 10-Year Inflation Index Nominal_TRILyxor USD 10Y Inflation Expectations UCITS ETF

INFG0.25%-2.33%Markit iBoxx USD Breakeven 10-Year Inflation Index Nominal_TRISource: Morningstar & Bloomberg