This article is paired with Australia's best ethical Australian shares ETF.

Environmental and social governance investing (ESG) has become increasingly popular. ESG investors want to be more selective about which companies they invest in. And think fund managers should care about things other than just performance when selecting stocks.

Australia has three main ESG ETFs that invest in global shares. They are:

TickerFund NameAUM ($mln)ETHIBetaShares Australian Sustainability Leaders ETF$986.71ESGIVanguard Ethically Conscious Australian Shares ETF$53.30VESGVanEck Vectors MSCI Australian Sustainable Equity ETF$151.79

But what are the differences between them? And what should investors know?

Investment strategies

Vanguard Ethically Conscious International Shares Index ETF (VESG)

VESG is a near clone of Vanguard's popular global shares index fund (VGS). It buys global shares on a market weighted basis that pass through a basic ethical screen. The screen excludes companies in fossil fuels, alcohol, tobacco, gambling, weapons, nuclear power and adult entertainment (pornography). The result is a fund that – by design – maintains a tight correlation to the global share market.

BetaShares Global Sustainability Leaders ETF (ETHI)

ETHI was the trailblazer for Australian ethical ETFs and is co-piloted by Future Super, the superannuation fund founded by former Canberra Greens Party candidates.

Future Super provides ETHI with a substantial chunk of its assets under management. ETHI starts with the same ethical exclusions as VESG (alcohol, tobacco, etc.). It then removes companies lacking boardroom gender diversity, that run detention centres, have "supply chain issues” or heavy carbon footprints.

Meanwhile, companies that produce renewable energy get boosted. The 200 biggest companies that pass through the filters are selected by market capitalisation.

ETHIESGIVESGStock selectionRevenue purity, Market capESG filtered, Market capRevenue purity, Market capStock weightingMarket cap, individual companies capped at 4%Market capMarket cap, individual companies capped at 5%Inception dateJan 2017Mar 2018Sep 2018Fund rebalance frequencyAnnually, following committee meetingQuarterlyQuarterlyInvestment committee oversightYes, meets annually, includes Future SuperNoNo

VanEck Vectors MSCI International Sustainable Equity ETF (ESGI)

ESGI begins with similar exclusions to VESG - but with a deeper focus on excluding carbon emitters.

It then applies a positive screen, which involves scoring companies on a constellation of issues, including: labour standards, supply chain management, animal cruelty, opportunity for women, environmental standards – and more. Companies with the highest scores in their sector are included and weighted by market capitalisation.

The end result is that Germanic and Scandinavian businesses get a heavy presence in the index while American companies get less.

Angels and demons: what counts as ethical?

The ethical screens that the funds all run are very different.

Study: ethical ETFs promote job killing companies

VESG’s ethical screen does little legwork compared with its peers. Almost all the exclusions are of alcohol, tobacco and fossil fuel companies. There are very few weapons manufacturers in the top 1,800 largest global companies. And only a handful of gambling and casino companies.

ETHIESGIVESGUnionsNo policySome vetting, such as around workplace fatalities and labour disputesNo policyDiversityExcludes companies with no women on board of directorsCompanies with less diversity can receive lower scoresNo policySupply chain managementWorst offenders excludedSome vetting, but no explicit exclusion criteriaNo policyAnimalsAnimal cruelty companies removedNo policyNo policyWater, environmental conservation, pollutionWorst environment destroyers removedWorst environment destroyers removedNo policyFossil fuelsFossil fuel producers and major financiers both removedFossil fuel producers and big consumers both removedFossil fuel producers removedCarbon efficiencyCompanies ranked on emissions per dollar of revenueCompanies ranked on emissions per dollar of market capitalizationNo policyRenewable energyRenewable energy companies boostedRenewable energy companies get higher scoresNo policy

ETHI runs sector exclusions too but casts a wider net than VESG. The crux of its exclusions relate – but are not by any means restricted to – global warming.

However, the fund does not use comprehensive positive screening, meaning there is less scope for vetting. This can mean that companies that some would tip as unethical – like UnitedHealth, the villain of the Bernie Sanders campaign – get in because they dodge the negative screens.

Future Super sit on the fund’s investment committee and can help steer the investment strategy. (The index changed considerably in May 2020).

The oversight has the benefit of ensuring the fund evolves. But a hands-on committee can have drawbacks if it subjects investors to what appear to be sudden and unexpected changes. One such change was the dumping of Facebook in 2018 after the Cambridge Analytica revelations.

ESGI uses both positive and negative screens. The fund outsources the role of Saint Peter to index provider MSCI. How MSCI compiles its research data, judges right from wrong, and applies scores, is not explained in the index documents. (Here and here).

My reading elsewhere lends me to believe MSCI uses surveys which are sent out to publicly traded companies. The survey results are then put into a spreadsheet.

Regardless of the index's methods, the use of positive screens means vetting is comprehensive. ESGI ends up holding a portfolio that looks very different from the broad market.

Performance and dividends

The three funds are relatively new. This makes comparing their returns difficult. Making return comparisons more difficult still is the fact that many ethical investors are not purely motivated by returns.

ETHIESGIVESG1-Year 22%2%8%3-Year19.7%n/an/aHistorical yield1.1%1.60%1.6%Distribution frequencySemi-annualAnnualQuarterlyMedian market capitalisation ($bln)$134$67$136Number of securities2001851600

Nonetheless, ESGI and VESG have performed similarly to date. The similar performance comes despite the two funds holding very different stocks. The difference is most rendered most obvious by looking at the different country tilts.

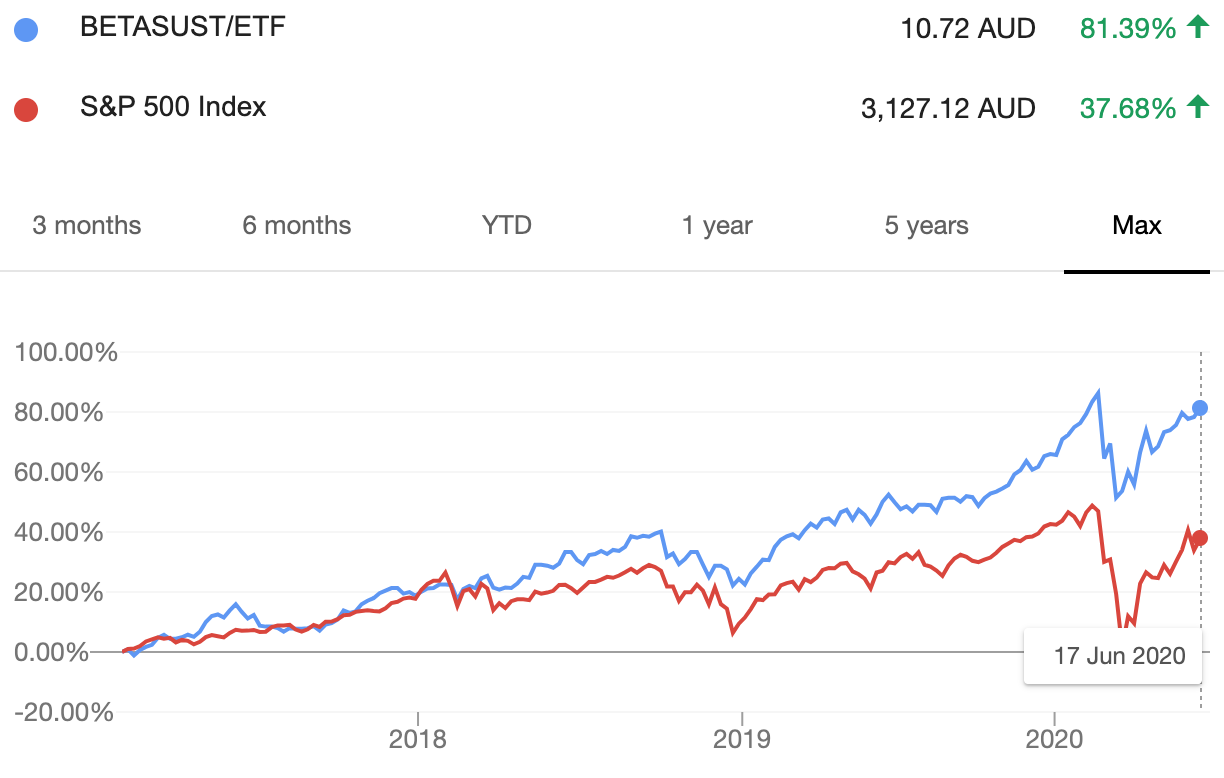

ETHI for its part has been a stellar performer, crushing both the other two ETFs and the benchmark. Why? From what I can tell a lot owes to the fact that ETHI ends up with a tech tilt, thanks to its ESG filters.

Among the best performers in its portfolio over the past year appear to have been Tesla and Nvidia.

BetaShares ETHI has crushed the index

Dividends for ethical funds are usually lower than they are for the broad market. One suspects they will remain lower as fossil fuel businesses and the sin stocks – gambling, alcohol, tobacco – are among the best dividend payers. In my opinion, this is the wrong type of fund for yield-conscious investors.

Fees

VESG is the cheapest of the ETFs. It cheaper still once indirect costs – which include things like the transaction costs the fund pays – are factored in.

Fees and costsETHIESGIVESGManagement fee0.59%0.55%0.18%Operational costs0.15%0.09%0.05%All-in expense ratio0.74%0.64%0.23%

ETHI and ESGI, by contrast, are not cheap at all. There are some mitigating factors. These include the fact that these types of fund do not hit the scale that broad market global shares ETFs do. And the fact that index license fees are higher.

However, the index license fees are not *that* much higher and ETHI has hit scale.

Liquidity and spreads

In theory, the cost of trading an ETF is a function of three things:

Trading volume of the ETF

Trading volume of its underlying assets

Trading volume of proxies

ETHI is typically the most traded of the three funds. For this reason, it tends to be cheaper (“more liquid”) to trade than ESGI.

Trading data October 2020ETHIESGIVESGAverage daily trading volume $2,956,213$173,659 $599,274ASX buy-sell spreads0.16%0.27%0.12%Average 52 week premium0.11%0.39%0.13%

VESG however is usually the cheapest of the three to trade. This is due to point 3. Because VESG is built so that it correlates closely with the market, it is easier to find proxies. To cut a long story short, when proxies are easier to find, it is easier for market makers – who work with the ETF providers and control most ETF trading on the ASX – to give investors a cheap ride.

Conclusion

There are both positive and negative things you can say about all three of these funds. The negative: ESGI and ETHI are expensive. ETHI has the additional peculiarity of Future Super sitting on the investment committee, as a potentially unwanted presence for outside investors. While VESG, for its part, has threadbare ethical criteria that will leave many underwhelmed.

On the positive side, ESGI and ETHI are examples of brave product building. ETHI got wheeled out when there was no good evidence that a market for this type of product existed. Its emphasis on renewable energy is also commendable and so is its recent performance.

ESGI – to me – holds a portfolio that mostly closely resembles what most investors have in mind when it comes to ethical investing.

VESG, for its part, is very cheap and because it hugs the index it is unlikely to underperform it.

Sign up to ETF Stream’s weekly email here