Moorgate Benchmarks has called for “revolution” in the index provider industry amid the unchallenged dominance of the “big four”.

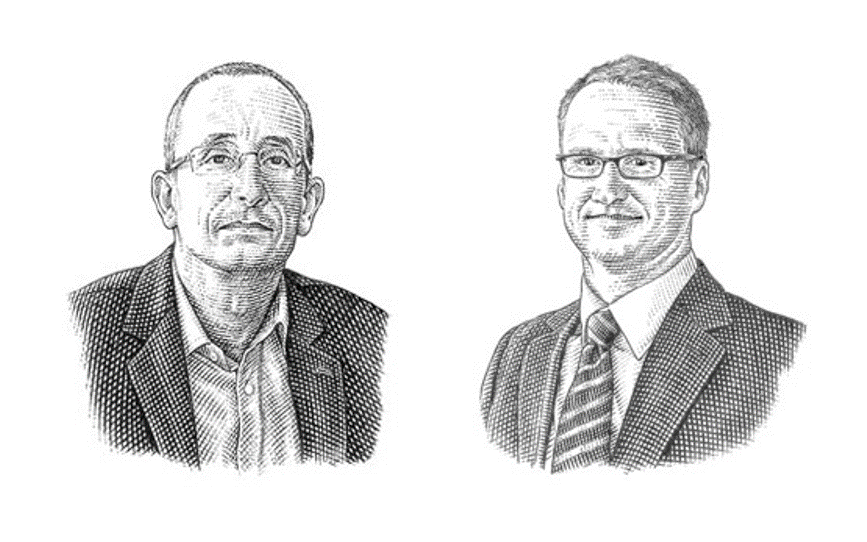

Moorgate Benchmarks’ chief indexing officer Gareth Parker (pictured left) and CEO Tobias Sproehnle (pictured right) warned FTSE Russell, S&P Dow Jones Indices, MSCI and Bloomberg were “stifling” innovation among product providers which in turn has limited end investor choice.

The reason for this, the duo said, is the major index providers have been extracting fees from their clients “that exceed the true value of the services they provide, simply because they can”.

“Creativity is being stifled. It is becoming increasingly difficult for product providers to source high quality, bespoke and optimised indices swiftly unless they embrace self-indexing or have sufficient scale to influence one of the big index providers.”

It has been well documented the dominance of the “big four”, which control around 80% of the market, and the high fees they charge clients.

While fees on ETFs listed in Europe have fallen 32% on average across all asset classes, according to data from Ultumus, the fees charged by major index providers have “barely declined”.

“The world of indexing has the potential to be truly innovative but the current makeup of the market is preventing providers from creating products that deliver true choice for investors.

“Sadly, these practices are going unchallenged due to the sheer magnitude of their market share,” the duo bemoaned. “This underscores exactly why evolution is no longer good enough. We need revolution.”

Index provider disruptor launches

While the duo said there is no single silver bullet to address their dominance, there are other areas of financial services the industry can learn from where innovation has been leveraged to “huge advantage”.

Sproehnle and Parker, who co-founded FTSE, referenced research from the Confederation of British Industry and Oracle, which found if businesses adapt to new technology and innovate it could add up to $100bn to the UK economy.

“Getting rid of the old to nurture the new is no effortless task, particularly in an era of unprecedented geopolitical upheaval.

“We want to enable innovation and deliver true choice,” they continued. “To help create a market in which the rules are not made by a handful of behemoths rooted in an antiquated world.”