Single-country exposures might be one of the less glamourous ways to play emerging markets but Brazil ETFs have undoubtedly put the product class in the limelight so far this year.

There are a dizzying number of different ways to slice the market – by factor, geography, sector, theme and ESG – but returns above 40% throughout the range of Brazil ETFs in Europe last quarter is a standout performance that puts all other equity exposures to shame.

While broader Latin America ETFs in Europe also returned over 30% over the same period, it is worth noting their most popular benchmark, the MSCI EM Latin America index, is weighted almost two-thirds to Brazil equities alone.

Other constituents also look far less favourable. For instance, Mexico’s weighting in the broader MSCI emerging market index has been cut by three quarters over the last 15 years while Argentina has been removed from MSCI’s Latin America index altogether.

However, investors should not be entirely blown away by Brazil’s strong start to the year, despite its relative strength within its home region.

In an environment of soaring inflation, strained resource supplies and an energy crisis, it no shock that ETFs tracking the MSCI Brazil index are outperforming, given its aggregate weighting of more than 42% to materials and energy. Likewise, its 25.4% to financials puts it in a position of relative strength amid interest rate hikes.

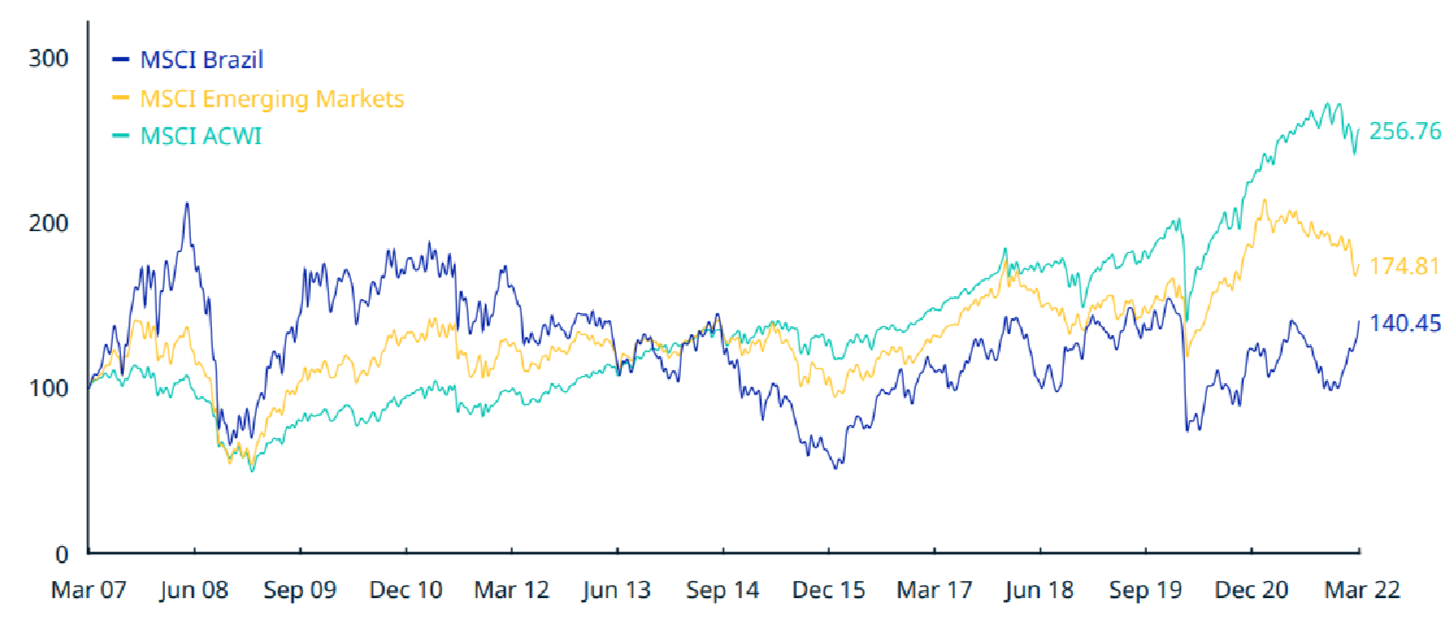

Like all country plays, Brazil equities have strong correlations with certain factors and sectors. Its overlap with value and cyclicals has not served it well over the past 15 years but only time will tell whether this will change in a world with less accommodative monetary policy.

Source: MSCI

Stop ESG-washing regular products?

As with all new trends, there is an unfashionable chorus of investors resisting the seemingly unrelenting tide of environmental, social and governance (ESG). But is this opposition now gaining volume?

Following an extraordinary general meeting (EGM) in early April, BlackRock only gained approval for one of the two products it had proposed to switch to tracking ESG indices. Its euro corporate bond will now join two of its sector ETFs which also did not get the green light for ESG conversion earlier this year.

However, rather than a show of defiance by investors, it was suggested the failure to secure the votes for this particular ESG switch owes to an administrative error regarding the delivery of voting forms.

Nonetheless, it is not the first time an ESG overhaul has failed to pass and it will unlikely be the last. Many investors want simple, market cap-weighted beta as a way of ‘owning the market’ of any given exposure. Replacing this with an ESG overlay would redefine the parameters and outcomes of passive index investing.

UK government gestures at crypto acceptance

This week the UK government announced it would move to regulate stablecoins, commission a non-fungible token (NFT) and make a concerted effort to research and collaborate with the crypto industry while finding ways to make the UK tax system more appealing to crypto participants.

The issue is this is more a game of catch-up than acceptance, with the UK looking for ways to remain at the cutting edge of finance – having spent the years leading up to 2021 either sceptical or critical of crypto assets.

Also, neither the government nor the Financial Conduct Authority (FCA) has yet said anything about reversing the ban on UK retail investor access to crypto exchange-traded products (ETPs).

Having been banned for being too complex, crypto ETPs are no more conceptually challenging than any other ETP-wrapped asset class. In fact, their most notable trait is the fact investors can trade and own them like they would an equity, with key encryption, custody and managing wallets all handled by product issuers and brokers.

ETF Wrap is a weekly digest of the top stories on ETF Stream

Related articles