S&P Dow Jones Indices (SPDJI) has removed a number of thermal coal companies from the S&P 500 ESG index following a market consultation.

The index will now remove any company that has more than 5% of its revenues deriving from thermal coal.

As a result, the final 11 of the 17 thermal companies within the S&P 500 have been removed from the ESG-equivalent index following an “extraordinary” rebalance on 21 September. The other six thermal companies had already been excluded due to existing criteria.

The firm said the decision to exclude thermal coal companies will not have a material impact on the risk-return profile of the index.

SPDJI data shows the tracking error of the ESG index versus the S&P 500 between the 2019 and 2020 annual rebalances was 1.08%. Back-tested results show this would have been 1.11% if the new 5% thermal coal exclusion rule was in place.

Mona Naqvi (pictured), senior director, head of ESG product strategy, North America, at SPDJI, said this was one of the key reasons for implementing the change.

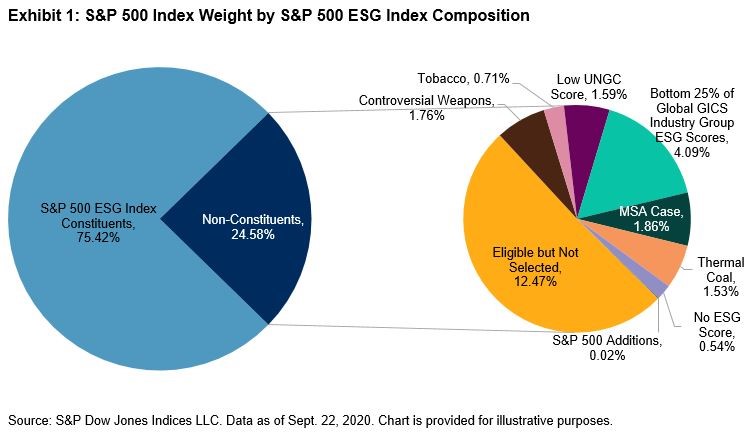

Some 299 constituents now make-up the S&P 500 ESG index following the rebalance with 78 of the remaining companies in the S&P 500 ineligible and the other 125 deemed eligible but not selected due to relatively poorer ESG scores.

SPDJI’s Navqi said thermal coal had not been considered alongside controversial weapons and tobacco when the index was launched as a type of business investors deemed “unacceptable”.

However, Naqvi added: “Just over 19 months [since launching the index], the landscape has evolved to a point at which thermal coal companies may now be counted among this lowest common denominator of ‘unsustainable’ investments.”

The move to incorporate stricter sustainable measures will likely be welcomed by ESG investors exposed to this index.

There are three ETFs in Europe that track the S&P 500 ESG index. UBS Asset Management was the first to market in April 2019 with the launch of the UBS S&P 500 ESG UCITS ETF (5ESG) which reached $1bn assets under management (AUM) in September.

State Street Global Advisors (SSGA) was next to market when it unveiled the $158m SPDR S&P 500 ESG Screened UCITS ETF (500X) in December last year while ETF Stream revealed Invesco had listed the $133m Invesco S&P 500 ESG UCITS ETF (SPXE) in March.