Artificial intelligence (AI) may be dominating headlines with the launch of ChatGPT, Bard and Nvidia breaking through a $1trn valuation but attention should also be paid to whether investors are being well-served by the roster of ETFs addressing the theme.

In a recent paper, Deutsche Bank summarised: “AI is an overnight success that has been many years in the making.”

While more than 175,000 AI-related patents were filed between 2012 and the end of 2022, only recently has the theme had the limelight shone its way with its current intensity.

Mentions of the technology in US corporate documents shot up from 135,000 in 2020 to 715,000 last year while the volume of AI media coverage exploded fivefold during the first five months of 2023, according to Bloomberg data.

Valuations of the theme’s winners’ circle may have started to look somewhat heady in recent months, according to investors who have been interested in the theme over the long-run.

Andrew Limberis, investment director at Omba Advisory & Investments, argued “some of these valuations are looking quite stretched while IDAD Funds portfolio manager Andrew Merricks suggested “the recent surge is probably a little overdone and a correction of some kind will probably occur”.

However, a repeat of the ‘dot-com’ bubble scenario is not hard-wired. Of the patents filed over the past decade, some 52% came in just the last three years alone. A flurry of innovation and new products may be yet to come, Deutsche Bank said.

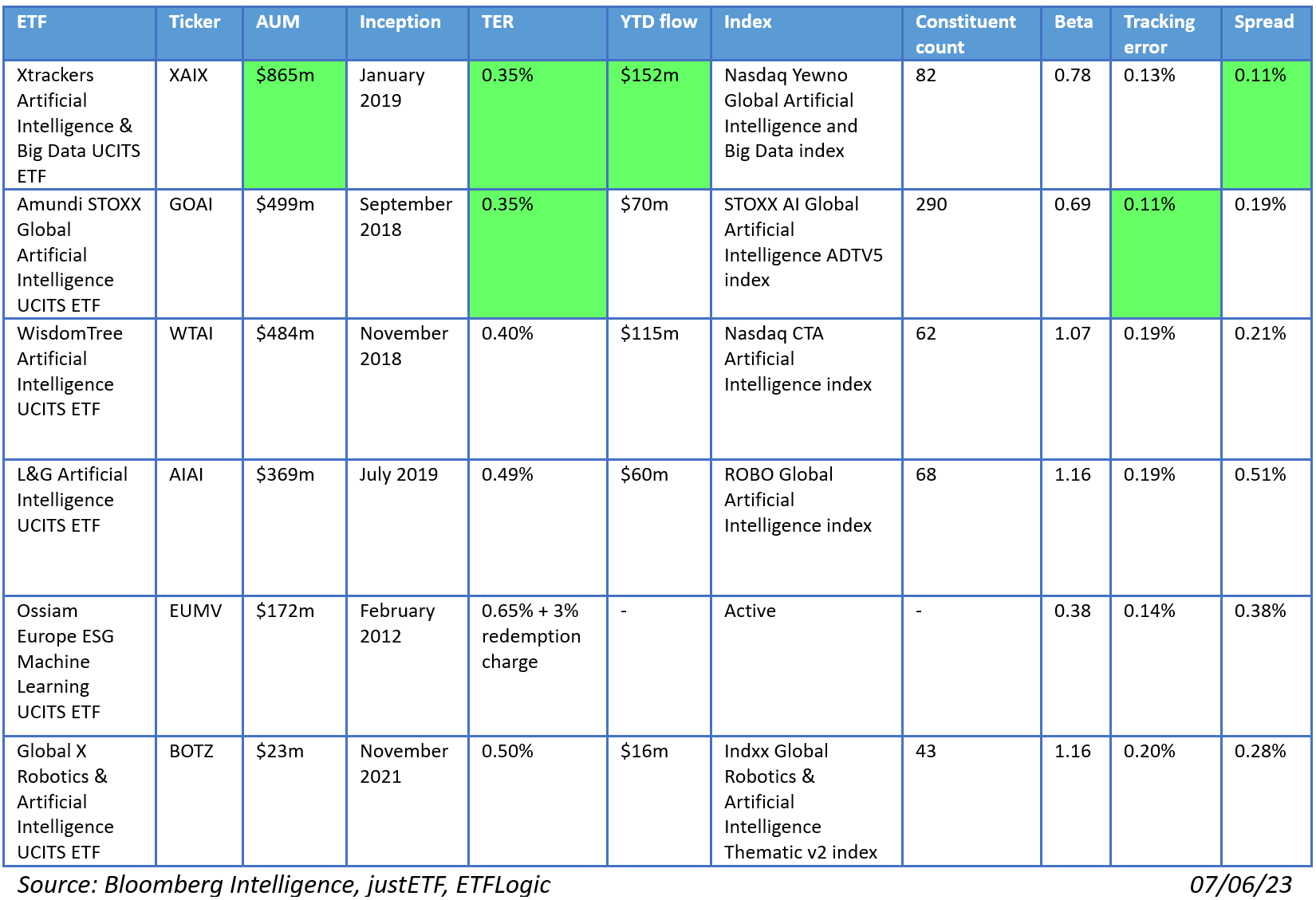

With this in mind, it is worth breaking down the suite of ETFs targeting the theme in Europe – some of which have offered exposure for over a decade.

Chart 1: Introducing Europe’s AI ETFs

Unsurprisingly for anyone familiar with packing future themes within an ETF structure, the fine balancing act of defining relevant companies, preserving theme purity and ETF liquidity can result in some very different end products. In this respect, AI is no different to other well-established themes such as clean energy or cybersecurity.

The cost of ownership of some of the roster is more than double their more cost-effective counterparts while the trading costs attached to some are almost five-times that of rival products.

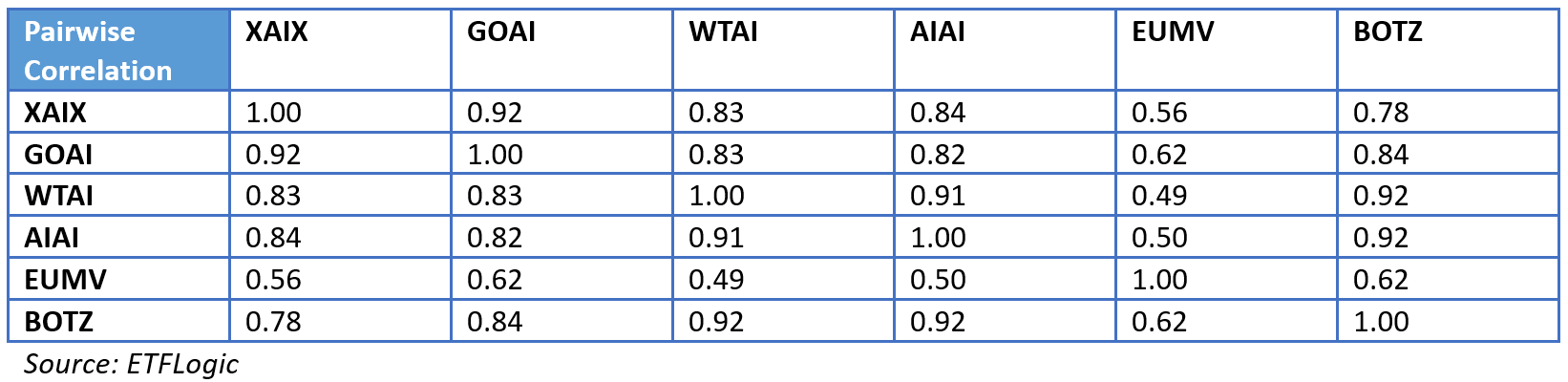

The AI ETFs’ varied benchmarks and number of constituents also create meaningful differentiation in how the returns of each product correlates with others.

Chart 2: AI ETF returns correlation

While the two largest names have a clear degree of overlap, others such as Ossiam’s EUMV represent a clear black sheep.

The next step is to take a closer look at how the ETFs are coded and how this affects investor outcomes.

XAIX

Starting with the largest and third youngest of the pack, courtesy of DWS. XAIX tracks a Nasdaq index providing market cap-weighted exposure to companies involved in big data, cybersecurity, cloud computing, deep learning, natural language processing (NLP), image recognition and speech recognition and chatbots.

The top 50% of companies already in the index at rebalance date in terms of scoring on purity and contribution – how many AI patents they file versus other companies – are reselected for the index. The top 35% of securities for each sub-theme and market cap segment – large, mid-cap and small-cap – from the broader stock universe are also included.

Each constituent must have a market cap of at least $500m, six-month average daily trading volume (ADTV) of $2m and at least 20% of their outstanding share must be available to foreign institutional investors.

Potential spare allocations are decided based on intensity scores – how many times a security has passed through the filtering process, contribution scores, patent filing activity and liquidity screens. Each company is capped at 4.5%, with up to 100 companies included in the basket.

At present, seven of XAIX’s top holdings are overweight including Nvidia, Meta, Amazon, Alphabet, Microsoft and Apple. Its largest weighting currently stands at 8.7%.

GOAI

Amundi offers the second-largest strategy, offering equal-weighted exposure to companies with at least 50% revenue exposure to AI-related sectors by tracking the STOXX AI Global Artificial Intelligence ADTV5 index.

While equal weighting and a basket with almost four times the number of constituents represent clear departures from XAIX, the two ETFs rely on data provided by AI company Yewno, whose algorithms are used by GOAI’s index to identify companies within the top 75% of AI IP exposure and contribution out of players active in the theme.

IP exposure is defined as the percentage of AI-related patents versus non-AI patents granted to a company, whereas contribution relates to a company’s share of AI patents versus those filed by other companies over a given period.

To add a liquidity shield against potentially early-stage innovators active in patent filings, GOAI’s benchmark features a liquidity threshold of three-month ADTV over €1m and a minimum market cap of €100m. This enables Amundi’s candidate to allocate to smaller companies than DWS’s AI contender.

While some ‘usual suspects’ of US mega-cap tech find room in GOAI’s top 10, its largest allocations are currently awarded to Taiwanese tech hardware company Wistron, quantum computing specialist IonQ, document database MongoDB and big data service provider Palantir.

WTAI

WisdomTree’s offering tracks another index provided by Nasdaq, providing exposure to AI ‘enablers’, ‘engagers’ and ‘enhancers’, according to Consumer Technology Association (CTA) classifications.

Enablers make up 40% of the basket and include companies deemed to be the building blocks of AI including advanced machinery, autonomous systems, semiconductors and machine learning databases.

Engagers comprise 50% of the basket and cover companies designing and using AI in their products and internal systems.

Enhancers are the final 10% and describe companies providing ‘value-added services’ in AI, without this being their core business.

Securities are capped at 4.5% at rebalancing and must have a market cap of $250m as well as three-month ADTV of $50m.

Companies must also be identified by Sustainalytics as being compliant with UN Global Compact principles, having no involvement in controversial weapons and deriving no more than five percent of their revenues from either distribution of tobacco products, thermal coal extraction and power generation, unconventional oil and gas production or manufacturing small arms.

AIAI

Next is a candidate from UK issuer Legal & General Investment Management, whose ROBO Global benchmark offers a modified equally-weighted exposure to 11 subsectors impacted by AI. These include computing and AI, autonomous systems, healthcare, 3D printing, food and agriculture, business process, logistics and manufacturing.

The index selects companies exposed to robotics and automation and gives them a ‘ROBO Score’, covering level of revenue generated from robotics and automation, level of investment in robotics and automation and level of market and technology leadership in the space.

Companies with a score equal to or greater than 50/100 are eligible for inclusion and then given a ‘THNQ Score’, examining levels of revenue received from different AI activities, level of investment in AI and market and tech leadership in AI.

The index looks to capture at least 50 companies with a market cap of at least $200m and ADTV of $2m. Constituent weightings are then tilted according to AI exposure factors.

AIAI’s top five holdings are currently Microsoft, Alphabet, Nvidia, Amazon and Arista Networks.

EUMV

A differentiated play is offered by the oldest ETF in this product class, with Ossiam’s actively-managed strategy looking to outperform the Solactive Europe 600 index in returns and carbon emissions reduction by investing in Europe-listed companies involved in machine learning.

The ETF can use total return swaps and invests at least 75% of its basket in equities or rights issued by companies registered in the European Economic Area excluding Liechtenstein.

The strategy has seen considerably lower volatility than the rest of the AI cohort in recent years, with Ossiam stating volatility and drawdown reduction are two of the main goals of its portfolio managers.

While actively managed in other areas, the ETF follows a rules-based approach to ESG, excluding companies involved in controversial weapons, tobacco or coal, those undergoing severe ESG controversies of breaches of the UN Global Compact, as well as those on the Norges Bank Investment Management exclusion list.

Whereas other ETFs on the roster are dominated by tech names, EUMV focuses more on companies taking advantage of machine learning, resulting in pharmaceutical company Novo Nordisk, retail goods manufacturer Ahold Delhaize, eyewear company EssilorLuxottica and Deutsche Telekom making up its top allocations.

BOTZ

Rounding off our comparison is the youngest ETF in the pack courtesy of Global X. Its Indxx benchmark captures companies potentially set to benefit from the increased adoption of robotics and AI including industrial and non-industrial robots and autonomous vehicles.

This covers subsectors including the development and production of unmanned vehicles, military and consumer drones, industrial robots and automated processes, AI in healthcare, consumer applications and entertainment, and the development and delivery of AI products, systems and products.

AI-related companies targeted by the index need to derive at least 50% of their revenues from target industries or prove AI subsectors are their growth focus via R&D investments, joint ventures or acquisitions.

Companies must also have a minimum market cap of $300m – the highest watermark in the roster – a six-month ADTV of $2m and must be traded on at least 90% of eligible trading days over the trailing three months.

Securities are weighted based on market cap, with a single security cap of an 8% weighting and all with a weighting of 5% or greater collectively capped at 40% of the basket. Remaining holdings are capped at 4.5%.

Its top allocations are currently awarded to Nvidia, Intuitive Surgical, sensor manufacturer Keyence, robotics manufacturer ABB and robotics and wireless systems specialist Fanuc. Due to BOTZ’s small basket and recent single stock outperformance, Nvidia is awarded an 11% weighting.

Which AI ETF works best?

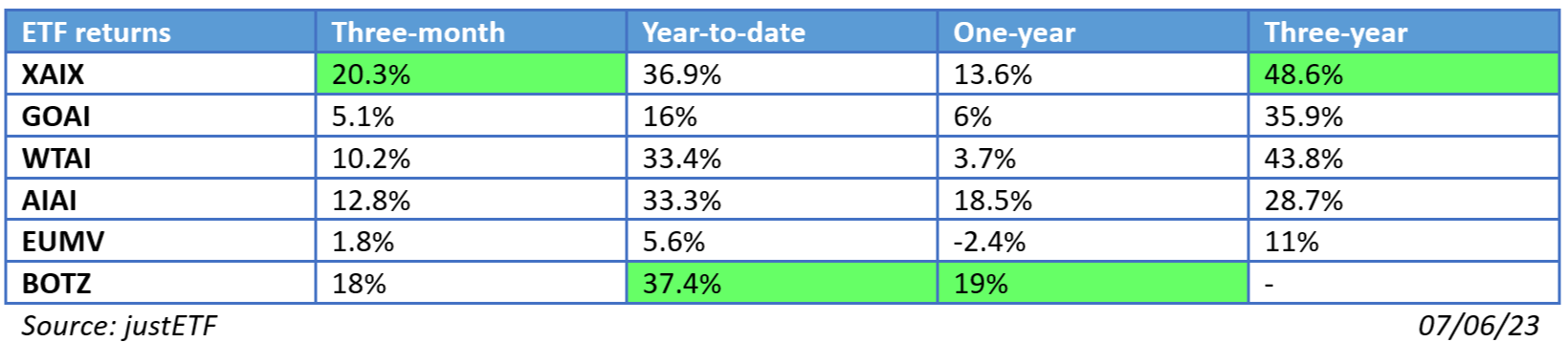

Having reviewed the wiring of each strategy, here is how they have performed in the field.

Chart 3: Mapping the performance of AI ETFs

It seems investors have already identified the strongest in the pack. The largest ETF by assets under management (AUM) – DWS’s XAIX – is also the joint-lowest-fee, has the second-lowest trading costs and the highest three-year returns.

However, Amundi’s GOAI is also of interest. It is almost as attractive as XAIX on total cost of ownership and does not rely on large tech names – which are the mainstay of vanilla equity indices – for its exposure. Its unique focus on company IP is an interesting approach when coupled with equal weighting, especially if its returns can catch up with XAIX and WTAI.

Tech-heavy baskets promise outstanding returns but also greater volatility. While Ossiam’s strategy is the odd one of the bunch in terms of exposure and methodology, it has also been the steadiest ship since the start of 2022, when the recent bout of volatility began in earnest. Whether sacrificing some AI beta for reduced drawdowns is worthwhile is a judgement call investors will have to make.