ChatGPT may be writing the script when it comes to artificial intelligence (AI) and recent parallels with the advent of mobile phones or the internet, but investors should be mindful of confusing generational opportunities and Dutch-tulip-scented moments.

Much as the saying goes that Rome was not built in a day, Deutsche Bank argues “AI is an overnight success that has been many years in the making”.

Those who remember AOL entering the Fortune 500 pre-crash in 2000 – and acquired at half that value in 2015 – may also remember IBM’s Deep Blue machine learning computer beating chess grand master Garry Kasparov for the first time in 1996.

AI awe and fear have been making headlines for at least a quarter of a century, the difference now is generative AI developments put these technological capabilities freely within the reach of hundreds of millions of new users each month.

To AI’s credit, however, the handful of frenzy-inducing technologies represent only the tip of the iceberg when it comes to the full scope of innovation.

Deutsche Bank analysis of 175,072 patents since 2012 found the number of annual filings increased seven-fold over the coming decade, to almost 37,000 filings per year by the end of 2022, with 52% of these coming in just the last three years alone.

For every Amazon Alexa, Apple Siri or bank chatbot, there is a more sophisticated and less familiar machine – whether this be Google’s ‘MUM’ AI for complex search engine queries, Microsoft’s ‘Inner Eye’ that cuts radiotherapy planning times or even the ‘IndexGPT’ AI being developed by JP Morgan as a generative solution for investing.

Overnight celebrity

The problem is while these technologies are already proving transformative, their exponential nature is already being anticipated and priced-in to an even greater degree.

Mentions of AI in corporate documents surged from 135,000 in 2020 to 715,000 last year – before it even came to dominate the news cycle. By February, 60% of Americans surveyed by Deutsche Bank Research said their workforce had started to use ChatGPT in some form.

GlobalData estimates the global AI market will see 21% compound annual growth between now and 2030 while Goldman Sachs predicts generative AI alone could drive 7% global GDP growth over the coming decade.

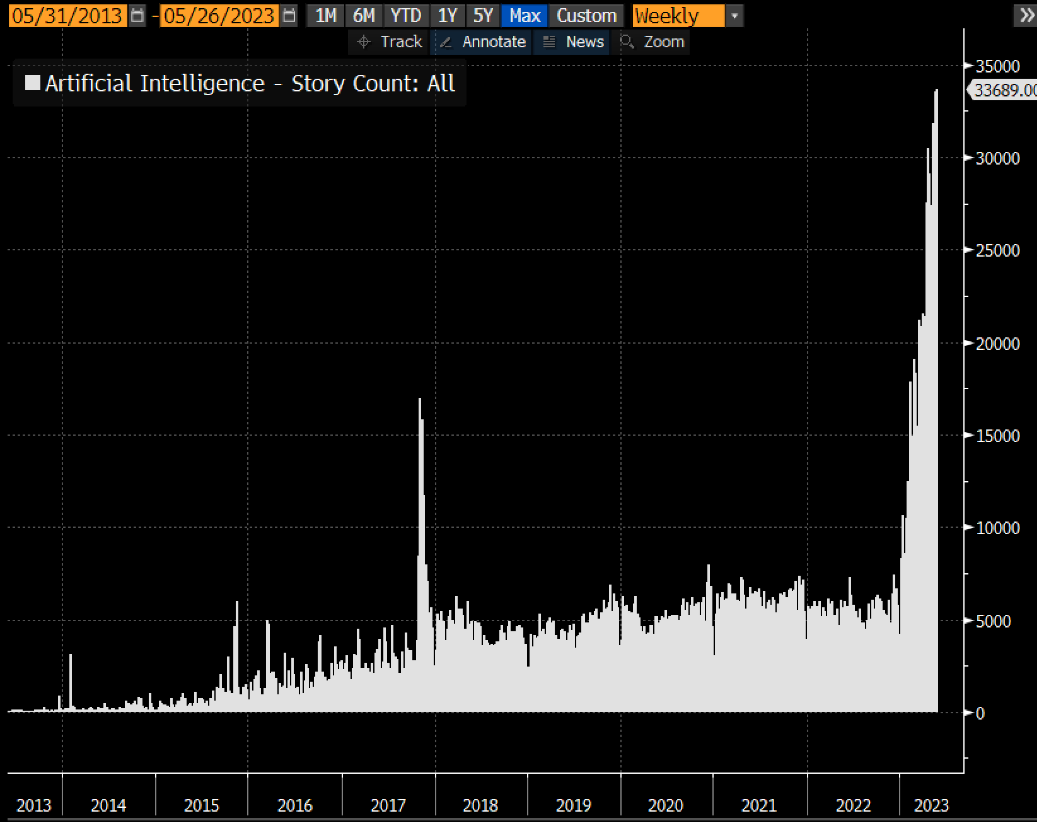

Such sensational numbers naturally elicit at least a concurrently sensational response by market participants – journalists included – with the number of AI-related online articles exploding fivefold between the end of 2022 and May, according to Bloomberg data.

Source: Bloomberg Intelligence

Morningstar analysts Ran Romanoff and Jack Keegan recently said Microsoft’s $10bn – 49% – stake in ChatGPT creator OpenAI will likely create 50 to 100 basis points of annual revenue growth over the next decade.

Such a figure probably does not explain away the tech giant’s 40.2% share price boom since the start of 2023, nor the 70% spike among the ‘magnificent seven’ US tech mega-caps during the same period.

It is little secret the leader among these is Nvidia, the semiconductor manufacturer referred to by many as a ‘picks and shovels’ candidate of the AI ‘gold rush’.

At the end of May, it became the first chipmaker to hit a $1trn dollar market cap, with 170% year-to-date share price gains, quarterly results outlining $11bn in sales and to cap it off, the launch of its new DGX GH200 super-computer designed specifically to operate the next generation of AI models.

Blunt instruments

A week later, US large cap booked its largest weekly inflow ever courtesy of a model portfolio rotating a $6.6bn torrent into the Vanguard Information Technology Index Fund (VGT), according to Bloomberg Intelligence senior ETF analyst Eric Balchunas.

Source: Bloomberg Intelligence

As Deutsche Bank data show – with the annual value of AI venture capital deals surging 50 times from $1.8bn to $83bn in the decade to 2022 – plenty of investment is taking place in private markets. However, most investors are looking to large companies able to acquire small AI disruptors or spend on R&D, often through broad vehicles such as VGT.

Not to be outdone, ETF investors have also joined in on the excitement. The US-listed $2.2bn Global X Robotics & Artificial Intelligence ETF (BOTZ) has seen $454m this year, as at 2 June, while European investors added $153m to the $864m Xtrackers Artificial Intelligence & Big Data UCITS ETF (XAIX) and $105m to the $475m WisdomTree Artificial Intelligence UCITS ETF (INTL).

In customary fashion, the hulking $9.1bn iShares USA Momentum Factor ETF (MTUM) is belatedly throwing its weight back behind tech sector buzz, with Bloomberg Intelligence US quantitative equity strategist Christopher Cain predicting the sector allocation to information technology would be propelled from 2.9% to 20.6% at the end of May. Healthcare and energy allocations were set to be cut by similar margins.

The icing on the cake is a replay of a 2021 calling card, whereby ETF launches start chasing noise surrounding a theme. Roundhill Investments, the issuer behind the world’s first metaverse ETF, announced in May it was launching the Generative AI & Technology ETF (CHAT).

Artificially inflated

In an interview with CNBC, Richard Bernstein Advisors’ CIO Dan Suzuki compared AI hype to the ‘dot-com’ bubble and stressed the importance of separating exciting future themes and those with investment merit.

Agreeing, Andrew Limberis, investment director at Omba Advisory & Investments, which runs a fund of thematic ETFs, said: “AI is strong theme but valuations do matter and some of these valuations are looking quite stretched.

“Key risks, being regulatory and political in nature, are highly uncertain and will likely differ significantly between countries, further complicating the assessment of winners and losers in the field.”

Andrew Merricks, portfolio manager at IDAD Funds, said we are witnessing a “sudden realisation” of a theme his firm has invested in as a “slow burner” for several years.

“This said, the recent surge is probably a little overdone and a correction of some kind will probably occur,” he added.

“This is why ETFs are so useful as they offer access to whole sectors and do away with the risk of selecting the wrong individual stocks, either on their way up or on their way down.”

However, much as speculative bubbles are behavioural defects enacted at a group level; so too are the eventual sell-offs as investors rush for the exit.

Such phenomena can even burn seemingly learned individuals. Renowned scientist and mathematician Sir Isaac Newton doubled his initial £7,000 investment in South Sea Company (SSC) in 1720, only to reinvest amid wider speculation on the company later that year and lose £20,000 – £3m in today’s money – as others exited their positions.

“I could calculate the motions of heavenly bodies but not the madness of the people,” Newton said.