DWS is back in ETF asset gathering territory this year after being plagued by controversy and its worst outflows in a decade in 2022.

While ranking behind BlackRock, Amundi and Vanguard in Q1 inflows, the German asset manager still boasted €4bn net new assets, according to data from ETFbook.

This included bright spots such as fixed income, which “contributed strongly” to quarterly flows on the back of a “dedicated sales campaign”, DWS chief financial officer Claire Peel said during the firm’s Q1 earnings call.

“We have an average market share in Europe of 10% and our net flows were in that range. But I noted that of the ETF inflows, almost half of that was coming from fixed income, which was substantially higher than our market share in fixed income ETFs,” Peel added.

This form has continued into Q2, with the $3.6bn Xtrackers EUR Corporate Bond UCITS ETF (D5BG) adding $1.2bn this year, as at the end of April.

Not only does this make D5BG the second-highest inflowing fixed-income ETF in Europe so far in 2023 but the fourth-highest inflowing product overall.

Furthermore, one of the three products outpacing it is the $3.4bn Xtrackers IE Physical Gold ETF (XGDU), which has amassed almost $1.5bn net new assets in the first four months of the year.

Outside of robust numbers in its core range, DWS has also made a statement of intent in building out its more exotic exposures. Earlier this year, it unveiled a suite of seven thematic ETFs targeting the UN’s Sustainable Development Goals (SDGs) as well as announcing plans to launch a “comprehensive suite” of crypto exchange-traded products (ETPs) as part of a “strategic alliance” with digital asset manager Galaxy.

Europe’s third-largest issuer has also enjoyed some positive media coverage of its ESG efforts after Finnish pension fund Ilmarinen rotated $2bn from the Xtrackers MSCI USA ESG Leaders Equity ETF (USSG) to seed the newly-listed Xtrackers MSCI USA Climate Action Equity ETF (USCA) – earning the latter headlines of ‘biggest ETF launch in history'.

A year to forget for DWS

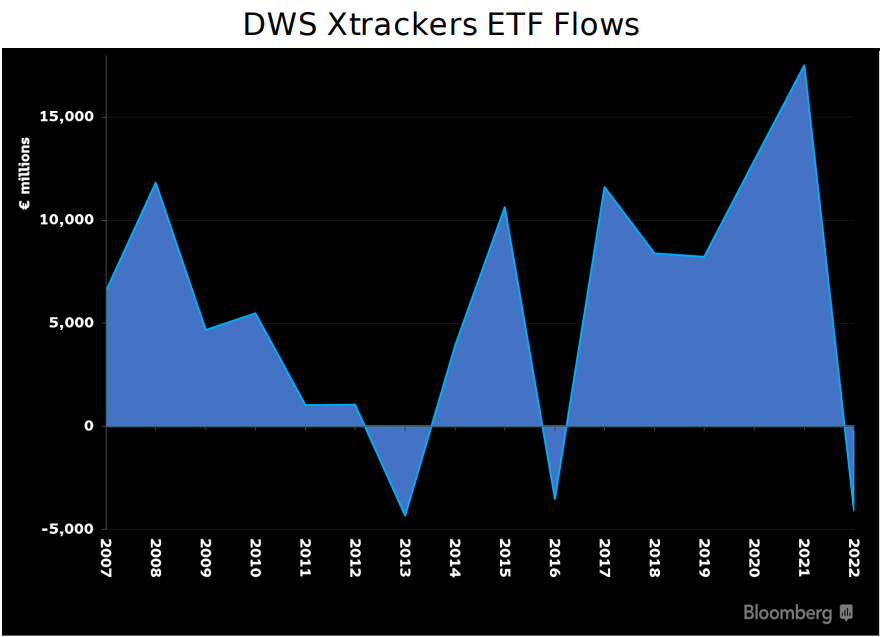

This marked a notable turnaround from 2022, where CEO Stefan Hoops attributed the asset manager’s €19.9bn outflows – €4bn from its ETF range – to the firm being used as a “guinea pig in the public eye for how other asset managers should set up their ESG”.

Source: Bloomberg Intelligence

The outflows came after former group sustainability officer Desiree Fixler alleged around €900bn of its assets were being dubiously declared ESG-aligned in 2020, prompting investigations by a number of regulators and eventually a raid of the offices of DWS and parent company Deutsche Bank by 50 German law enforcement personnel last June.

The uproar surrounding the raid saw CEO Asoka Woehrmann step down within the day, with COO Mark Cullen, CIO Stefan Kreuzhamp, head of communications Adib Sisani and other ESG and strategy staff also departing or demoted.

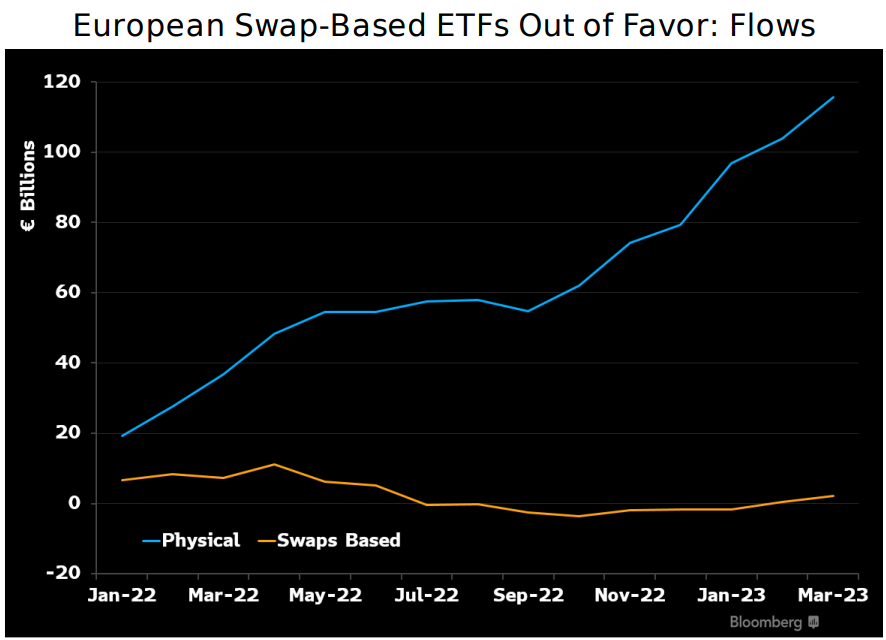

Outside of ESG, the ETF issuer was also hampered by its strong position in synthetic ETFs, with the structure seeing €2bn outflows last year versus €80bn inflows for European ETFs overall, according data from Bloomberg Intelligence.

In fact, just two ETFs – the Xtrackers Euro Stoxx 50 UCITS ETF (XESC) and Xtrackers S&P 500 Swap UCITS ETF (D5BM) – accounted for €4bn outflows in 2022. D5BM’s €1.5bn exodus was particularly damning given the nine physical strategies tracking the same index gathered €3.3bn net new assets over the same period.

Source: Bloomberg Intelligence

DWS only launched one synthetic ETF last year, with its 43 swaps-based ETFs making up €22bn of the €131bn across its 223-strong product range.

“Xtrackers launched in 2007 under the Deutsche Bank brand with only synthetic ETFs, but it has slowly moved over to the physically backed structure,” Henry Jim, ETF analyst at Bloomberg Intelligence, said.

“After a challenging 2022, marked by management shake-ups and industry headwinds, the ETF issuer has refocused on its core and thematics line-up.”

As the company ventures into new exposures and investors navigate an unpredictable monetary policy backdrop, only time will tell if Germany’s largest asset manager and its ETF arm can maintain its currently strong momentum, under the leadership of its relatively new CEO.