With the continuing success of the ETF industry, it is quite something to hear the view of one group of insiders who often suggest that the growth of fixed income ETFs will go from strength to strength while another group decries the poor design of fixed income ETF indices, particularly those where the weights of the individual securities are based on the market cap levels of the bonds in question. This is the long-standing debate, but what is the best way to construct a fixed income index?

At its simplest, the critics suggest this gives rise to European government bond indices with a disproportionate amount of exposure to those countries with the most national debt, such as Greece.

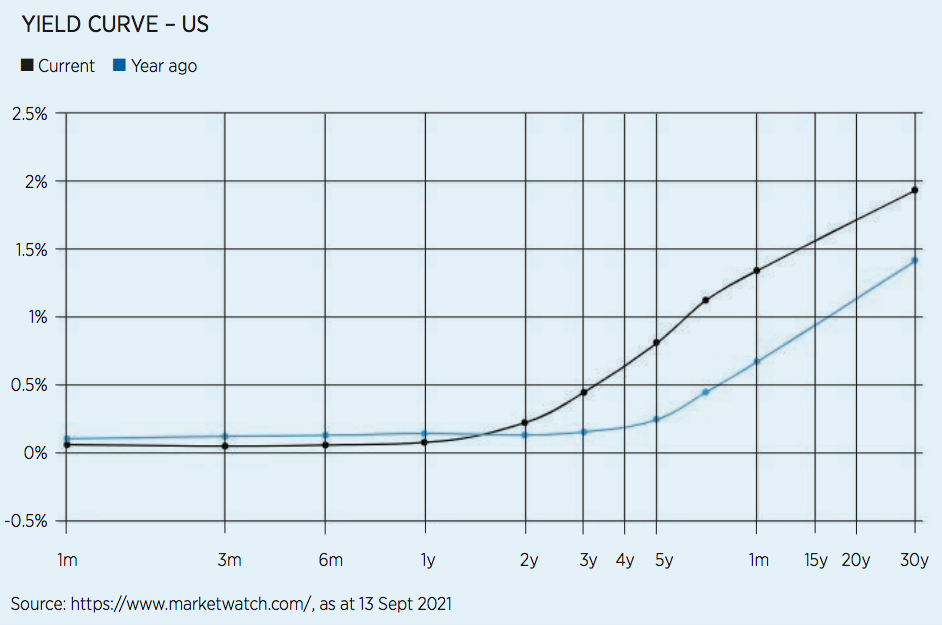

With 30-year US Treasury yields struggling to pay more than 2%, one can be forgiven if they ask, why do investors bother to invest at all? Yet with over $1trn allocated to fixed income ETFs, it does suggest something other than the level of returns is driving those investment decisions. Indeed, if ever there was a topic where confusion and over-complexity abounds in equal measures, then fixed income investing is that topic.

In the case of Greek sovereign bonds, if the market has priced them correctly, one would expect a higher coupon is paid to compensate for the extra risk taken. How much a manager wants to allocate to that specific exposure is clearly an investment decision, but in all fairness to those critics, that is outside of the investment manager’s control, as the index design has made that choice for them.

The topic of which weighting scheme is the right one within fixed income has a rich history with a range of ideas that often could be described as falling into the fundamental weightings’ category. For example, Goldman Sachs Asset Management favoured a GDP-inspired weightings methodology, a framework that had much in common with a similar offering that Lombard Odier subsequently brought to the market. Both amount to a fixed income equivalent of the smart beta movement that had previously swept through the equity indexing space. However, smart as the selection and rebalancing rules are, there is still the technical challenge of managing the rest of one’s portfolio, and invariably those assets will be correlated.

The barriers to innovation

Detail matters, and life would be made so much simpler for discretionary fund managers if more fixed income benchmarks were not so unwieldly. If we study ETFs that track the Bloomberg Global Aggregate Bond index, then it would not be uncommon to find over 8,000 bonds in the replicating basket which is lower than the 20,000 or so defined by the index itself. For professional managers, who most likely account for most of the $10bn or so of the assets under management, that sounds like an abrogation of responsibility, as I would expect them to show more expertise than that. This is the hint – if ever one is needed – if the professionals are taking these shortcuts, maybe it indicates that there are barriers to entry to be a market leader in this space.

What is it that makes the topic of fixed income index weightings so much more difficult than the case with equities? More importantly, with so much at stake, and access to the brightest minds in finance, why are we still even having this debate today? The answer might surprise you, and involves the vested interests of the way the financial services industry has progressed over the years.

For those of you familiar with Steven Johnson’s groundbreaking book about how innovation unfolds in the real world, Where Good Ideas Come From, one is reminded of the fact that innovation is stifled when there is not a free flow of ideas. In the case of modelling fixed income indices, the barriers to entry are notoriously high, the cost of data is often prohibitive and access to the state-of-the-art systems is limited. These observations alone go on to explain why BlackRock’s Aladdin system, which excels as a fixed income risk management tool, has managed to command such a large market share, and revenues that come with that dominant position.

A risk-based approach to indexing

In the case of more accessible areas of research, much success has been achieved by taking a risk-based approach to portfolio construction, which begs the question, would this concept work with fixed income indices? Of relevance to this discussion would be one’s ability to take a broad universe of bonds including government, investment grade, high yield and mortgage-backed bonds, and for each type to have access to a risk model that would allow an index provider to rank the broad universe of bonds by their risk/return characterises.

The days when the structured notes industry was launching new ETFs on a monthly basis may be behind us, but part of its legacy has been the evolution of a range of pricing models that became part and parcel of every bank’s risk management department. These models were first developed by the quant teams that supported the multitude of trading desks, and over time, variations to these analytical tools have become a regulatory requirement of banks’ risk management procedures.

One measure that became popular in the mid-1990s was JP Morgan’s Value at Risk (VaR) methodology which estimates the risk of loss for a portfolio, but due to its shortcomings and the occasional global financial crisis since then, The Basel Committee on Banking Supervision now recommends that an extension to that approach, the Conditional Value at Risk (CVaR), is used instead.

With these models in hand, and the ability to compare different bonds in a meaningful way, this would allow the index construction process to risk-weight the allocations, in the same spirit that a risk parity portfolio looks to increase the diversification of a portfolio under consideration.

What is driving the increasing demand for fixed income ETFs?

However, this would just overweight short-term government bonds, I hear you say, but similar to equities, where we distinguish between large, mid and small cap ETFs, one could provide products for the different categories in fixed income, like separate products for government, investment grade and high yield bonds.

The topic of liquidity risk is always central when designing an index’s selection rules and would be included as is standard here, combining with the weighting scheme outlined above. If all fixed income indices were constructed along such lines, then it would allow an investment manager to have access to a suite of building blocks, namely the ETFs that track these indices, each with well-understood risk/return characteristics. It is precisely this feature that is a prerequisite to turning the portfolio construction process into a science.

Allan Lane is founder and CEO of Algo-Chain

This article first appeared in ETF Insider, ETF Stream's new monthly ETF magazine for professional investors in Europe. To access the full issue,click here.