ETFs capturing tech companies across the globe came to life in recent weeks as investors turned risk-on, however, is this just another ‘dead cat’ bounce or the start of a more substantive recovery for growth?

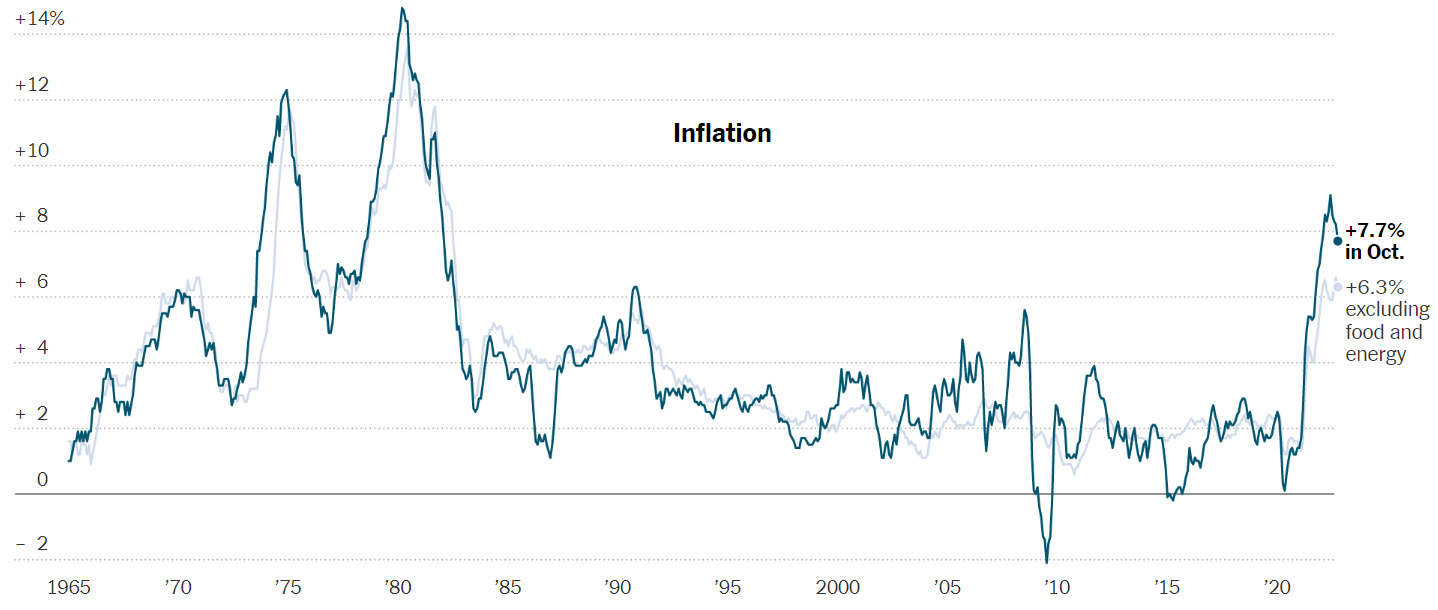

The recent sentiment change, as with most this year, started in the US as year-on-year consumer price growth (CPI) slowed to 7.7% in October.

Not only was this below the 8% forecast by economists and the lowest reading since January, but core and headline inflation metrics were both over 20 basis points (bps) below expectations, the first time this has happened since 2014, according to Deutsche Bank’s head of global fundamental credit strategy Jim Reid.

Source: US Bureau of Labor Statistics

The reading sparked a series of dramatic reactions, such as the S&P 500 jumping 5.5% on 10 November – its largest one-day jump since April 2020 – while two-year US Treasury yields plummeted 24.7bps, their largest daily decline since 2008, Reid said.

This ‘bad news is good news’ logic, whereby a weakening economy and falling inflation mean the Federal Reserve is likely to soften the pace of future interest rate hikes, is one growth-focused investors have been happy to buy into following the recent CPI reading.

Within two days, Cathie Wood’s flailing ARK Innovation ETF (ARKK) surged 24% including its best single day since inception in 2014.

Similarly, within four trading days the Invesco EQQQ NASDAQ 100 UCITS ETF (EQQQ) and Invesco NASDAQ Next Generation 100 UCITS ETF (EQJS) returned 5.6% and 5%, respectively.

Dovishness also lifted Europe tech ETFs

Expectations of more dovish monetary policy also crossed the Atlantic, with Bloomberg forecasting the next European Central Bank (ECB) rate hike to soften to 50bps. Also, as US Treasuries fell on the recent CPI reading, German bund, French and Italian government bond yields fell 16.2bps, 19bps and 27.9bps, respectively.

Softer inflation also prompted a 4% drop in the US dollar versus a basket of six other currencies between the start of the month and last Friday, on pace for its largest monthly fall in 12 years, according to Refinitiv data.

With the euro trading at $1.04, up from 96 cents two months ago, the cost of importing dollar-denominated goods – including paying dollar-based debt – becomes less impactful for European companies and consumers.

On the prospect of a more dovish ECB and less burdensome debt, European tech also shone, with the SPDR MSCI Europe Technology UCITS ETF (ITEC), iShares MSCI Europe Information Technology Sector UCITS ETF (ESIT) and Xtrackers MSCI Europe Information Technology ESG Screened UCITS ETF (XS8R) rallying between 5.7% and 5.8% over the past week, as at 17 November.

So far so good for China tech ETFs and the new politburo

Chinese tech equities were also lifted by the prospect of a softening dollar and a surprisingly accommodative approach to the sector by the country’s newly appointed politburo.

The standing committee is made up of seven loyalists to President Xi Jinping, a fact many had feared would spell more punitive policymaking for tech-focused sectors after more than 50 regulatory actions – such as antitrust cases and IPO cancellations – were carried out against software companies between November 2020 and the start of this year, according to South China Morning Post Research.

Peter Garnry, head of equity strategy at Saxo Bank, said: “The Hang Seng index soared 7.3% on the post-CPI rally in the US stock market and fine-tuning of pandemic control measures in China.

“Following a meeting of the Chinese Communist Party’s new politburo standing committee, China’s health authorities issued 20 guidelines to optimise pandemic measures, relaxing quarantine and PCR testing requirements, and prohibiting excessive lockdowns.

“China interest stocks led the charge higher following Alibaba reporting earnings beating expectations and adding to its share repurchase programme. The Chinese authorities’ grant of a new round of 70 online game licences to firms including Tencent and NetEase also help the market sentiment.”

On these positive developments, China tech ETFs soared in the week following the US CPI reading, with the KraneShares CSI China Internet UCITS ETF (KWEB) returning 24.4%, the EMQQ Emerging Markets Internet & Ecommerce UCITS ETF (EMQQ) up 15.8% and the Invesco MSCI China Technology All Shares Stock Connect UCITS ETF (MSTE) up 12.8% by 17 November.

Too soon to celebrate?

The issue with calling the bottom on tech is we have seen short rallies at other points in 2022 – such as at the middle and end of summer – only to be followed by more than a month of additional drawdown. Some of the facts underlying this year’s drawdown remain true.

For instance, inflation remains near 40-year highs, far ahead of what some have described as the ‘new normal’ range of above three percent and some distance from policymakers’ two percent level – and future readings may be subject to volatility.

Reflecting this, analyst consensus expectations for the Fed funds terminal rate remain at 5%, signalling at least a percent of additional hiking from the current rate of 3.75% by the end of H1 2023.

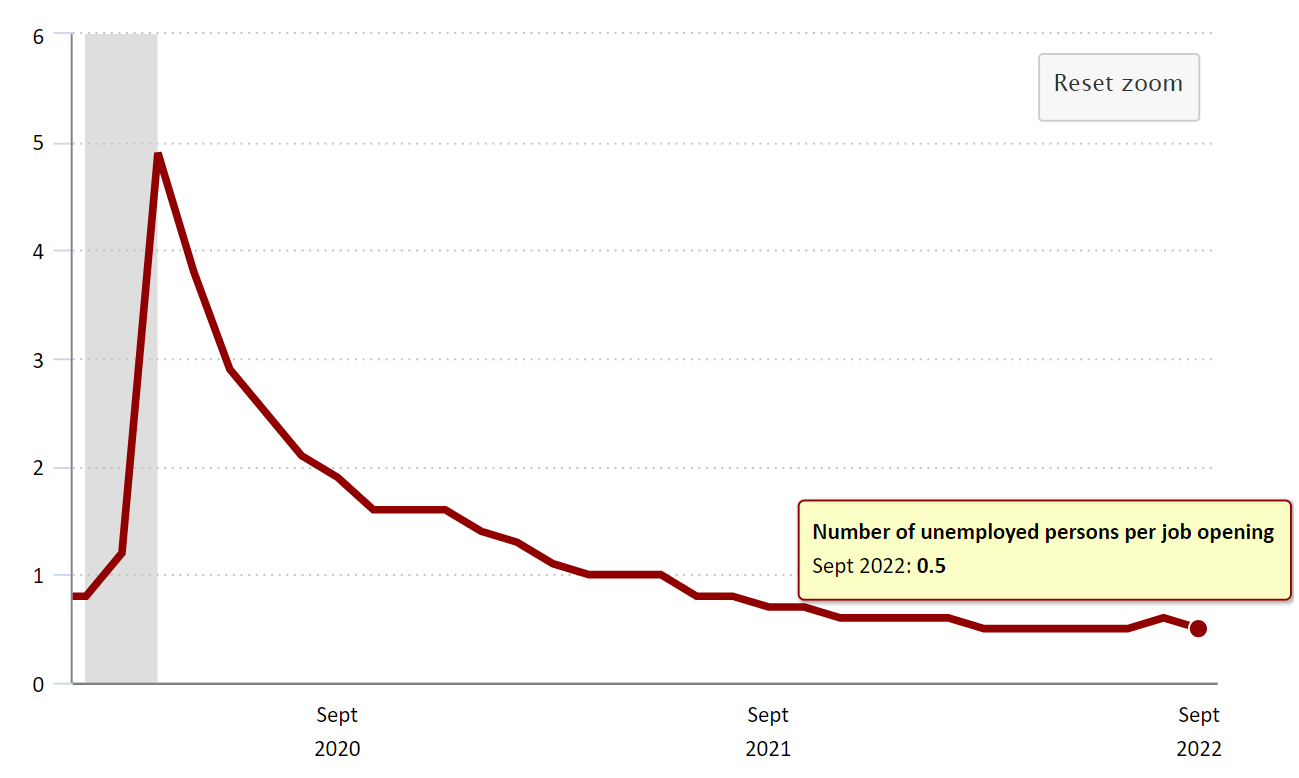

While inflation has fallen, the US Bureau of Labor Statistics jobs report on 4 November showed there were 1.9 job openings per unemployed person, evidencing a still-tight jobs market which will give the Fed confidence to continue its currently hawkish regime.

Source: US Bureau of Labor Statistics

After initial giddiness following the inflation reading, the euro and Chinese have also fallen by 1.5% and 1.7%, respectively, against the US dollar, showing the market still prices in more robust hiking by the Fed.

To keep pace with the US and protect its currency, the ECB will also have to continue lifting rates, a fact set out by the policymaker’s President Christine Lagarde last Friday, as she signalled hikes may have to become more restrictive to manage inflation in a “timely manner” and that “withdrawing accommodation may not be enough”.

The prospect of higher rates for longer will do little to support a continued growth rally, given tech stocks will be less likely to borrow the money they need to finance the research and development their future earnings rely on. Persistent inflation will also encourage investors to seek out yield opportunities including materials and utilities in the equity space.

In China, a new spike and COVID-19 cases and the first death from the virus in six months could prompt policymakers to backtrack on plans to loosen lockdown restrictions, which will have both immediate economic impacts but could also raise questions about the new politburo’s laissez-faire batch of initial policy.

China tech was also dealt another blow late last week as Tencent announced it would be distributing $20bn of its shares in digital shopping platform Meituan. The Hang Seng Tech index closed 5.7% down on Monday morning.

Related articles